Last month, the government announced a sweeping set of tax rises designed to raise funds to tackle the social care crisis.

From 2022, National Insurance contributions (NICs), and Dividend Tax will all rise by 1.25 percentage points, affecting both individuals and businesses.

As these changes will affect most people, here’s what the tax hikes mean to you.

NICs and Dividend Tax rising by 1.25p in the pound

From April 2022, employees, employers, and the self-employed will all pay 1.25p more in the pound when it comes to NICs.

- Employees will pay additional NICs on their salary

- Employers will pay higher NICs for staff

- Self-employed people will pay more NICs on their profits.

Then, from April 2023, National Insurance will return to its current rate, and the extra tax will be collected as a new Health and Social Care Levy.

In addition, Dividend Tax will also rise by 1.25p in the pound from April 2022. This increase will mainly affect company owners and directors, and those who receive more than £2,000 in dividend income from non-ISA investments.

Tax rises set to fund the NHS and social care

The government says it expects the tax increases to raise £12 billion a year. Initially, this will go towards easing the pressure on the NHS as the country comes out of the pandemic. It will then be channelled towards the social care system.

The increases were part of a wider set of proposals that aim to ensure no individual in England pays more than £86,000 in care costs from October 2023.

Note here that this “cap” does not include accommodation and food, and so people in care could still end up paying significantly more than the £86,000 cap.

Anyone with assets – for example, their home, savings, or investments – of less than £20,000 will have their care fully covered by the state. If you have assets between £20,000 and £100,000 then your care costs will be subsidised.

Employed? The amount of National Insurance you will pay will rise

If you’re a salaried employee than you’ll pay higher NICs from April 2022. You’ll then see the 1.25% Health and Social Care Levy as a separate entry on your payslip from April 2023.

According to the BBC, if you earn £50,000 then you can expect to pay £505 more in NICs from April 2022. If you’re on £100,000 a year, you’ll pay £1,130 more.

It’s also worth noting here that working age pensioners will pay a form of National Insurance for the first time under the proposals.

Under the current system, taxpayers stop making NICs when they reach the State Pension Age of 66. From April 2023, the government will ask pensioners to pay for the first time, with contributions starting at a rate of 1.25%.

The Telegraph reports that a working pensioner earning £60,000 a year will go from paying nothing to paying £630 a year in National Insurance on top of Income Tax.

Self-employed? You’ll also pay more National Insurance

If you’re self-employed, then you will also pay more NICs from April 2022.

Self-employed workers pay Class 2 and Class 4 contributions on their profits.

In the 2021/22 tax year, that’s £3.05 per week in Class 2 contributions if you earn more than £6,515, plus a 9% Class 4 contribution on earnings between £9,568 and £50,270. Earnings over £50,270 are charged at 2%.

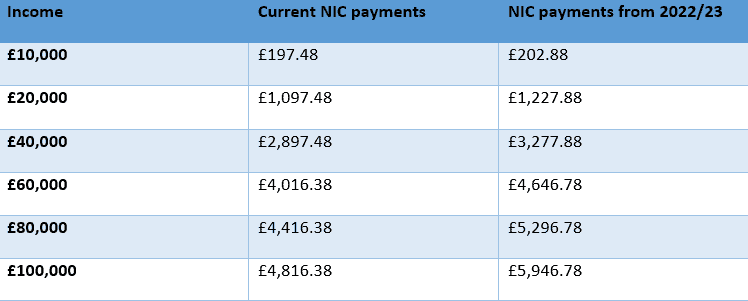

From April 2022, self-employed workers will pay Class 4 contributions of 10.25% and 3.25%. Here’s how contributions would look after the NI rate increase.

Source: Which?

Again, National Insurance will revert to its current level in April 2023, with the additional 1.25% taken as a Health and Social Care Levy.

Business owner? Your National Insurance bill will rise in 2022

If you own your own business, the tax rises will have a dual effect. Not only will your own NICs (or Dividend Tax) rise, but you will also pay a higher rate of NICs on every employee.

Businesses pay secondary NICs for any earnings from employees of more than £737 a month. This tax will rise from 13.8% to 15.05%.

According to the Federation of Small Businesses, the total cost to small businesses will be around £5.7 billion. A small business with five employees on salaries of £31,000 will pay an annual National Insurance bill of £16,500.

Dividend Tax also rising in April 2022

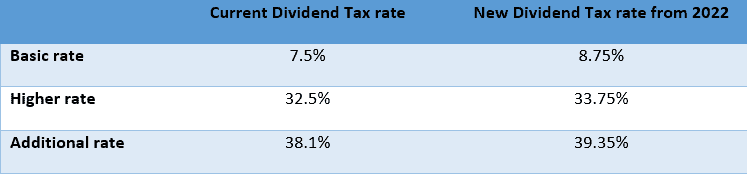

Taxes on dividend payments will also increase by 1.25 percentage points from April 2022 as part of the package of social care reforms. The government say this will raise an additional £600 million in revenue.

Every individual has a Dividend Allowance of £2,000 and so only dividends above this amount will attract the higher tax rates. Remember that dividends in an ISA will not be taxed.

If you earn more than £2,000 in dividends each year, then you will pay a slightly higher tax bill.

For example, a basic-rate taxpayer receiving £3,000 in dividends must pay dividend tax on £1,000. Their bill will rise from £75 to £82.50.

A higher-rate taxpayer taking £10,000 in dividend payments will pay 33.75% on £8,000 of dividends with a dividend tax bill of £2,700. This is an increase of £100 from the current system.

Get in touch

With several months to these changes, there are opportunities now to mitigate these tax rises. For example, using salary sacrifice to make pension contributions could reduce your NICs. And maximising your ISA holdings mean you won’t pay the increased tax on dividends.

To chat about your options, and what these tax rises mean for you, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.