A generation ago, financial advice used to be a largely transactional business. A client had a specific problem they needed to solve – some money to invest, a need for protection, they wanted to start a pension – and a qualified adviser would “sell” them a product that would meet their needs.

These days, financial planning takes a much more holistic approach.

When we meet a new client, we start by finding out about them – their personality, relationship with money, and their goals for the future. Advice is then tailored to a client’s short-, medium- and long-term plans.

So, it’s perhaps no surprise that recent research has revealed that more clients cite emotional reasons for working with a financial planner than identify financial ones.

For clients going through a divorce, this emotional support can be particularly valuable. Read on to find out why.

Clients cite these emotional reasons for hiring a financial adviser

New Morningstar research published by Professional Adviser has found that most advised clients cite an emotional reason than a financial reason for hiring an adviser.

“We found clients hired their adviser not just because they were looking for assistance with a specific financial problem,” Morningstar said.

Common reasons given by clients for seeking advice included:

- To help me better navigate the number of things available to me

- To help give me a better understanding and confidence in my financial security

- I feel more secure having a different view of my finances

- I don’t like making financial decisions

- I lack discipline to stay invested when the market is erratic

- They are a sane voice and I am able to bounce ideas off them

- I found an adviser who understood me and I found to be a good fit.

This chimes with our own evidence.

When we ask our clients about the benefits of working with BlueSKY, investment returns or other financial reasons rarely feature in their responses.

Most talk about the “peace of mind” that working with us gives them. Others talk about the “understanding and clarity” they get about working with an expert and how they feel more in control of their finances. And many tell us that working with us gives them the confidence to make financial decisions.

For clients separating or divorcing, these are three powerful benefits.

In a highly uncertain time, the reassurance and confidence we can give to your clients can empower them to make important decisions about their future. We can help them answer questions like:

- Can I afford to stay in the family home?

- Will I have enough income to maintain my lifestyle?

- Do I have the right financial protection in place?

- Am I getting a fair share of pension (and other) assets?

- Will I have enough to live on in later life?

For these specific clients, we are particularly well-placed to provide this emotional support. That’s because we’re both regulated to give financial advice and are experienced in the divorce process from a financial and legal perspective.

As Resolution accredited specialists, we’re one of a small number of financial planning firms who have proven their skills and expertise working with clients facing family disputes. We’re also a Chartered firm – often called “the gold standard of financial planning” – meaning we can combine specialist family knowledge with high-quality, ethical financial planning.

“Advice can deliver more than just financial benefits”

It’s not just our own evidence that supports the idea that financial planning can provide meaningful emotional support to clients.

A major study by insurer Royal London, Feeling the benefit of financial advice, also found the same. Their conclusion was that “advice can indeed deliver more than just financial benefits. It also helps to improve the emotional wellbeing of customers by making them feel better about their money – and themselves.”

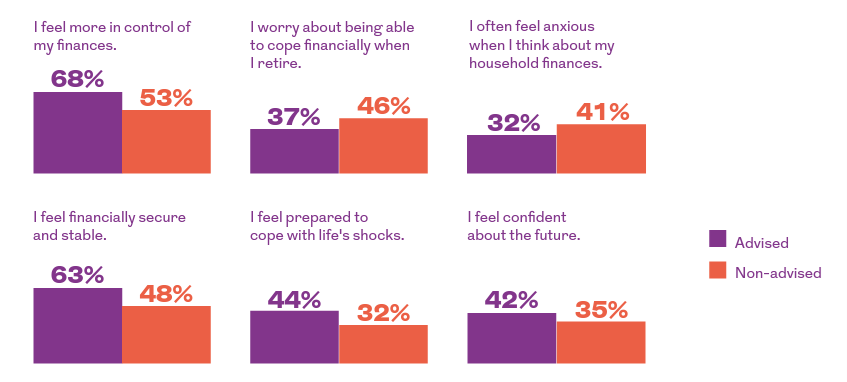

Source: Royal London

As you can see, clients who worked with a financial planner felt more in control of their finances, more financially secure and stable, and less worried about their future than those who did not seek advice.

As the insurer says: “Advised customers enjoy psychological and emotional benefits – not just financial gains.”

Get in touch

If you have clients who would benefit from the reassurance of speaking to a Resolution-accredited financial expert, please get in touch.

Email info@blueskyifas.co.uk or call us on 0118 987 6655.