After almost three years of spiralling prices, last month the news came that UK inflation had finally slowed to the target rate.

The Bank of England (BoE) aims to keep inflation at 2%, and data from the Office for National Statistics (ONS) shows that it fell to 2% in May, down from 2.3% in April.

The recent spike saw inflation peak at 11.1% in October 2022, the highest in 40 years.

So, as inflation returns to its target rate, what effect could it have on your expenses, interest rates, savings, mortgages, and pensions?

Read on to discover what the return to 2% inflation could mean for your finances.

Lower inflation means prices are rising at a slower pace, but they are still rising

Inflation “slowing” or “falling” usually doesn’t mean that prices have stopped rising. Rather, it indicates that prices are still increasing but at a slower pace.

While this slowdown offers some relief, it might not immediately alleviate the pressure on your household budget, nor does it reverse the significant price increases that have accumulated over the past few years.

So, despite the fall in inflation, the rocketing prices that led to the cost of living crisis may continue to impact your weekly receipts.

Although inflation has slowed, the base rate is still at 5.25%

The BoE sets the base rate of interest as a means of managing inflation.

When inflation is high, the BoE generally sets a higher base rate to encourage saving and dissuade spending. When inflation is low, the BoE usually lowers the base rate to encourage spending and dissuade saving.

In August 2023, the BoE set the base rate at 5.25%, the highest in 15 years, and they have kept it there since.

Despite inflation slowing and returning to the target level, the BoE decided to maintain the 5.25% base rate in June. This is likely because they want to be sure inflation stays low and stable and won’t rise again when they come to cut interest rates.

This is Money reports that many experts forecast the first base rate cuts to come in August 2024, with further cuts reducing the base rate to 3% in 2025. However, these forecasts don’t take unexpected events into account, which could significantly alter the economic landscape and impact future interest rate decisions.

Returns on savings may currently be higher than inflation, but this is unlikely to last

High inflation is usually bad for your savings as it erodes the real value of the money you hold in cash accounts.

However, since the base rate is currently higher than inflation, many savings accounts are offering interest that exceeds the inflation rate. This means your cash savings are likely to outpace inflation and gain real value, which is an uncommon but advantageous situation for savers.

But this is unlikely to last.

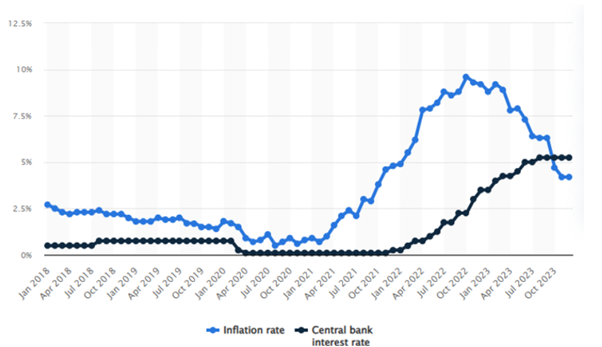

The graph below shows that, until the end of 2023, inflation had been consistently higher than interest rates for more than five years.

Source: Statista

As you can see, the base rate tends to be lower than inflation and the BoE will likely reduce it again soon, meaning savings are unlikely to outpace inflation in the long term.

So, while inflation is relatively low and interest rates are still relatively high, fixed-rate savings accounts could be a good option for delivering returns on your cash savings.

With inflation currently below the base rate, interest on cash savings is likely to beat inflation, and a fixed-rate account could provide favourable returns for up to five years.

Mortgage rates could come down

While inflation does not directly affect mortgage rates, it does affect the level of the base rate which, in turn, influences mortgage rates.

The interest charged on tracker- and many variable-rate mortgages fluctuate in line with the base rate. Fixed-rate mortgages, on the other hand, are based on longer-term predictions of future base rates.

As a result, a drop in inflation can lead to lower mortgage interest rates if lenders anticipate a subsequent decrease in the base rate. But if you have a fixed-rate mortgage, you won’t experience the effect of the shift until your fixed-rate deal ends.

The graph below shows the average mortgage rates since the end of 2019.

Source: Statista

As you can see, most average mortgage rates for the period peaked in September 2023, a month after the BoE raised the base rate to 5.25%. Mortgage rates have since fallen slightly despite the base rate remaining the same, which is perhaps in part due to providers anticipating a cut.

So, while lower inflation may not directly impact mortgage rates, a prospective cut in the base rate could benefit your mortgage repayments in the coming months.

Lower inflation generally good news for pensions

Inflation has a varying influence on pensions depending on the type of pension you have, but lower inflation is generally good news.

The triple lock guarantee should protect the State Pension from inflation by ensuring it increases with living costs to preserve a basic level of purchasing power. Under this system, the State Pension rises each year in line with the highest of inflation, the average wage increase, or 2.5%.

This means that during periods of low inflation, State Pension increases may beat inflation levels, while during periods of high inflation, the State Pension should keep up.

Defined benefit (DB) and defined contribution (DC) pensions, on the other hand, are more susceptible to inflation.

DB pension schemes are workplace pensions based on the number of years you were a member of the employer’s scheme and your salary when you left or retired.

DB schemes usually rise in line with inflation up to a certain cap, typically 3% to 5%. This means that during periods of high inflation, DB pensions may lose some of their real value.

So, lower inflation levels will be welcome news if you have a DB pension.

With a DC pension, your provider invests your contributions with the expectation that market returns will beat inflation.

Over longer time horizons, the market typically outperforms inflation, and the likelihood of achieving this increases the longer you remain invested, though this is not always guaranteed.

Get in touch

We can help you to make the most of the recent fall in inflation to maximise your financial benefits. To find out more, please get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.