Understanding the experiences of others can help you to build your own plan for retirement. That’s the aim of the third Great British Retirement Survey, featuring responses from more than 10,000 people.

This comprehensive study of attitudes to retirement is important, as it can not only help to refine your own thoughts, but it can also build consensus for policy and legislative change.

This year’s survey reveals that, perhaps unsurprisingly, a pension remains the top choice among ways to provide an income in retirement for two-thirds of people. Here are five other key takeaways.

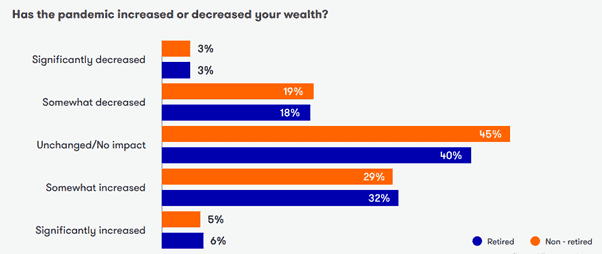

1. There have been winners and losers from the pandemic

The last couple of years have affected everyone in a variety of ways. What this year’s Great British Retirement Survey revealed was that, in terms of wealth, there had been winners and losers from the pandemic.

A potential surprise is that more respondents said that the pandemic had increased their wealth than said it had decreased it, as this chart shows.

More than one in three (34%) retired respondents said their wealth had increased since March 2020. Responses suggest that some were lucky in their investment timing, while others said they had been able to invest extra when normal spending was restricted during lockdowns.

Among non-retired people, even more (38%) said their wealth had increased.

On the flipside, a smaller but significant number – around one in five people – saw their wealth depleted during the pandemic. 22% of retired people and 21% of non-retired people said their wealth had decreased.

Even when markets had recovered, many people were still taking a hit in terms of income because of companies slashing or cancelling dividend payouts. Over the year from March 2019 to 2020 UK companies cut dividends by 41.6%. 51 FTSE 100 companies, 115 FTSE 250 companies and 149 AIM-listed companies cut, suspended, or cancelled dividends in 2020.

2. Many savers are concerned about changes to tax and regulations

Many survey respondents highlighted that one of their key fears was that tax and regulation changes would impact the benefits of their efforts in saving for retirement.

Comments about a respondent’s “biggest financial concern” included:

- A change in policy on retirement age

- Wealth being means-tested or taxed away

- Further buy-to-let tax raids

- Changes in pension legislation

- Changing government policy – for example, freezing the Lifetime Allowance.

The survey commented: “These fears can act as a disincentive to saving for retirement. They can build distrust in heavily regulated savings vehicles – such as pensions – that require savers to lock away money for the long term in accounts that are at the whim of many successive governments over a working life.”

The Lifetime Allowance (LTA) came in for particular criticism. Many respondents suggested that it was a disincentive for people to save for retirement, while others felt that the LTA penalised good investment performance.

This issue is likely to affect many pension savers. 45% of non-retired survey respondents expected a pension pot of over £500,000, and 21% expected their pot to be at least £1 million – and so likely to be affected by the LTA.

3. Significant numbers wished they had understood “risk” better

One interesting outcome of this year’s survey was that a significant number of people reported that they felt they had not taken enough investment risk in their life.

The survey asked whether respondents wished they had understood more about the benefits of taking a higher-risk approach with their pensions when they were younger – and potentially generating a higher return.

Just under a third (30%) of retired respondents said they wished they had understood more at an earlier stage, while 2 in 5 (39%) of non-retired respondents saying they wished they had known more about investment risk and its benefits when they were younger.

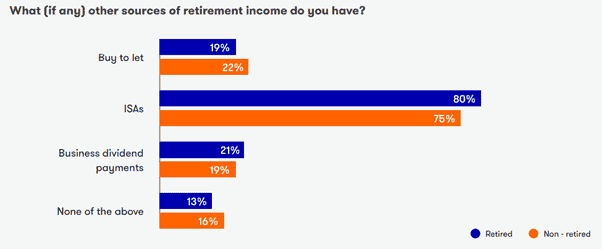

4. Retirement income will come from a variety of sources

While pensions remain the most popular way to save for retirement, it’s clear that many people expect to fund their later years from a variety of sources.

80% of retired respondents and 75% of those who were not yet retired said they had ISAs, while around 1 in 5 respondents had a buy-to-let property.

Only 13% of retired respondents did not have any of these additional sources of income.

5. Only a quarter of people are working with a financial planner

When it came to asking for help in planning their retirement finances, many respondents were still going it alone – despite the benefits of working with a planner.

Almost two-thirds (64%) of retired people said they did their own research online, while 2 in 5 (42%) also said they gained information from reading the financial press.

Around 1 in 4 respondents (27% of retired, 23% of non-retired) said they paid a financial adviser for help, and a worrying 13% did not look for any help or guidance at all.

Working with a financial planner in the run-up to (and at) retirement can have huge benefits. We can create a plan to ensure you have “enough” to retire, use sophisticated cashflow modelling software to ensure you won’t run out of money, and help you to ensure you structure your retirement income in the most tax-efficient way.

To find out what we can do for you, please email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.