The Relief

Business Property Relief (BPR) is Inheritance Tax legislation that’s been established since 1976. It allows qualifying assets to be passed on free from inheritance tax once they’ve been owned for at least two years.

If an asset qualifies for BPR, the value of the asset is reduced by either 50% or 100% when calculating Inheritance Tax (IHT).

This is obviously good news for many business owners who plan to die while they still own the qualifying business. But many don’t plan things this way.

The Problem

The dream may well have been to build a successful business, sell it, and retire into the sunset. Receiving a lump sum for the sale of a business may be the ultimate financial independence that a business owner may have been working towards. Aside from capital purchases, gifts and a big holiday the purpose of the remaining funds if often to produce an income for the future.

But if this happens, many may have missed the point that they have exchanged assets that would have got 100% IHT relief, for cash that gets no relief. In an instant they have unwittingly walked into a potential 40% inheritance tax bill on a large chunk of their wealth.

Solutions

Many clients become conscious of the potential IHT liability at this time. They’ve had a lifetime of paying tax and minimising further tax is a high priority, whether they are alive or dead. So, Inheritance Tax now becomes an issue.

Typically this is a time when financial planning guidance is invaluable in establishing income streams that are predictable, tax efficient and aren’t likely to run out.

Using ‘Replacement Relief’ allows sale proceeds to be reinvested into another BPR qualifying asset within 3 years and immediately qualify for Business Property Relief.

Example

Derek is 71 and has built up a successful construction business over his lifetime. He has agreed to sell the business to another local construction company for £4M.

Derek receives £4M as cash which creates an immediate IHT liability. After taking independent financial advice he retains £1M for projects and holidays and within the 3 year ‘Reinvestment Relief’ period he makes the following investments with the remaining £3M:-

- £1.5M – Octopus Inheritance Tax Service

- £1.0M – Triple Point Generations Estate Planning Service

- £0.5M – AIM portfolio

The benefits of these actions are that all these investments qualify for Business Property Relief and Reinvestment Relief allows the £3M to immediately fall outside Derek’s estate thus potentially saving £1.2M of inheritance tax.

The combined investment returns of 1 & 2 should yield a targeted return of circa £65,000 per annum and with a capital withdrawal of £35,000 this gives Derek the £100,000 annual income that he requires. The combined effect of this is that the investment fund should last for about 30 years. In addition to this the AIM portfolio satisfied Derek’s wish to expose some of his money to a much higher risk area.

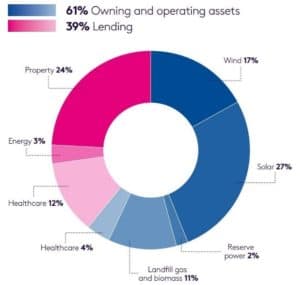

The Octopus and Triple Point services, endeavour to provide capital protection and modest returns through investing in assets that qualify for Business Property Relief and do not have a high correlation to typical UK equities. An example of the Octopus investment portfolio is shown below which demonstrates the diversification of investments.

The above note describes one method of dealing with inheritance tax issues created on a business sale but independent financial advice should always be taken before any action is taken to ensure that you are fully aware of the options and potential risks.

It should also be noted that these are not risk-free investments and that the value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.