Divorce is a complex and emotionally challenging process, with financial settlements playing a vital role in ensuring a fair and secure outcome for both parties.

Among the many financial considerations, pensions are particularly important, as they often represent one of the most valuable assets within a marriage.

Owing to the importance of pensions, it is strongly suggested that clients engage with a financial planner to work through the possible financial implications of a divorce. Furthermore, if the pensions have a significant value, then a Pension Sharing Report should also be considered to help with the divorce negotiations.

Bluesky is unique in that we have both financial planners and pension on divorce experts (PODE) available to our clients and their solicitors.

It is important to note that if a client instructs us to write a pension sharing report, we wouldn’t be able to give either party individual financial advice until the divorce has been finalised. Similarly, if a client or their solicitor asked us to act as a financial planner, we wouldn’t be able to produce a pension sharing report.

As a Chartered financial planning firm with over 20 years of experience working with divorcing couples and their solicitors, we have a unique set of skills for helping divorcing clients.

Our “two hats” of being both PODEs and Chartered financial planners can be misunderstood. This is because some family lawyers are more used to getting pension sharing reports (or “PODE reports”) from actuarial firms.

Read on for an overview of the key differences between financial planning and PODE services.

Financial planning can play an important role in divorce

Financial planning in the context of divorce usually entails working for one of the divorcing parties. Occasionally, it may be possible to work with both parties, providing the parameters are clearly defined.

Financial planning considers a wide breadth of different aspects, including:

- Valuing assets – Identifying and valuing properties, savings, investments, and pensions

- Income needs and expenses – Assessing the financial requirements of an individual post-divorce

- Tax implications – Understanding how asset division may impact tax liabilities

- Cashflow forecasting – Projecting how financial decisions made during divorce will affect future financial stability

- Lifestyle considerations – Planning for any changes in living arrangements or employment.

These tasks are typically conducted by a financial planner or an independent financial adviser (IFA). In our view, the gold standard is an independent Chartered financial planning firm.

Financial planning can help divorcing individuals understand the long-term implications of their decisions, and the consequences of taking different actions now.

A pension on divorce expert will write a pension sharing report

A pension sharing report typically outlines how best to divide pensions on divorce in a way that is fair to both parties. It is a specific document prepared by a PODE.

Pensions are often among the most complex financial assets to divide due to their income-producing function and the different ways they can be accessed.

A pension sharing report typically includes:

- Valuation of pensions – Calculating the current and projected value of each pension pot

- Comparison of different pension schemes – Examining whether defined benefit (DB) or defined contribution (DC) schemes are involved

- Pension sharing calculations – Determining how a pension should be split to achieve a fair financial settlement

- Offsetting calculations – Considering whether one party might retain more of another asset (such as the family home) in exchange for a smaller share of the pension

- Impact assessments – Evaluating how different pension division options will affect retirement income for each party.

Pension sharing reports are essential for ensuring that pension assets are divided fairly and that both parties fully understand their options.

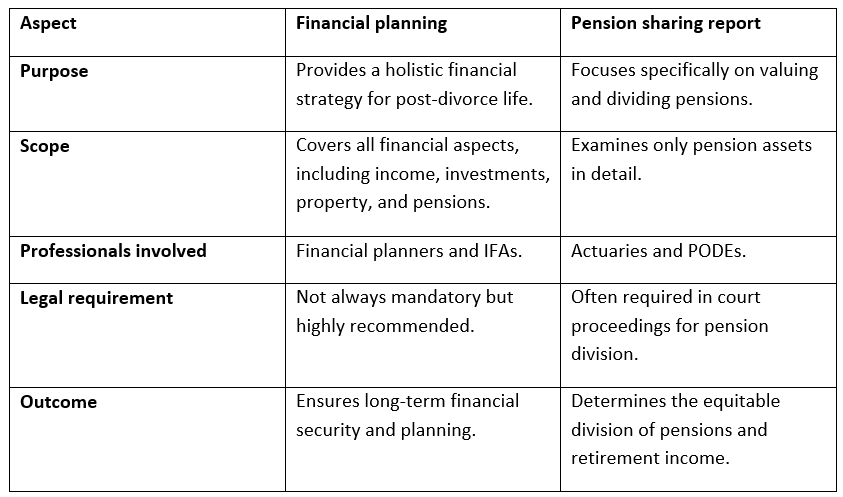

There are some key differences between financial planning and a pension sharing report

While financial planning and pension sharing reports both play vital roles in divorce settlements, they serve different purposes.

Financial planning ensures a broad, long-term strategy for financial security, while a pension sharing report specifically addresses the fair division of pension assets.

In our view, both elements are essential for achieving a fair and sustainable financial settlement, and divorcing parties are advised to seek professional guidance to navigate these complex financial matters effectively.

Get in touch

If you have divorcing clients who could benefit from working with either a financial planner or a PODE, get in touch.

Email info@blueskyifas.co.uk or call us on 0118 987 6655.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.