When the market is high, you may be inclined to think that what goes up, must come down.

This might mean you feel hesitant to make further investments during market highs and you may even be tempted to liquidate some of your investments in preparation for a potential dip.

However, recent research by Schroders examining the US stock market between January 1926 and December 2023, has revealed that returns in the year following market highs are generally higher than returns at other times.

Read on to discover why you shouldn’t worry about investing when markets are high.

Stock markets hit all-time highs more often than you might think

Record-breaking highs are a relatively common occurrence in the stock market, and historically the market has bounced back and continued to grow after significant downturns.

For example, data from Trading Economics shows that, after a big dip during the pandemic, the UK stock market reached a new all-time high in February 2023.

Just over a year after that previous high, Shares Magazine reports that the latest figures from the end of March 2024 show that the UK market is within touching distance of reaching another all-time high.

Meanwhile, IG reports that in the 16 months between January 2017 and May 2018, the UK market hit highs on six separate occasions.

In the US, the stock market reached a new high in mid-December 2023 and it has moved higher since, reaching 3% above the previous peak by the end of January 2024. And the Nikkei in Japan achieved a record high in March 2024.

Schroders’ research of the US stock market shows that the market hits record highs more often than you might think.

In the 1,176 months between January 1926 and December 2023, the US market was at an all-time high for just over 30% of the time, 354 months in total.

As an investor, you may feel hesitant to make further investments during market highs for fear that it may soon fall, and your returns may be lower.

However, the data suggests that even if the market does fall after reaching a high, historically it has returned to an upward trajectory.

So, notwithstanding fluctuations and short-term volatility, leaving your investments and focusing on long-term returns could be more beneficial than liquidating your investments in anticipation of a fall.

Returns following all-time highs on the US stock market are better on average than at other times

Schroders’ analysis of the US stock market over almost a century reveals that, on average, the 12-month returns following all-time highs are stronger than at all other times.

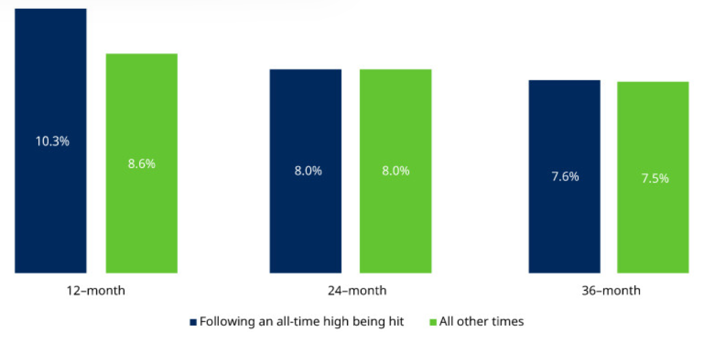

The graphs below show the average one-, two-, and three-year returns following an all-time high, against average returns during all other times on the US stock market between January 1926 and December 2023.

Source: Schroders

Returns in the year following an all-time high were, on average, 10.3% ahead of inflation, compared with 8.6% at all other times. Similarly, returns on a two- or three-year horizon following a high were slightly better than average too.

So, though you may fret about the potential for your returns to fall after a market high, the data suggests that, generally, the opposite is true, and returns are at their strongest in the period following a peak.

Leaving your investments in the market long-term could lead to higher returns than liquidating them

The research from Schroders shows that if you had $100 invested in the US stock market in January 1926 it would be worth $85,008 by December 2023, adjusted for inflation, representing an average growth of 7.1% a year.

Whereas, if you had adopted a strategy of liquidating your investments into cash every month the market hit an all-time high, and then reinvesting once it had fallen again, that $100 would only be worth $8,790 in December 2023.

Of course, this is an extreme example – you’d be unlikely to sell all your equities after a high and rebuy later! – but it illustrates the point that staying invested can prove to be a more prudent long-term strategy.

Over shorter horizons, the same principle is true.

For example, $100 invested in US stocks 10 years ago would have returned $237 by December 2023, while liquidating after all-time highs over the same period would leave you with $181.

$100 invested 20 years ago would have returned $382 by 2023, but liquidating would have left you with $255.

The data indicates that over long-term horizons the difference compounds and could have a significant effect on your returns and your overall financial situation.

The research suggests that holding your investments during all-time market highs could be a better strategy than liquidating through fear that your returns will fall.

Get in touch

To find out more about why you shouldn’t be afraid of investing during market highs and how keeping your investments over a long-term horizon could benefit your financial plan, get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.