Next month, more than 40,000 runners will take to the starting line for the 42nd London Marathon. Watching people from all walks of life battle their way through 26.2 miles of the capital’s streets is inspirational in more ways than one.

This year’s runners have trained to be as fit as possible ahead of the race, but have you considered what shape your finances are in?

Here, inspired by the London Marathon, are five essential lessons about building a successful investment strategy that you can learn from long-distance runners.

1. Make sure you’re in it for the right reasons

For professional runners, the London Marathon is just one of many races in the annual event calendar. But for those amateur participants who raise thousands of pounds for charity each year, the marathon holds some personal significance – and there’s a lesson in that for investors.

Running isn’t always just about the fastest time, and similarly there should be more to investing than simply achieving returns. Before you go any further in your investment journey, think about this: why do you really want to invest?

Maybe you want to enjoy a comfortable retirement. Perhaps you want to help children or grandchildren onto the property ladder?

Whatever it is, keeping that motivation in the back of your mind will help you stay on the right track.

2. Get off to a confident start

According to Athletics Weekly, one of the most common mistakes runners make at the beginning of a race is to overreach their legs, straining the hips.

It’s better to start with small strides and build consistently from there, and there’s a comparable technique in investing that could provide better long-term results.

Making regular, smaller payments towards investments over time, instead of investing one initial lump sum, can result in a benefit called “pound cost averaging”. The idea behind drip-feeding investment payments in this way is to help take the emotions out of investing, as you’ll be making contributions whatever state the market is in.

Pound cost averaging is a disciplined approach to investing, so if you’re at the outset of your journey, it could provide a solid foundation to build on. Even if you’re a seasoned investor, making regular contributions can help provide some protection against the market falling immediately after you invest a lump sum.

3. Don’t give up when the going gets tough

The middle miles of a race are notoriously the most difficult on both the body and the mind. You may have successfully run 13.1 miles, but there are still another 13.1 miles to go, and investors can draw inspiration from how runners push past this barrier.

The key to overcoming the middle miles of a race is avoiding distractions and refocusing on your end goal, and the same applies to investing. Here’s an example.

On 24 February 2022, the day Russia invaded Ukraine, the FTSE 100 fell by 3.8%. Any panicked investors soon had their worries put to rest, though, because the next day the index rose again by almost 4%.

It’s not uncommon for adverse situations to affect your investment portfolio. The trick is being able to hold your nerve.

4. Keep your eyes on the finish line

Whether you’ve set a new personal best or just managed to limp along to the end, there’s no greater feeling than crossing a marathon finish line. It’s the achievement all your patience and hard work has been building towards, which is a point worth bearing in mind at other times too.

Investing is typically about long-term results, not short-term gains. Concentrating on your ultimate goal will help allay any fears you might have.

Here’s an illustration of why that’s so important.

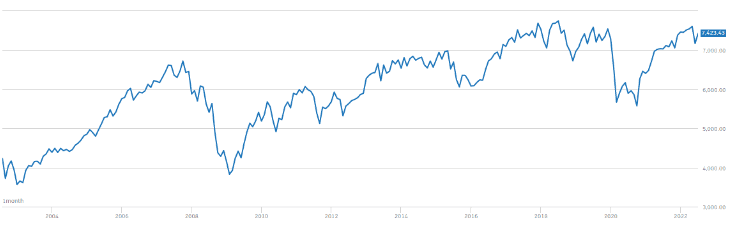

The graph below shows the performance of the FTSE 100 index, which tracks the performance of the London Stock Exchange’s top 100 companies, between the end of July 2002 and the end of July 2022.

From the right-hand axis, you can see that despite many downturns and even two market crashes, broadly speaking the index has significantly risen in value.

Source: London Stock Exchange

If you’d been rattled by those slumps, you may have decided to sell your investments, and missed the potential for significant gains further down the line. Remember: you’re in it for the long run.

5. Build the right support network around yourself

Do you know who Alex Stanton is?

How about Paula Radcliffe?

The former was the coach of the latter, who still holds the elite women’s London Marathon record, set in the 2003 race with a time of 2:15:25. Paula attributed much of her incredible success to Alex’s tuition, something runners – and investors – can learn from.

When preparing for the London Marathon, professionals and amateurs alike can benefit from working with a coach, joining a running club, or even using a training app. The point is that a little outside help can make a big difference, and that’s the case with investing as well.

A professional financial planner can help put a plan in place that considers all your individual circumstances. To give yourself the best possible chance of a happy and comfortable financial future, seek the services of someone you trust to help you get there.

Get in touch

If you’re ready to play the long game and invest in your future, our financial experts can point you in the right direction. We have over 20 years’ experience in helping clients just like you to achieve peace of mind and fulfil their aspirations through effective financial planning.

To find out how we can help you, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.