When stock markets fall, your instinct may be to sell. It’s a perfectly understandable human reaction – after all, no one wants to lose their money.

However, how do you know when is the right time to buy and sell?

The answer is: you don’t. Even highly paid fund managers don’t get it right every time.

Take the coronavirus pandemic as an example. Markets fell sharply as governments introduced lockdowns across the world in spring 2020. Now, most global markets have recovered with some, including the US Dow Jones and Nasdaq, hitting record highs.

Had you sold as the markets fell, you’d have potentially missed out on significant growth over the next few months.

There’s an old investing phrase that says that “it’s time in the markets, not timing the markets” that counts. Now, new research from Schroders has revealed how missing even just a few of the best days in the market can cost you significant sums. Read on to find out more.

A quick note on “loss aversion” and how it can be detrimental to your wealth

Firstly, here’s brief word about why it’s human instinct to sell when markets are falling. It’s a psychological phenomenon called “loss aversion”.

Loss aversion is a term first used by Nobel prize-winning expert Daniel Kahneman and his associate Amos Tversky. It describes the human tendency to prefer avoiding losses over acquiring the equivalent gains.

Research suggests that we feel the pain of a £100 loss twice as sharply as the pleasure of a £100 gain. What this means is that you can end up being more cautious than necessary as you try to avoid losses.

Avoiding investments because you don’t want to lose money or selling as markets fall as you’re worried about losses, can be detrimental to your long-term wealth.

Missing just a few days in the market can cost you thousands

Rather than trying to time when you enter and exit the market – attempting to “buy low, sell high” – a better option could be to invest, and then just leave your money for the long term.

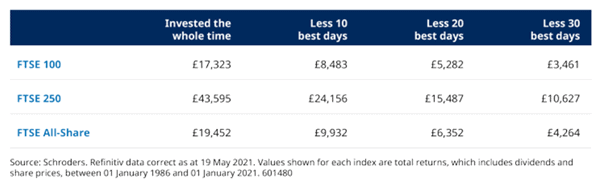

This approach can be beneficial, as recent research from Schroders has revealed. They considered the performance of the FTSE 100, the FTSE 250, and the FTSE All-Share indices over a period of 35 years from 1986.

They found that, during this time, mistimed decisions on an investment of just £1,000 could have cost you almost £33,000-worth of returns.

If at the beginning of 1986 you had invested £1,000 in the FTSE 250 and left the investment alone for the next 35 years, it might have been worth £43,595 by January 2021.

During the same period, if you missed out on the FTSE 250 index’s 30 best days the same investment might now be worth £10,627, or £32,968 less, not adjusted for the effect of charges or inflation.

Over the last 35 years your original £1,000 investment in the FTSE 250 could have made:

- 4% per year if you stayed invested the whole time

- 5% per year if you missed the 10 best days

- 1% per year if you missed the 20 best days

- 7% per year if you missed the 30 best days

It’s the same story if you had missed just a few of the best days in the FTSE 100 or FTSE All-Share.

If you’d missed just the 10 best days over a 35-year period invested in the FTSE 100, your investment would have been worth less than half the amount it would had you stayed invested for the entire time.

Source: Schroders

Nick Kirrage from Schroders says: “You would have been a pretty unlucky investor to have missed the 30 best days in 35 years of investing, but the figures make a point: trying to time the market can be very, very costly.

“As investors we are often too emotional about the decisions we make: when markets dive, too many investors panic and sell; when shares have had a good spell, too many investors go on a buying spree.”

He adds: “The irony is that historically many of the stock market’s best periods have tended to follow some of the worst days. It’s important to have a plan of how long you plan to stay invested […] then it’s just a matter of sticking to it – don’t let unchecked emotions derail your plans.”

Why working with a financial planner can help you to maximise your returns

This Schroders research shows clearly that trying to time the market is fraught with danger. Even missing a handful of the best days over a long period can put a serious dent in your returns, which is why our investment principles are so important.

The final point here, about “endurance”, is particularly relevant. Investing is a marathon, not a sprint.

One of our roles as financial planners is to provide a sounding board to help you avoid making knee-jerk or emotional decisions. We’re here to counsel you when markets are volatile, and to encourage you to stick to your long-term plan and to avoid making mistakes you’ll later regret.

Get in touch

To find out how our investment approach can help you to achieve your goals, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.