Could financial planning help people considering a divorce? And might exploring the financial implications before starting the process empower clients to act? Here are Mark’s thoughts on these questions and more…

A recent survey initiated by Brewin Dolphin produced some interesting statistics which resonated with me after a recent conversation that I had with a family lawyer.

The conversation reflected on the anguish that many people suffer when considering whether to pursue a divorce or not. There’s a huge pool of individuals who are, sadly, unhappy in their marriage but not sure what to do about it. Apparently, 52% of those who have thought about a divorce don’t think they could afford to do it.

This postulation continues with thoughts such as:

- I don’t think I could afford to house myself after a divorce

- I don’t think I can afford the legal fees

- I don’t think I can live on a lower income

- I don’t think my share of the finances would last me in retirement.

All these ‘don’t thinks’ mean that 59% of those thinking about leaving their partner delay the decision. It’s something we and family professionals hear regularly.

When people say they ‘don’t think’ they are essentially saying that they don’t have the knowledge. This is a dangerous thing. It creates procrastination and increased anxiety and, in some cases, depression.

The ‘live your life as you only live once’ mantra that may be sought seems unobtainable. The thought of divorce is shrouded by unknowns and often further tainted by bad advice from friends they may have confided in.

If the main concerns are financial, why is a family lawyer the first port of call on divorce?

The obvious solution to the ‘I don’t thinks’ is to seek professional help. Obtain some authoritative input that can set the record straight, dispel myths, and give guidance on how the future might look.

From the research, it becomes clear that understanding how the future might look can offer the reassurance and motivation that clients need.

If finances are the biggest concern, why is the traditional first port of call legal assistance? And not just legal assistance, but legal assistance that 32% of those considering divorce are worried about the cost of?

Legal assistance can’t normally provide the financial advice that clients need to allay fears.

It would seem to be the tradition that a family lawyer is the first port of call when considering a divorce. But it is evident from the research, and my own anecdotal experience, that the majority of people want to explore how things might work out financially before pursuing the legal process of divorce.

A Mediation Information Assessment Meeting (MIAM) can help divorcing couples to understand the options available but there are two issues with this:

- Many want to explore their options before discussing divorce with their partner.

- Many MIAM courses do not include financial guidance that is sufficient or specific enough to give the individual financial outlook required.

The conclusion is that early financial guidance would help many who are thinking about divorce.

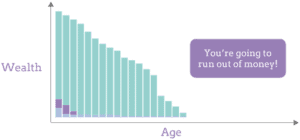

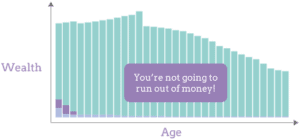

As the illustrations below show, we use cashflow modelling to illustrate how things might look post-divorce. This tool helps to clearly demonstrate whether a client is likely to run out of assets and identify at an early stage what a client’s financial future may look like.

The visual representation is often the light-bulb moment that many seek. Where can we find this advice?

Ideally, it needs a professional who is regulated to give financial advice and is conversant with and experienced in the divorce process from a financial and legal perspective.

The vital role of a Pension on Divorce Expert (PODE)

In 2019, the Pension Advisory Group (PAG) produced A guide to the treatment of pensions on divorce in which it recommends the use of a PODE (Pension On Divorce Expert). It also notes the list of competencies that the PODE should have in order to provide guidance on pension sharing matters.

This would seem a good place to start when seeking financial guidance on divorce – although not all the competencies noted are necessary for the assistance I have described.

The Resolution website also has a list of qualified IFAs who are likely to be able to help.

Perhaps, in addition to running MIAM courses, there should be FIAM (Financial Information Assessment Meeting) courses which might help individuals with that first scary step: “Can I afford to get divorced?”

For more than 20 years BlueSKY have been producing pension sharing reports for courts, solicitors, and mediators. We also act for individuals as described above, and act as a shadow expert to help you and your client make sense of the options that they may have been presented with.

We can help your clients

If you have clients who you feel could benefit from a confidential chat with a firm of professionals that have been dealing with finance and divorce for many years, please feel free to suggest that they get in touch.

Any conversations will be in the strictest confidence and could well prove the clarity that your client needs to move their life forward.

Email info@blueskyifas.co.uk or call us on 0118 987 6655.