Earlier this month, the UK stood in silence to remember the fallen on the 75th anniversary of Victory in Europe day.

In an address to the nation, the Queen said: “Many people laid down their lives in that terrible conflict. They fought so we could live in peace, at home and abroad. They died so we could live as free people in a world of free nations. They risked all so our families and neighbourhoods could be safe. We should and will remember them.”

Just two weeks after VE Day, the UK voted in a General Election that returned a landslide Labour government. One of the first challenges that Clement Attlee faced was the huge public debt that had been generated as a consequence of the wartime effort and how best to increase tax revenues to tackle this deficit.

There are many economic parallels between the aftermath of the Second World War and the likely outcomes of the coronavirus pandemic. In both cases, the government has been forced to borrow substantial amounts to fund the effort.

And, both 1945 and 2020 highlight the challenges of regaining control of the public finances without penalising those (often working-class) people who were at the front line of the efforts. Back then it was soldiers, sailors and airmen – today it is NHS staff, retail workers, bus drivers and care home workers.

The government is facing some stark choices, just as it did in 1945. So, what can history tell us about what might happen as we exit the pandemic?

Inheritance Tax set to rise?

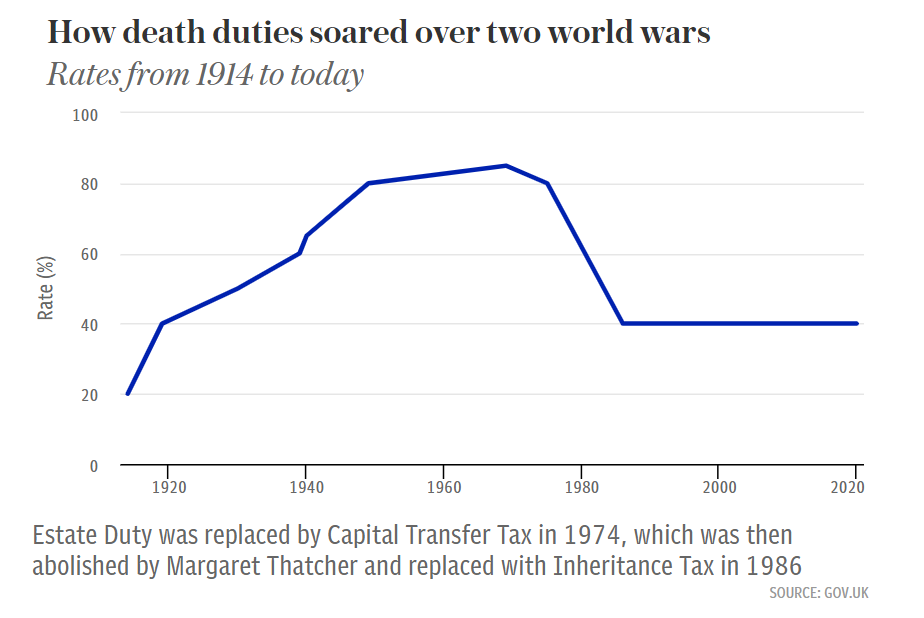

One way the post-1945 government sought to increase tax revenue was to substantially raise the rate of Inheritance Tax (IHT).

Then called ‘estate duty’, the rate was increased from below 60% to 80% after the Second World War and reached a peak of 85% in 1969.

Source: Telegraph

Today, the IHT rate stands at 40% – as it did a century ago – so could we see similar rises over the next couple of decades as we did in the aftermath of WWII?

While there was speculation that the Chancellor might reform IHT in his first Budget, no changes were made. However, as the tax typically affects the better-off – likely to be a key requirement of any tax hike – changes could be on the way.

Measures the Chancellor could consider include:

- Increasing the rate of IHT from 40%

- Reducing the current thresholds so the tax kicks in earlier

- Reforming the current reliefs, perhaps abolishing gifts, the ‘seven-year rule’ or the ability to pass on unused pension assets tax-free.

IHT raised more than £5.2 billion for the Treasury in 2017/18. Widening the tax net, implementing reforms or raising the rate could result in a significant revenue hike for the government.

It could therefore be wise to take advantage of the various allowances and exemptions while they are available.

Could Income Tax be set to rise?

During World War II, the government borrowed heavily in order to finance the war effort. By the end of the conflict, Britain’s debt exceeded 200% of GDP, and the last of its war loans to the US wasn’t repaid until 2006.

We have looked at how the government is borrowing more than £200 billion to support the economy during the coronavirus pandemic.

And, just as after 1945, British taxpayers could be facing significant increases in Income Tax to repay this eye-watering debt. Indeed, the Chancellor has already hinted that the self-employed could be facing tax rises to bring them in line with employed workers.

When announcing his package of measures to support the self-employed, Rishi Sunak said: “If we all want to benefit equally from state support, we must all pay in equally in future. It is just an observation that there is currently an inconsistency in the tax treatment of the employed and self-employed”.

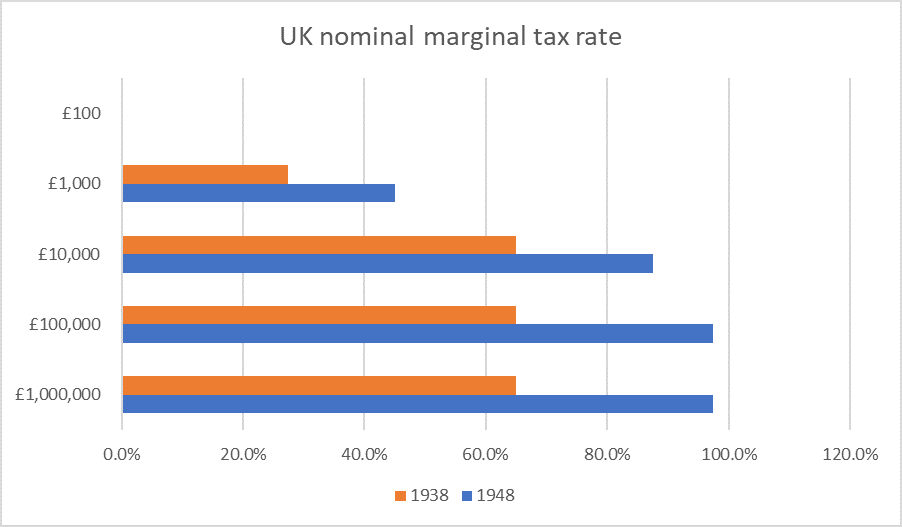

Studies have found that the top marginal Income Tax rates in the UK rose substantially between 1938 and 1948:

Source: https://www.ehs.org.uk/dotAsset/8706c2fa-8c55-4d40-bfa5-75177223df68.pdf

While the top rates of tax rose from 65% to 97.5%, Income Tax rises also affected workers on more modest incomes.

History shows us that increasing the rates of Income Tax does have precedent in times of crisis and so the 45p top rate could be set to rise.

There could also be changes to some of the existing reliefs and exemptions. Most of the £21.2 billion a year the government foregoes through pension tax relief is claimed by people earning more than £50,000 a year and so there could be changes to pension tax relief for higher earners.

In addition, Council Tax bands have not been revised in almost 30 years and so further property taxes could also raise revenue.

Get in touch

In coming years, it is reasonable to expect that there will be changes to tax laws, tax rises, or new taxes introduced to fund the coronavirus effort. These could be on property, wealth, income or inheritances.

Now could therefore be the time to act in order to benefit from some of the reliefs and exemptions that are available. If you need any advice, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation which is subject to change.