Picture the scene. You’re standing outside your daughter’s university, celebrating her graduation. As a proud smile fills your face, she and her friends fling their caps in the air to mark their achievements, and the three years of hard work that got them there.

Sending a child to university is a watershed moment for any parent, and something you need to be prepared for not just emotionally but financially too. But how much do you really know about student loans, and the long-term effect they could have on your children’s lives and finances?

Read on for the complete guide to student finance for parents, including how and when loans are repaid, and more.

How much university costs in 2022

According to the National Student Money Survey (NSMS), the rough cost of going to university in 2022 is about £57,000.

On average, living expenses are the biggest outgoings for university students. The NSMS found the average annual cost of living for UK students to be £9,720 a year.

The second largest expense for university students is tuition fees. For most UK students, the cost of tuition is £9,250 per year, according to the NSMS.

If your child could benefit from some help with paying for university, the first thing to know is which student loan options are available.

The 2 types of student loan available

UK students can apply for two different kinds of loan to cover their university costs: a tuition fee loan, and a maintenance loan.

As the name suggests, a tuition fee loan is designed to cover the cost of university course fees in full. Students can apply for a tuition fee loan up to a maximum of £9,250 a year, and these fees are paid directly to the university.

Maintenance loans are designed to cover the cost of a student’s living expenses while they study at university. They’re paid to the student in three instalments, normally at the start of each term.

Unlike tuition fee loans, maintenance loans are means-tested, so if you’re a high earner, your child may not be eligible for the full loan. The amount your child receives is based on their household income.

In 2022/23, the government say that any household with income over £50,778 would receive less than the maximum annual maintenance loan, which is:

- Student living with parents – £8,171

- Student living away from parents outside London – £9,706

- Student living away from parents in London – £12,667.

Every child is eligible for a minimum maintenance loan, which Money Saving Expert report is £3,597 in the 2022/23 academic year.

In addition to a maintenance loan, there are several different ways students can get additional money towards university expenses.

3 ways your child could get extra money to pay for university

Whether you or your child already have some money to contribute to their university costs or they’re starting from scratch, support is available. Here are some of the things your child could do to get extra money towards their time at university.

- Apply for bursaries, scholarships, and awards

Certain universities and colleges offer grants directly to their students, and these often don’t need to be paid back.

- Enquire about hardship funds

If your child is experiencing financial hardship, they may be able to get extra money from their university or college, usually as a grant but occasionally repayable.

- Get a job

Many students get a part-time job while studying, which could help cover the costs of tuition fees and living expenses.

Repaying student loans

A successful student loan application means your child can breathe a sigh of relief, knowing at least some of their university costs are covered. The money needs to be repaid at some point, though, and whether you’ve supported your child’s loan application or not, you’ll want to know what that repayment involves.

Over the period of study, the loans can add up. Here’s an example.

Say you’re from Reading, and your daughter attends the University of Nottingham on a three-year course, living away from home and receiving the maximum maintenance loan. She could expect her student debt to be in the region of £56,800 when she graduates.

While this may seem like a significant amount, it’s crucial to remember that repaying a student loan is based on an individual’s ability to repay.

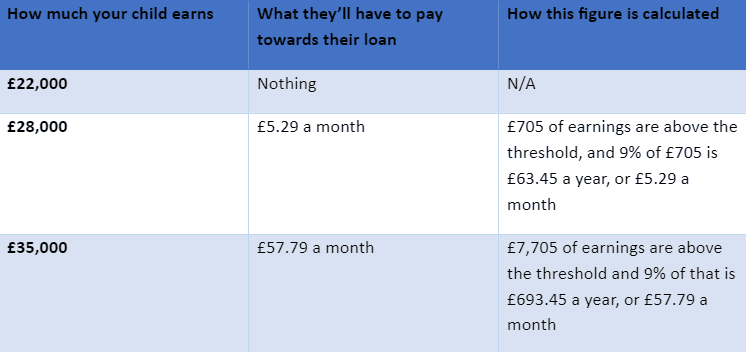

The income threshold for repaying a loan for students going to university in 2022/23 is £27,295. Your child pays 9% of their income above the threshold towards their loan.

The table below will give you an idea of how much your child will pay towards their loan according to their graduate income.

Note that from September 2023, the income threshold will fall to £25,000.

Remember that a graduate on a low wage will pay little or nothing at all towards the loan, so you don’t need to worry that they’ll struggle to keep up repayments. The system is designed so that, in the main, those who gain the most financially out of university contribute the most.

It’s also important to remember that relatively few students will end up repaying their loan in full before the loan is written off after 30 years (rising to 40 years in 2023).

The government themselves say that only around 20% of full-time undergraduates starting in 2021/22 would repay their loans in full.

Many students won’t exceed the income threshold, while others earning just over the threshold won’t pay anywhere near the total amount back before the debt is written off after 30 or 40 years. Debts are also expunged on death.

In simple terms, if your child never earns above the repayment threshold, they’ll never have to pay back any of their student loan. It’ll then be written off in 30 or 40 years’ time.

Get in touch

A university degree could unlock a world of opportunities for your child, setting them on the path to future success and fulfilment. But the cost of sending your child to university is more expensive than ever, so it’s crucial to be clear about your finances in readiness.

If you’re worried about the effect student loans could have on your child’s finances or your own, we can help put your mind at ease. To learn more about what we can do to support you, email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.