In the last few weeks, the government and Bank of England have responded to the coronavirus pandemic with a range of measures designed to support personal and business finances.

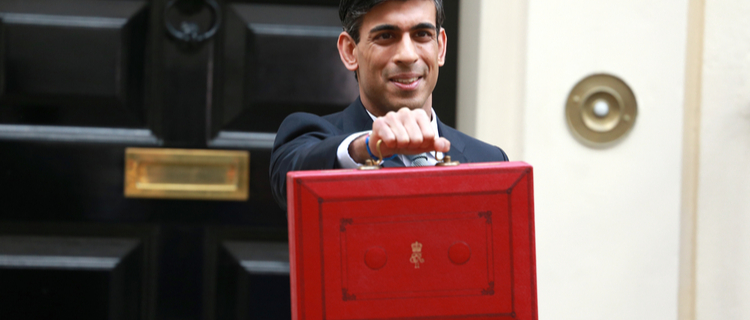

From a Base rate cut to £330 billion in business support, here are five takeouts from the Budget and subsequent government commitments.

1. Interest rates cut

Even before the Budget began, the Bank of England had already taken steps to support the economy by cutting the Base rate from 0.75% to 0.25%. There has since been another cut, reducing the Base rate to an all-time low of 0.1%.

Borrowers with a tracker rate mortgage can expect to see their repayments fall as a result of the emergency cut. Borrowers linked to their lender’s Standard Variable Rate (SVR) will have to wait and see whether banks and building societies decide to pass on the rate cut.

The move could hit savers as it is reasonable to assume that there will be more cuts to savings interest rates. Moneyfacts reported that, after the Bank of England last reduced the Base rate in 2016, the average savings rate for an easy access bank account fell by 0.14% in the ensuing three months.

2. £330 billion support for small business

The Chancellor began his Budget speech by outlining a £12 billion package of support to help businesses through the coronavirus pandemic. Since the Budget, it has become clear that UK businesses are going to need significantly more backing in order to survive the next few months.

Here’s a summary of the main announcements.

Statutory Sick Pay

Businesses with fewer than 250 employees (at 28 February 2020) can reclaim the cost of any Statutory Sick Pay caused by the coronavirus (up to a limit of 14 days per individual). This will be refunded to the company, in full, by the government.

In order to be eligible for the changes to statutory sick pay, you must keep records of the employee’s absence and SSP payments, but the employee will not need to provide a doctor’s note.

Business Interruption Loans

A new Coronavirus Business Interruption Loan Scheme will see banks offer loans of up to £5m to support SMEs, with no interest due for the first six months. The business loan scheme will be delivered by the British Business Bank and businesses will access the loans via their high street bank by requesting a government-backed business interruption loan.

To be eligible for a business interruption loan you must:

- Be based in the UK with an annual turnover of no more than £41 million

- Operate within an eligible industrial sector (a small number of industrial sectors are not eligible for support)

- Have a sound borrowing proposal but have inadequate security to meet a lender’s normal requirements

- Be up to date in respect of any accounts and tax filings due (even if tax is not necessarily fully paid)

- Be able to confirm that you have not received other public support of de minimis state aid beyond €200,000 equivalent over the previous three years

Business Rates Support

If you have a business in the retail, hospitality or leisure sector with a rateable value of less than £51,000 then a cash grant from the government of £25,000 will be made available. Speak to your local authority to check your eligibility.

Additionally, business rate holidays will be extended to all firms in these sectors.

The £3,000 grant announced in the Budget for businesses that qualify for Small Business Rate Relief or Rural Rate Relief has been increased to £10,000. This will be administered by the local authority from early April and, if you’re eligible, you will be contacted directly and do not need to apply.

Postponement of IR35 rule changes

To support the self-employed and sub-contractor community, the government have announced a delay to the introduction of the IR35 legislation for the private sector.

This was due to come into force from April 2020, but this has now been delayed until April 2021. It is hoped that the delay to the introduction of this legislation will provide much-needed assistance to sub-contractors during this period.

Other Budget announcements

In addition to emergency measures to tackle the coronavirus outbreak, there was other good news for small businesses.

The government also announced that it is delivering on its commitment to increase the Employment Allowance to £4,000. This means that businesses will be able to employ four full-time employees on the National Living Wage without paying any employer National Insurance contributions (NICs).

The Chancellor also confirmed that the Corporation Tax rate would remain at 19%.

3. Changes to pensions allowances

Before Christmas, the government promised an urgent review of the Tapered Annual Allowance in light of the impact it was having on some NHS staff.

In the Budget, the Chancellor announced that the thresholds at which the Tapered Annual Allowance came into effect would rise by £90,000.

Now, if your threshold income is above £200,000, then you need to check if your ‘adjusted income’ (essentially all income that you are taxed on including dividends, savings interest and rental income, before tax plus the value of your own and any employer pension contributions) is over £240,000.

If it is above £240,000, the annual allowance will reduce by £1 for every £2 that your ‘adjusted income’ exceeds £240,000.

According to the Chancellor, this will take 98% of NHS consultants and 96% of GPs out of the taper.

While the threshold earnings level for the Tapered Annual Allowance coming into effect has been raised by £90,000, those on the very highest incomes will see a significant reduction in the amount they can contribute to a pension and retain tax relief.

The minimum level to which the Annual Allowance can taper down will reduce from £10,000 to £4,000 from April 2020. This reduction will only affect individuals with total income (including pension accrual) over £300,000.

The Lifetime Allowance – the maximum amount you can accrue in a registered pension scheme in a tax-efficient manner over your lifetime – will increase in line with CPI for 2020/21, rising to £1,073,100. Find out more about the Lifetime Allowance and how it might affect you.

4. Change to Entrepreneurs’ Relief

Entrepreneurs’ Relief offers a reduced 10% rate of Capital Gains Tax on qualifying disposals.

With immediate effect, the lifetime limit on gains that are eligible for Entrepreneurs’ Relief will reduce from £10 million to £1 million.

The Chancellor says that 80% of small business owners will be unaffected, but larger businesses or those realising significant gains on disposals will pay more tax.

5. Increase in Junior ISA limit

In the Budget statement, the government said: “By saving towards their future, families can give children a significant financial asset when they reach adulthood – helping them into further education, training, or work.”

To support this, the annual subscription limit for the Junior ISA (JISA) and Child Trust Fund (CTF) will more than double in the 2020/21 tax year, from £4,368 to £9,000.

This means that you can now contribute up to £9,000 into a tax-efficient savings vehicle for your child each tax year.

The adult ISA subscription limit will remain at £20,000.

Get in touch

If you want to find out more about how changes in the Budget affect you, or how you can take advantage of the Chancellor’s support for business, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.