In recent weeks, the issue of “social care” has once again been on the agenda. Boris Johnson had intended to make a policy announcement ahead of the parliamentary recess in July but was forced to postpone this until the autumn amid worries about the proposals from his own MPs.

While the prime minister has promised to “fix care once and for all”, uncertainty is undermining many people’s planning for a potentially significant later-life expense. Indeed, a recent survey by Just Group found that 54% are delaying making financial plans for care until a new policy is unveiled.

Understanding the rules around social care, and considering it as part of your financial plan, can help you to ensure you’re prepared should you need care later in life. Read on to find out more.

Why it’s important to think about later-life care

A concern that many experts have is that adults are not considering the costs of later-life care as part of their financial plan.

The Just Group research found that more than two-thirds (69%) of adults who have gifted significant sums to children did not even consider future care costs before handing over the cash.

Just 1 in 25 (4%) had an understanding that the children receiving the cash would help with future care costs.

While there can be great reasons for “living inheritances” – perhaps to help your children through university or to get on to the property ladder – it’s important not to leave yourself short of money in later life.

Understanding the issues can help you to plan

If you’re not clear about what the rules surrounding social care are, you’re not alone. Many people only learn about the rules when the issues become relevant to them – for example, when a family member requires care.

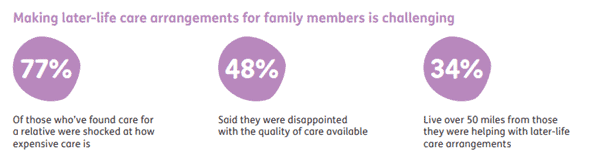

Source: Just Group

Under the current laws, funding rules vary between different parts of the UK. In England, your local council will meet the full cost of care for those people with savings and assets of less than £14,250.

Anyone with more than £23,250 in assets or savings is expected to meet their own care costs in full. Between the two thresholds, the cost is split.

The means test will generally include the value of your home although it is disregarded in certain circumstances. This may be because the care is being received at home or it is the home of a spouse or dependent.

In simple terms, if you have more than £23,250 you are likely to have to pay for your own care. Considering that Care Home state that the monthly average cost of receiving nursing care in a care home is £3,552, ensuring you have the means to pay for this – from your property or elsewhere – will be vital.

2 in 5 people expect to sell their home to pay for care

One way that you might consider paying for later-life care is by using the equity in your home. Indeed, a recent survey revealed that more than 2 in 5 (42%) homeowners aged over 45 expect to sell their property to cover the costs of care.

Half accept the principle of using some or all of their property wealth to fund these costs.

The idea of selling your home to pay for later-life care will partly depend on the value of your property, the equity you have, and whereabouts in the UK you live.

A new report shows that, if you own a property in London or the south-east, selling it is likely to result in you being able to afford up to 12 years of residential care. However, if you’re in the north-east, selling your home may fund just under four years of care.

Government proposes National Insurance rise and lifetime cap on care costs

While the government may have delayed a policy announcement, there has been speculation that there could be a tax rise to pay for increasing care costs.

One idea under consideration is to increase National Insurance contributions (NICs) by 1% and to ring-fence this money for social care.

However, this would renege on the government’s manifesto promise not to raise tax or National Insurance. It would also place the financial burden on younger and lower-paid workers.

Any policy could also include a “lifetime cap” on the amount an individual will be expected to pay towards later-life care, as originally proposed by the Dilnot report. This would restrict an individual’s care costs to somewhere between £25,000 and £50,000, with the balance met by the state.

Get in touch

Ensuring you can fund later-life care is a vital part of your financial plan. To find out how we can help you plan for social care, please get in touch by email at info@blueskyifas.co.uk or call us on 01189 876655.