While war in Ukraine and the cost of living crisis dominate the headlines at the moment, it’s possible to find reasons to remain optimistic.

If you’re searching for inspiration, look no further than the tale of the Japanese engineer who lived a quite remarkable life.

Tsutomu Yamaguchi’s story

On 6 August 1945, Tsutomu Yamaguchi and his two colleagues were preparing to leave Hiroshima, where Tsutomu was in the middle of a three-month business trip.

At 8.15 am, as Tsutomu was walking towards the docks, an American warplane dropped the Little Boy atomic bomb just 3 kilometres away.

Tsutomu was blown over by the explosion, and suffered ruptured eardrums, flash blindness and radiation burns, but was able to crawl to safety. He spent the night in an air-raid shelter with his colleagues, who’d survived the blast, and the next day he headed back to his hometown: Nagasaki.

Despite being heavily bandaged, Tsutomu reported for work just three days after the attack. At 11 am that morning, as he was describing his experiences to a supervisor, the Americans dropped the Fat Man bomb on Nagasaki.

Although he experienced a high fever and continuous vomiting for over a week, Tsutomu had no new injuries after the second bombing. He went on to lead a long and healthy life, and in 2009 was officially recognised by the Japanese government as a survivor of both attacks.

Tsutomu’s story proves that whatever the world throws at you, it’s possible to get through it. If you’re concerned about your financial wellbeing right now, here are four ways Tsutomu’s extraordinary experience can inspire you to stay positive.

4 lessons to learn from Tsutomu Yamaguchi to improve your financial wellbeing

- Don’t be lulled into a false sense of security

After being bombed in Hiroshima, Tsutomu probably felt the safest thing he could do was go back home to Nagasaki. That fateful decision placed him in the middle of another dangerous situation just three days later.

When we find ourselves in difficult circumstances, it’s human nature to choose the route that presents the least risk. With the UK’s current economic situation, you might think the safest option is leaving your money in the bank, but there’s something important to consider.

Interest rates are rising, but aren’t keeping pace with inflation, so any cash you’ve saved “safely” in the bank is effectively losing its value in real terms. In other words, your money doesn’t stretch as far as it did previously, as illustrated by this example:

- If you invested £10,000 a year ago in a savings account which pays 1.4% interest, you’d now have £10,140

- In the year to June 2022, the UK inflation rate was 9.4%, which means goods and services which cost £10,000 a year ago now cost £10,940.

As you can see, leaving your money in the supposedly “safe haven” of cash has seen its real value eroded, meaning your spending power has reduced.

- Try your best not to panic

Remembering the moment the atomic bomb fell on Hiroshima, Tsutomu described “a great flash in the sky, and I was blown over”. Despite the shock he went through, Tsutomu was able to stay calm enough to find shelter, locate his colleagues, and seek treatment for his wounds.

The daily headlines about the cost of living crisis are enough to make anyone panic. When it comes to your finances and investments, though, it’s crucial to remain level-headed, and there’s a simple reason why.

Imagine the value of your home had fallen by 10% since the start of the year. Would you immediately sell it, or sit tight and wait for property prices to bounce back?

You’d almost certainly follow the second path, and you should have that same attitude towards all your investments. The economy may be turbulent at the minute, but hold your nerve and avoid any rash decisions, and when normality returns, you’ll thank yourself.

- Don’t check the value of your portfolio every day

In his eighties, Tsutomu wrote books about his experiences, and took part in a documentary, which was screened at the United Nations. Up until then, though, he’d been content to put the events of the war behind him and carry on living his life in peace.

The lesson here is that it can be detrimental to revisit difficult situations, and that’s never truer than when it comes to your investments. Of course, you’ll want to check how current events are affecting your portfolio, but doing so too often can make you nervous, usually unnecessarily.

Here’s an example. On 24 February 2022, the day Russia invaded Ukraine, the FTSE 100 fell by 3.8%. Checking your portfolio at the close of trading may have made you worried and stressed. The next day, though, it rose again by almost 4%.

Over time, markets will rise and fall. So, leaving the markets to do their thing, and not worrying about day-to-day price movements, can help you avoid unnecessary worry.

There’s another valuable point to remember as well. Any good investment strategy will include at least some elements of diversification, or spreading your risk across different countries and economic sectors. While global events might cause some elements of your portfolio to fall in value, those losses will often be offset by rises in the value of your other investments.

- You’re in it for the long term, so be patient

Tsutomu’s experiences in Hiroshima and Nagasaki had lasting effects throughout his life. He lost the hearing in his left ear after the Hiroshima explosion, went bald temporarily, and spent significant periods swathed in bandages. Despite what he went through, though, Tsutomu enjoyed a long and happy life, living to 93 and raising three children with his wife.

Tsutomu could easily have wallowed in self-pity about his injuries, but instead he was able to envision a long-term future for himself and his family. You should have the same clear-eyed approach towards your investment portfolio.

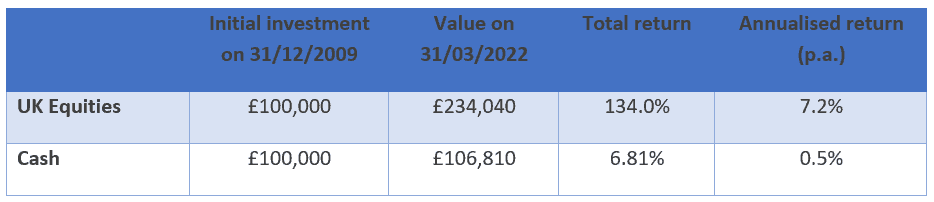

The table below compares the returns of investing in the UK stock market (as represented by the FTSE All-Share Index) with dividends reinvested and the returns of investing in cash deposits with interest reinvested, from the beginning of 2010 to 31 March 2022.

Source: FE fundinfo. Data as at 31 March 2022. Past performance is not a guide to future returns.

Investments, particularly stocks and shares, may fall sharply in the short-term. But with a long enough investment timespan, you should expect to see positive results overall.

Get in touch

Tsutomu Yamaguchi lived through one of the darkest periods in modern history, suffering unimaginable trauma in the process. But with the help of those around him, he was able to enjoy a full life, and there’s lots to learn from his example.

If you’re committed to securing a successful financial future for you and your family, it’s vital to seek the best possible advice. And if you can stay calm, patient, and optimistic at the same time, you should reap the rewards in the long run.

If you’re worried about your investments in these challenging times, we can help to put your mind at ease. Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.