In recent months, you’ll no doubt have seen headlines claiming that Buy to Let investment is dead. A combination of tighter regulations, tax changes and stagnating house prices have seen many experts sound the death knell for property as an investment, with research from the Royal Institute of Chartered Surveyors (RICS) finding that even as tenant demand continues to increase, landlords are more likely than ever to leave the market.

However, there are still significant opportunities for savvy investors to profit from property – if you know where to look.

Why property can be an excellent investment

In certain parts of the UK, it’s true to say that rental yields have suffered in recent years. Property prices have risen faster than rents, leaving some landlords questioning whether their bricks and mortar investment remains worthwhile.

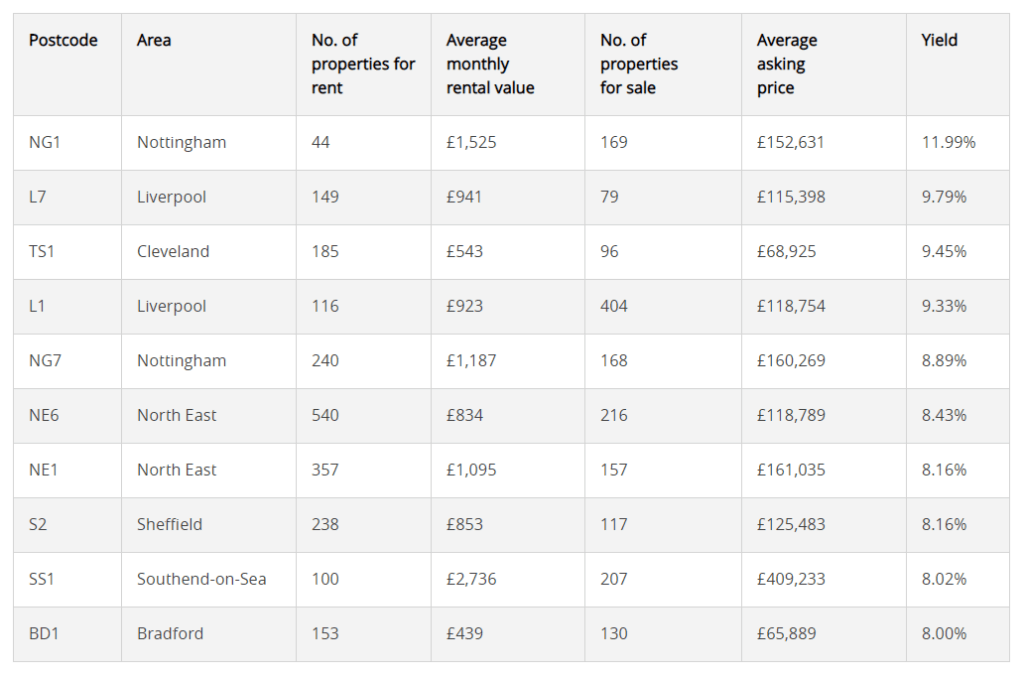

However, in certain parts of the UK, rental yields continue to be extremely strong. Research published in Which? in late 2018 found that property hotspots such as Nottingham, Liverpool, the North East and Yorkshire were still offering rental returns of 8% or even more.

Source: Which?

Even in London and the South East, there remain areas where rental yields of 4% or more are achievable. East Ham, Stratford, Hammersmith and Poplar are just four areas where yields exceed 4%.

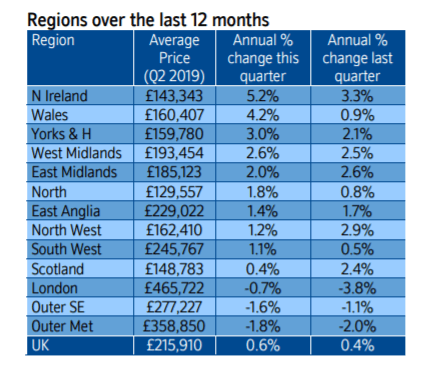

As well as excellent rental yields, property prices continue to grow in several UK regions. While the latest Nationwide House Price Index showed that annual house price growth across the UK remained subdued at 0.5%, property prices across northern England (North, North West, Yorkshire & Humberside, East Midlands and West Midlands) rose, on average, by 2.1% in the last year.

Source: Nationwide

If you’re thinking about property as an investment, you now also have the widest choice of Buy to Let mortgages in more than 11 years.

And, not only do landlords have a wide choice of mortgage products, but the cost of these deals is falling.

In terms of tracker rates, The Times reports that the average 40%-deposit tracker mortgage is now 3% cheaper than it was in March, while the average 30%-deposit tracker deal is 2% cheaper.

Fixed rates have also fallen this year. The average cost of a two-year fixed rate Buy to Let mortgage is now just 3.01% – 0.1% lower than at the start of 2019.

Many lenders have also widened their criteria to accommodate landlords who wish to borrow using a limited company. As this method becomes more popular for tax reasons, lenders have sensed an opportunity to adapt their lending policies to help these buyers.

Finally, the landscape for portfolio landlords may also be improving. In recent years, changes to lending rules have made it tougher for landlords with four or more properties to secure finance. Now, however, lenders are changing their criteria to help portfolio landlords to get the borrowing they need.

So, with a wide choice of deals, lower rates, and rental yields and property price growth remaining strong in certain regions, there are plenty of reasons to be cheerful about property. However, there have been tax and regulatory changes that have had an impact on landlords, and we look at these next.

Changes to tax rules you should know about

In recent years, the government has made some substantial changes to the way that landlords are taxed. Indeed, it was one of the former Chancellor George Osborne’s most significant policies.

Since 2017, the amount of mortgage interest that landlords can offset against tax has been gradually reducing. The effect of this is that, until 2020, the percentage of a landlord’s mortgage interest payments that can be deducted from rental income will decrease by 25% a year, and the portion of those interest payments that qualify for the new tax credit will increase by 25%.

By 2020, landlords won’t be able to deduct any of their mortgage interest payment from rental income before paying tax. Instead, the entire sum of interest payment will qualify for a 20% tax relief.

So, in the tax year 2019/20, if you received £20,000 in rent and paid £16,000 in mortgage interest, you would pay tax on the full £20,000 (the rate would be determined by your tax bracket).

You can then deduct £3,200 from your tax bill due to the 20% tax credit.

This may also have the effect of pushing you into the higher tax bracket, when this income is added to your other earnings.

In addition to this change in the way rental income is taxed, there is now an additional 3% Stamp Duty Land Tax charge on the purchase of investment properties.

On a property purchase up to £125,000, you will now pay 3% Stamp Duty, while you’ll pay 5% on any portion above £125,001 and less than £250,000.

As a comparison:

- Buying a £200,000 property as your main residence – Stamp Duty = £2,500

- Buying a £200,000 property as a Buy to Let – Stamp Duty = £10,000

Capital Gains Tax rules regarding the disposal of second properties are also set to change in April 2020. From this date, when a second home is sold, the owner must file a return and pay the Capital Gains Tax due on the sale within 30 days, rather than by 31 January following the end of the tax year in which the property was sold.

Outlook good for professional investors

Clearly, the changes to taxes and regulations have been devised to make it tougher for landlords. And, for some investors, it may mean that they end up exiting the market as Buy to Let is no longer viable for them.

However, with low rates, good potential yields and a great choice of Buy to Let mortgages available, the sector still offers excellent investment potential – particularly if you’re taking a long-term view.

Karen Bennett, Managing Director for Commercial Mortgages says: “Whilst the series of government and regulatory changes have had a significant impact on the sector, we have seen the impact felt more heavily amongst the ‘amateur’ landlord community which has presented growth opportunities for professional investors.”

Of course, when it comes to investing money for the long term there are many options available and it is important not to let the heart rule the head. Talking through your options with a financial planner will help you to identify the best route forward based on your own individual circumstances.