One glance at your workplace calendar and you’ll likely see 5 April circled in red. The end of tax year can be a stressful time as individuals and businesses alike double and triple check their returns to make sure everything is handled correctly.

So, getting a head start on your new tax year could be a useful way to reduce stress, improve your emotional wellbeing, and ensure your affairs are handled as tax-efficiently as possible.

Read on to discover five important things you should consider doing at the start of the 2023/24 tax year, rather than waiting until the end.

1. Review the past tax year and prepare a plan for the new one

A financial plan typically takes on a long-term outlook possibly spanning years or decades. However, it is important to also carefully review your plan at least once a year.

One such way to do so — once 6 April arrives — is to set up a meeting with your adviser and to review your plan in light of your circumstances and any changes to tax allowances and exemptions.

You may want to review:

- Any taxes you are liable to pay for the 2022/23 tax year

- Any missed opportunities to reduce your liability from the past two tax years

- Any allowances that have rolled over into the new tax year.

The recent spring Budget announced by Jeremy Hunt has also brought about several tax changes to be aware of in the coming year — some of which could offer you beneficial opportunities.

Once you’ve outlined areas to improve, you can start formulating a plan for the new year.

2. Re-examine and consider increasing your pension contributions

According to wealth and wellbeing research from LV, nearly 1 in 4 UK working adults don’t know how much they’re paying into their pensions. It’s a surprising statistic considering the associated tax benefits and how important your pension can be for your long-term plans.

Saving into a private or workplace pension scheme can be an incredibly worthwhile move, as you can benefit from:

- Tax relief on your contributions at your respective Income Tax rate (up to the Annual Allowance of £60,000 for the 2023/24 tax year)

- The effects of “compound returns” on your pension investments, which can generate substantial growth over time

- Employer contributions, where due to auto-enrolment rules, your employer will contribute at least 3% to your pot alongside your contributions.

Of course, making your pension contributions early in the tax year means that your money can start working for you immediately, in a tax-efficient way.

Reviewing your pension also allows you the opportunity to assess how much you’ve saved and how far you have to go to reach your goal. This might include checking on things like your State Pension and if you’re on track to have enough qualifying years before retirement.

3. Assess your ISA investments and how to utilise your Annual Allowance

ISAs can be valuable, tax-efficient saving and investing vehicles that could help you reduce your tax liability and help you generate the growth needed to reach your long-term goals.

And, according to HL, making a contribution to your Stocks and Shares ISA at the start of the tax year rather than the end could have significant long-term benefits.

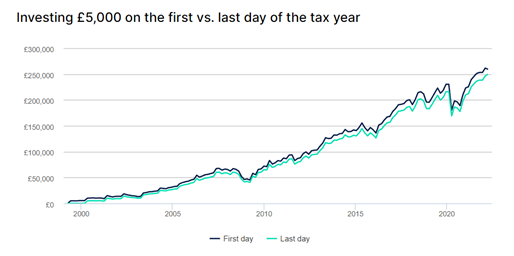

The firm studied how investment performance differed between investing £5,000 in a Stocks and Shares ISA on the first and the last days of the tax year for the 23 years between 6 April 1999 and 28 March 2022.

The research showed that both options, despite periods of economic instability such as the 2008 financial crisis and the dip in markets after the first Covid lockdown, returned growth of more than 115%, not including charges, as shown by the graph below:

Source: HL

You can see that investing at the start of the tax year ended up generating approximately £10,000 more growth over the 23-year period than investing at the end of the tax year. So, making your contribution earlier could have benefits.

Remember that the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

4. Consider steps to mitigate any potential Inheritance Tax liabilities

Inheritance Tax (IHT) can potentially leave your loved ones with a substantial bill once you’re gone.

One useful way to potentially reduce your IHT is to consider gifting your wealth to your loved ones while you’re still alive.

You could choose to:

- Gift up to the £3,000 annual exemption

- Gift small amounts of £250

- Give wedding gifts of up to £5,000 to your children or £2,500 to grandchildren

- Gift large sums of money through Potentially Exempt Transfers (PETs) — although this gift must usually be made at least seven years before you die to avoid IHT.

Taking any steps you can early in the tax year can help you to mitigate a potential IHT bill. Gifting early also increases the chances of you surviving for seven years, and thus any PETs you make falling outside your estate.

5. Complete your tax return early and get ahead of any potential liabilities

Completing your tax return might feel like an end of year task but starting it early can allow you to get ahead of the game from a tax planning vantage point.

If you complete a self-assessment tax return early, you can:

- Start sourcing any information you might need to complete it

- Evaluate any potential liabilities ahead of time

- Spread the workload towards completing it over the course of the year

- Reduce any potential stress arising from a last-minute rush and boost your overall peace of mind.

Knowing how much tax you may be liable to pay in January 2024 can help you to plan months in advance.

Get in touch

If you are interested in reviewing your plans for the coming year and seeing how you can make steps to be more tax-efficient, please get in touch. Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.