Back in 1999, the government introduced a brand-new method of tax-efficient saving. The Individual Savings Account (ISA) was designed to encourage more people to save, offering returns that were free of both Income Tax and Capital Gains Tax.

Since their introduction, ISAs have become one of the most popular ways to save, with the government reporting that a staggering £687 billion was held in adult ISAs at the end of the 2020/21 tax year.

What’s more, there’s no sign of their popularity fading. Indeed, research published by Money Marketing showed that Cash ISAs saw a record inflow of funds at the start of the 2023/24 tax year, with £9 billion saved in just three months.

In an environment of rising interest rates, using a Cash ISA – rather than the Stocks and Shares equivalent – may seem attractive. However, while there are many benefits to holding your tax-efficient savings in cash, there could also be some downsides. Read on to find out more.

Cash ISAs offer security and tax-efficient returns

The main benefit of a Cash ISA is that you can save tax-efficiently.

In 2023/24, you can save up to £20,000 in a Cash ISA, and you won’t pay any Income Tax or Capital Gains Tax on the interest you earn. And, you don’t have to declare your Cash ISA on your tax return.

You’ll normally have a range of choices, from easy access to fixed-term ISAs that offer a guaranteed interest rate in exchange for locking your money away for a set period.

They are ideal if you want simple access to your money – using one to house your emergency fund can be beneficial – or if you want certainty that your capital won’t lose value (just remember the £85,000 Financial Services Compensation Scheme limit!)

Tax on savings interest is one key driver for Cash ISA popularity

One of the key drivers for the record influx into Cash ISAs in 2023 has been rising interest rates. After a decade of rock-bottom rates, Moneyfacts reports that, as of 16 October 2023, it’s now possible to earn 5% on an easy access ISA.

Additionally, while interest rates were low, paying tax on your interest was unlikely to be an issue. However, as interest rates rise, it becomes more likely that you’ll pay Income Tax on the interest you earn.

FTAdviser report that more than 2.7 million people in the UK are expected to pay tax on their cash savings interest, up by nearly 1 million in just one year.

Each year, you benefit from your Personal Savings Allowance (PSA). This allows you to earn a certain amount of interest from your savings each year without paying any tax. In the 2023/24 tax year, the PSA is:

- £1,000 if you’re a basic-rate (20%) taxpayer

- £500 if you’re a higher-rate (40%) taxpayer

- £0 if you’re an additional-rate (45%) taxpayer.

With interest rates on cash savings hitting 5%, if you’re a higher-rate taxpayer you’d only have to hold £10,000 for a year in cash savings to use up your PSA – and after that, you’d lose part of your interest to Income Tax.

Considering that there is no Income Tax or CGT to pay on the interest from a Cash ISA, you can see why they may look much more attractive when compared to a traditional savings account.

Keeping wealth in a Cash ISA might not be the best long-term option

While holding savings in a Cash ISA can be useful if you need access to the funds, or you’re saving for a short-term purpose, holding too much wealth in this type of account can hinder your progress towards your financial goals.

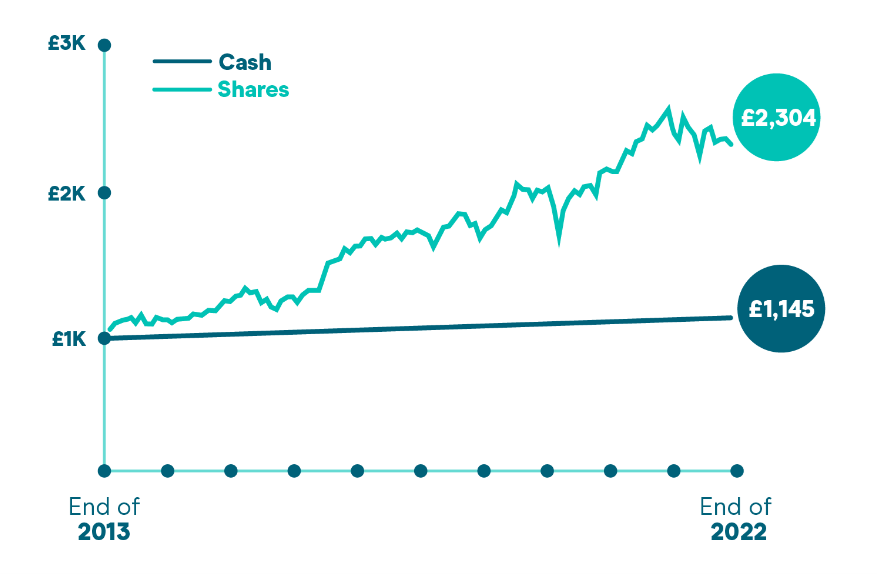

Over longer time periods, the returns from equities typically outpace those of cash. The simple chart below from Moneybox shows a comparison between the returns on their “balanced” investing option and cash over the decade to the end of 2022.

Source: Moneybox. Balanced option = 65% global shares, 10% global property shares, 25% corporate bonds

As you can see, investing for the longer-term can give you the potential to generate greater returns.

Without this growth, you may not see your pension fund or portfolio grow by the amount you need to achieve your later-life goals, meaning you could have to work longer or make compromises to your lifestyle in retirement.

Get in touch

If you’re not sure whether a Cash ISA is right for you, or you’d like to explore how we can help you to achieve your future goals, please get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.