We have talked before about the close link between financial and mental wellbeing. A study by the Money and Mental Health Policy institute found that almost 46% of people with debt problems also have a mental health problem and that more than 80% of people who experienced mental health difficulties said that their financial situation had made these issues worse.

Other studies back up this link. 2019’s Salary Finance survey revealed that money worries were the biggest source of stress for British workers, with the average employee taking one sick day each year to deal with financial problems.

We’ve also discussed how mental and financial wellbeing are linked irrespective of your wealth. Respondents to the Salary Finance study who earned more than £100,000 reported the same level of concern about their personal finances as those earning less than £10,000.

As Claer Barrett said in the Financial Times: “You can have a successful City career and still be troubled by these questions — debt problems pay scant respect to income. The more you earn, the bigger the debts you can amass.”

For these reasons and more we chose MIND as our BlueSKY charity of 2020. For more than 60 years, MIND has worked to provide advice and support to empower anyone experiencing a mental health issue. They have touched millions of lives and their high-profile campaigns have promoted a better understanding of mental health.

We’ve been fundraising throughout 2020 to support MIND, but we recently read another report which highlighted the ways that we can also support mental wellbeing in a professional capacity.

New report reveals financial advice can promote emotional wellbeing

We know there is a strong link between financial and mental wellbeing. Now, a new report from insurer Royal London, highlights the benefits that seeking advice from a financial professional can have on your mental health.

In the report, Feeling the benefit of financial advice, Royal London conclude that financial advice offers ‘game-changing’ outcomes for clients.

They say: “Our latest research reveals that professional advice offers so much more to customers than just practical, financial benefits. It also helps to improve their emotional wellbeing by making them feel better about their money and themselves – especially in times of crisis.”

So how does financial advice support mental health?

The Royal London study confirms that financial advice can deliver more than just financial benefits. It also helps to improve the emotional wellbeing of customers by making them feel better about their money – and themselves.

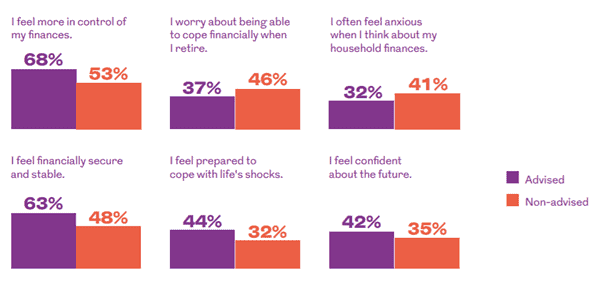

Source: Royal London

Clients who worked with a financial planner said that they were more in control of their money, felt more secure and stable, more confident, and better prepared to cope with life’s shocks.

Clients who had taken advice were also less likely to worry about coping financially in retirement and were less anxious about their household finances.

Tom Dunbar, Intermediary Distribution Director at Royal London, says: “Financial advice helps to improve the emotional wellbeing of customers by making them feel more confident and in control of their financial future.

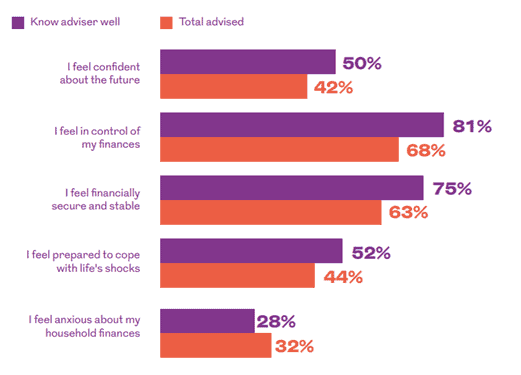

“Interestingly…the benefits of advice are significantly amplified when the customer has regular, ongoing contact with their adviser.”

This last point also seems to be important when it comes to mental wellbeing. The Royal London study found that the emotional benefits of financial advice are even greater for those people who know their adviser well or speak to them on a regular basis.

Source: Royal London

Other findings from the study include:

- There’s evidence that working with a financial planner also helps people to boost their knowledge and gain a better understanding of their finances – particularly when it comes to protection and retirement planning

- Customers who have taken financial advice and have protection in place feel the emotional benefits of advice more than those who are advised generally

- The vast majority of clients are very happy with the quality of the financial advice they receive. They’re also very satisfied with other key aspects of their adviser’s service, such as being easy to talk to and inspiring confidence and trust.

The 3 main reasons why financial advice can support emotional wellbeing

- Clients who receive financial advice trust their adviser and are happy with the service they receive. Satisfaction also increases over time where there is an ongoing relationship in place.

- People who receive financial advice feel more confident about their future and feel more financially resilient.

- Clients who take advice enjoy psychological and emotional benefits – not just financial gains.

If you’d benefit from the emotional benefits that financial planning can bring, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.