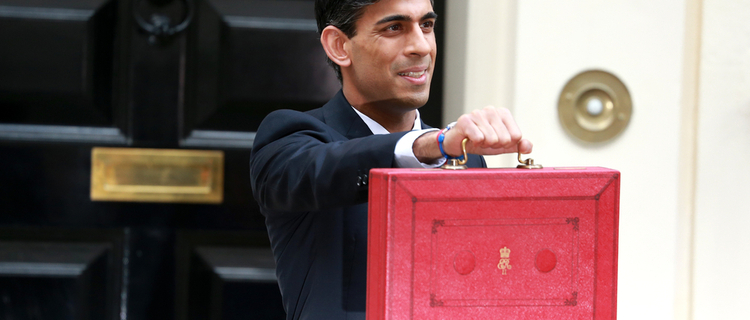

Just four months after delivering his first Budget as Chancellor, Rishi Sunak delivered a summer statement, which many commentators dubbed a ‘mini-Budget’, on Wednesday 8th July 2020.

Back in March, some of the Budget measures the Chancellor announced were focused on supporting people and businesses as the Covid-19 pandemic was taking hold. Four months later, the focus has now shifted to recovery as lockdown and social distancing restrictions ease.

The Chancellor began his speech by saying that, while the government had taken decisive action to protect the economy earlier this year, he acknowledged people were now worried about unemployment rates rising and economic uncertainty.

This is against a backdrop of a global economic downturn, with the International Monetary Fund (IMF) predicting the deepest recession since records began. With this in mind, the Summer Statement set out the measures the government plan to implement to further support the economy through the pandemic.

Sunak also confirmed that there will still be a full Budget and spending review delivered in the autumn.

A Stamp Duty holiday

Property prices and transactions have fallen during the pandemic. To get the housing market moving again, the Chancellor announced that he was abolishing Stamp Duty on homes worth up to £500,000.

This Stamp Duty holiday will take effect immediately and continue until 31st March 2021.

The holiday applies to all residential properties including second homes, holiday homes and Buy to Let property. Here, buyers will just pay the additional 3% Stamp Duty surcharge for second properties.

Buyers will pay 3% tax on the first £500,000 of the property’s price, 5% on the value between £500,001 to £925,000, 13% on the portion from £925,001 to £1.5m and 15% on anything over £1.5m.

A £1,000 Job Retention Bonus for employers

The government’s furlough scheme is set to end in October. The scheme has supported nine million jobs in the UK and, in an attempt to ensure that businesses don’t simply make furloughed staff redundant when support ends, the Job Retention Bonus aims to encourage firms to re-employ staff.

Any employer that brings back an employee who earns at least £520 each month from furlough, and keeps them in a job until January, will receive a £1,000 bonus.

If everyone on furlough were to benefit, the scheme would cost £9 billion.

A cut in VAT for certain sectors

Over 80% of businesses in the hospitality and tourism sectors were forced to close during lockdown.

To support these sectors, the Chancellor announced that VAT on tourism and hospitality will be cut from the current 20% to 5% until 12th January 2021.

This includes cafés and restaurants, accommodation and attractions, such as the cinema, theme parks and zoos.

A ‘Kickstart scheme’ to help young people into work

The Chancellor acknowledged that young people are around 2.5 times more likely to have been affected by Covid-19. So, to support younger workers into employment, Sunak announced the ‘Kickstart scheme’.

This initiative will pay the wages of 16 to 24-year-old workers for up to six months, as well as some overheads. The employee must work a minimum of 25 hours a week and be paid the national minimum wage.

It will amount to a grant worth around £6,500 per young person. Employers can apply to benefit from the Kickstart scheme next month and there will be no cap on the number of places funded.

In addition to this, there will be more funding for careers advice and more traineeships. There will also be a new £2,000 payment for firms to take on young apprentices (£1,500 for apprentices aged over 25).

Discounts for eating out

To encourage Brits to support the hospitality sector, the Chancellor unveiled his ‘eat out to help out’ scheme.

Throughout August, customers will be able to take advantage of a discount up to 50%, worth up to £10 per head (including children) when they eat out from Monday to Wednesday at businesses that have applied to be part of the scheme.

A new green homes grant

Sunak also announced a new £2 billion green homes grant. This will allow homeowners and landlords to apply for vouchers to make their homes more energy-efficient and support local green jobs.

The vouchers are expected to cover at least two-thirds of the costs up to £5,000 per household. For low-income households, the full cost will be covered, up to £10,000. It’s estimated energy efficiency could save families £300 a year.

A further £1 billion of funding has also been designated for improving energy efficiency in public buildings.

Get in touch

If you’d like to find out how the measures announced by the Chancellor will impact you, please get in touch. Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.