Back in the early 2000s, Sharon Stone was one of Hollywood’s most bankable stars. The star of hits including Basic Instinct had amassed savings of $18 million before, in 2001, she was rushed into hospital after suffering a brain haemorrhage that lasted for nine days.

The actress has recently spoken about how it took her seven years to recover from the incident and how, during that time, people “took advantage” of her.

She told the Independent: “When I got back into my bank account, it was all gone. My refrigerator, my phone – everything was in other people’s names. I had zero money.”

Serious illness, accidents, and injury can happen at any time, without warning. Stone was just 43 years old when she was admitted to hospital. So, as you never know what is around the corner, it’s vital to take steps now to ensure that someone you trust can manage your affairs if you can’t.

A Lasting Power of Attorney (LPA) is an effective way to give yourself the peace of mind that someone can make important decisions on your behalf if you’re unable. Yet, Canada Life research reveals that 4 in 5 adults in the UK have not registered an LPA – including 2 in 4 over 55s.

Read on to find out why putting an LPA in place is so important.

An LPA lets you nominate someone you trust to make important decisions for you

An LPA is a legal document that empowers your chosen person (an “attorney”) to make decisions for you if you’re unable. You can specify the scope of the LPA when you set it up and outline the wishes you’d like your attorney to follow.

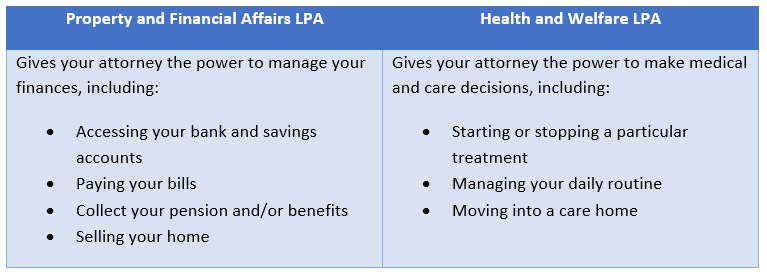

There are two main types of LPA.

It’s important to note that a Health and Welfare LPA can only be used once you have lost mental capacity. A Property and Financial Affairs LPA can be used at any time – for example, you might delegate financial matters to your chosen attorney even if you retain mental capacity.

You can also set up an LPA temporarily – for example, if you know you are going to be in hospital for a short period.

Registering an LPA is vital at any age

It’s easy to assume that an LPA is only necessary for older people who perhaps can’t manage their affairs or care due to conditions such as dementia or Alzheimer’s.

However, as Sharon Stone’s story indicates, you never know when you will be incapacitated and need someone to look after your affairs for you. Nominating a trusted person to make decisions might be useful if:

- You have to go into hospital for a period for surgery or a procedure

- You are in an accident and incapacitated

- You are diagnosed with a serious illness

- You decide to travel for a period and need someone to manage your finances while you are away.

Remember that you can’t set up an LPA once you have already lost mental capacity – you have to register it before. Consequently, many people only realise they need an LPA when it is too late – when they are already in hospital or when they have been diagnosed with an illness such as dementia.

If you don’t have an LPA, it could make life difficult for your loved ones

As you have read, an LPA can give you peace of mind that there is an “understudy” in place who can make important decisions on your behalf.

However, if you’re one of the 78% of UK adults without one, this could cause many problems for your loved ones if you are incapacitated.

You may have to wait weeks or months to make decisions

If you have registered an LPA, your attorney can start to make decisions immediately.

Without one, your family would need to appoint a deputy, which involves a potentially time-consuming application to the Court of Protection.

Leading law firm Irwin Mitchell says that the process of appointing a deputy can take four to six months – and this is a time where your family or friends would not be able to act for you.

It may be more costly

In 2024, it costs £82 to register an LPA (for most people).

Aside from potential lengthy delays, the process of appointing a deputy could cost your family up to £365, plus any associated legal costs.

The appointed deputy may not be the person you would have chosen

One of the key benefits of an LPA is that you can choose the people you’d like to act for you. For example, you might nominate a close family member to make care decisions and a colleague, co-director, or professional to manage your finances.

You can also specify whether your attorneys will need to all agree on a decision or can act individually. This is an ideal solution when you need to think about specific areas as you can choose people with expertise to help with each element of your affairs.

Without an LPA, your loved ones would have to apply to the Court of Protection for a deputyship order – and the court may not appoint the person (or people) you would have chosen for the role.

Get in touch

Registering an LPA is a key element of a strong financial plan. To find out how we can help you achieve your goals, please email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, Lasting Powers of Attorney, or will writing.