Supposedly, the first rule of investing is: buy low and sell high.

Of course, if it were that easy everybody would be doing it! Trying to time the market by buying when the market hits rock bottom and selling when share prices peak is something that not even the most celebrated investors can achieve on a consistent basis.

For example, less than five years after the financial crisis many pundits were saying that US stocks were overvalued. Fast forward five years and the US market has gained more than 60%.

The Brexit example

Back in June 2016, in the immediate aftermath of the EU referendum, the FTSE 100 and the FTSE 250 fell 9% and 12%, respectively.

Many experts were predicting that things were only going to get worse, and many nervous investors pulled out of the market.

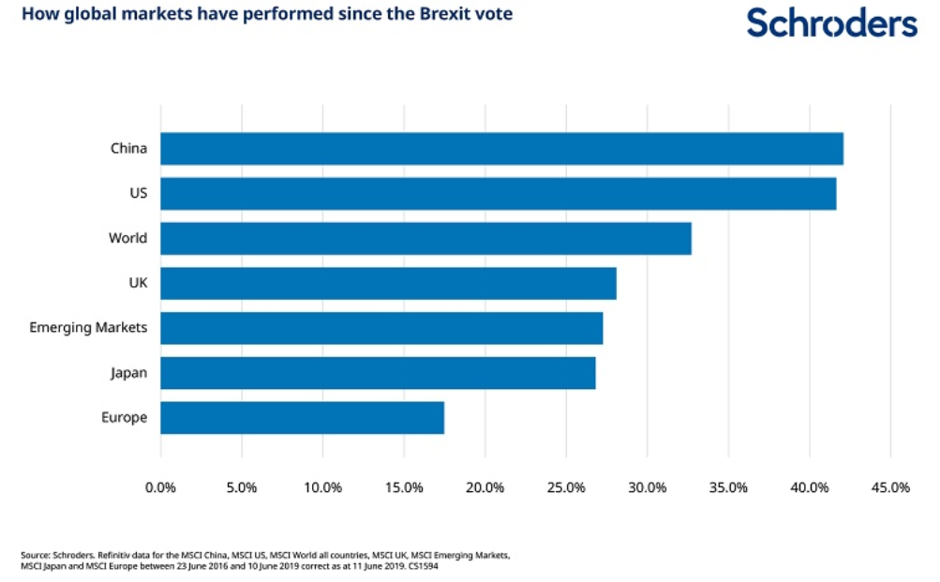

But, between the close of the market on 23 June 2016 and 15 June 2019, UK shares (as measured by the FTSE All-Share) rose by 28.1%. Indeed, during this period, UK stocks outperformed emerging market, Japanese and European stocks.

It wasn’t just UK shares that performed well over this period. Since the Brexit vote, China shares have returned 42.1%, according to Thomson Reuters data; US stocks returned 41.6% and world stocks have returned 32.7%.

If you had sold the day after the Brexit referendum, you’d have missed out on a potential 28% return over the next three years. Trying to second-guess the markets can be a fruitless endeavour.

Award-winning journalist Robin Powell says: “The most overlooked challenge with market timing is that it requires you to make two correct decisions: You must get out at the right time — and you need to know when to get back in.

“The fact is, market timing is tricky, because big gains and losses can come in relatively short periods. Not even the professionals have much of a track record in successfully negotiating these unpredictable twists and turns.”

As part of our investment philosophy we accept that trying to time the market is unlikely to be a successful strategy over the long term. As a result, our investment strategy incorporates the following beliefs.

1. Making sure you have a diversified and balanced portfolio

We believe that all clients should have a diversified and balanced portfolio that is aligned to their risk profile. This might include a mixture of stocks, bonds and cash although the right blend will depend on your age, goals and circumstances.

Whatever your risk capacity, diversification is key. Spreading your risk across different asset classes and geographies will reduce the impact of disappointing returns or a slump in one particular market.

2. Taking a long-term view

In the last five years, investors have been given lots of external reasons which could have affected their investment decisions. From the ongoing Brexit negotiation process to Donald Trump becoming President of the US, there have been many events which could have affected your confidence in investing whilst also delaying any major financial decisions you may have wanted to make.

The old adage applies here: “Time in the market, not timing the market”.

Over the very long term, patient investors holding diversified investment portfolios have almost always been rewarded.

3. Investing on a regular basis

One of the main arguments for making regular monthly investments is that you take advantage of ‘pound cost averaging’ – where you can benefit from market volatility by buying shares or units more cheaply on average.

Here’s an example.

Let’s say you invest £300 a month. In the first month, the share price of whatever you’re investing in is £5, allowing you to buy 60 shares.

If the share price falls to £4 in the following month, you will buy 75 shares. Overall you then have 135 shares and the potential for greater returns when the share price rises again.

If you had initially spent a lump sum of £600 on the shares, you would now have just 120 shares. In a volatile market, the average price per share tends to work out lower when you save regularly – in this case, the price per share is £4.44 rather than £5.

Of course, while drip-feeding your investment can mitigate the effects of downward share price movements, it may also limit gains when the market is rising.

4. Rebalancing from time to time

Generally speaking, the less you tinker with your financial plan, the better. Any changes you make should be done in a strategic, structured and disciplined way that reflects your needs and circumstances.

Speaking to your financial planner on a regular basis can help in this regard. That is because, over time, your portfolio can become unbalanced from your original asset allocation (perhaps if one asset class has risen sharply in value).

Rebalancing your portfolio periodically will bring its asset allocation back into line with your target portfolio weights. This will ensure that your investment remains aligned to your risk level.

Get in touch

As a BlueSKY client we keep your investments under regular review. However, if you want to know more, email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.