Trying to keep on the positive side of things during this lockdown I have been reading some books which indulge my passion for modern history. Currently I’m reading a book called Who Dares Wins by Dominic Sandbrook which covers off the period of British history from 1979 to 1982.

Whilst focusing on the political, social and cultural aspects of our history, inevitably, the book includes a chapter on the Falklands War. Quoted in an interview in Woman’s Own a few weeks after the war had finished, Mrs Thatcher gave a rather uncharacteristically open interview.

She reminisced about being in the garden at Chequers during the war and thinking how strange it was that ordinary life went on:

“The flowers grow. The garden looks the same. Of course it does. The sun shines. You think, how can it shine?…but someone has had terrible news that day. Everything looks lovely, and yet somehow you feel you ought not to enjoy it because there are terrible things happening…”

Now, irrespective of your political views, I’m sure that we can all relate to this sentiment. Whilst thankfully not at war, there are parallels which can be drawn. Our movements are restricted, our shopping habits have had to alter and there is a daily briefing that gives us updates on ‘casualties’. All unprecedented in modern times.

The coronavirus has struck just at a time when the British countryside awakens from its winter gloom and reveals the full glory of spring with blossom on the trees, green shoots bursting forth, birds singing and the sun feeling warmer. We ought to be enjoying ourselves.

And so, despite the coronavirus, the cycle continues, and the seasons change. In the investment world, Bull and Bear markets are the seasons. They come and go.

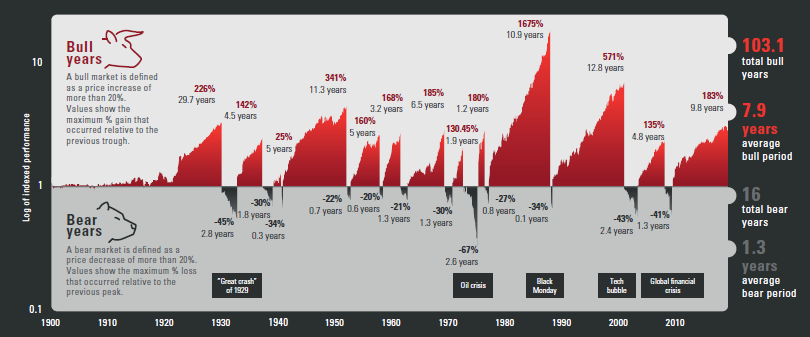

Let’s remind ourselves of the Bull and Bear markets that the UK has experienced since 1900:

Some key takeaways to learn from this:

Out of 120 years of UK stock market performance, 103 of those years were positive. In other words, the UK stock market increased 85% of the time. The average Bull period lasted 7.9 years and the average Bear period lasted 1.3 years.

Taking away the emotion from investing in the markets (easier said than done), if you were to play the odds, what would you put your money on happening over the long term? And don’t forget that, historically, much of the recovery has come at the front end of the next bull market. Which is why we don’t sell – unless we absolutely have to and why we should buy more – if we can.

Back to ‘the now’.

You may be feeling quite disoriented, fearful and anxious as our ‘normal’ has been shaken.

The coronavirus has impacted the global economy unlike anything we’ve seen in the past. The uncertainty of its length and breadth is what is adding to the unusual volatility financial markets are experiencing. Stock markets are in bear market territory. If you own bond funds (most of you do) they have served as a ballast to cushion the fall.

No one really knows if we are at the beginning, middle or end of the crisis. From all the measures taken by organisations and governments around the world to stop the spread of the virus bringing economic activity to a standstill, we would expect to see a recession in the coming weeks and months. We don’t know how severe or mild the impact will be.

Once the virus is under control, we should see a pick-up in demand and markets should recover. Until then, we’ll need to weather the volatility as best we can. Governments are already putting together stimulus plans to help those most affected by disruptions to daily living.

In the meantime, sitting still, doing nothing, not selling can seem stupid. Here at BlueSKY, we won’t call doing something like selling ‘stupid’; just unfortunate. Unfortunate because then you have locked in your losses, and then the next hardest task lies ahead – deciding when to get back in. And yet we know that if you miss the bottom, even by a few weeks or months, you can miss the quickest part of the recovery.

In this very challenging and uncertain environment, I recommend we hold steady. Tune out the noise, focus on your long-term goals and let the benefits of diversification play out.

Please know that we are your ‘thinking partner’, your resource, your guide holding the lamp to light the way forward. Call us if you want to talk things through.