The first Monday of the new year has long been dubbed “Divorce Day”, due to the spike in enquiries solicitors and counsellors tend to receive in early January.

According to the BBC, marriage counselling service Relate Cymru reported on 3 January it received 50 enquiries for help from couples, compared with about eight or nine a day in early December.

The current economic difficulties facing millions of households could also compound the issue in 2023. A recent survey published by This is Money revealed that nearly 60% of respondents fear that current financial pressures might lead to the breakdown of their relationship.

For many clients, the uncertainty surrounding their financial situation is one reason that they may stay in an unhappy marriage.

Indeed, the above survey revealed that 30% of people aged 25–74 who are married, living together or with a partner are staying in their relationship due to concerns about the cost of living crisis.

Seeking professional advice early on in the process can give your clients the peace of mind that their finances will be secure post-divorce. Read on to find out why.

A financial planner can be a good first port of call for clients considering a divorce

For many people, a lack of understanding about how their financial situation will look after they separate is a major issue. Consequently, some authoritative input that can dispel myths and give guidance on how the future might look may provide the clarity a client needs.

Many individuals turn to a solicitor as their initial port of call – even though their finances might be their biggest concern. However, legal assistance can’t normally provide the financial advice that clients need to allay their fears.

From our own anecdotal experience, most people want to explore how things might work out financially before pursuing the legal process of divorce.

A Mediation Information Assessment Meeting (MIAM) can help divorcing couples to understand the options available but there are two issues with this:

- Many want to explore their options before discussing divorce with their partner.

- Many MIAM courses do not include financial guidance that is sufficient or specific enough to give the individual financial outlook required.

The conclusion is that early financial guidance would help many who are thinking about divorce.

We can show your client what their financial future will look like

One of the key reasons to bring a financial planner into the process early is because the opportunity to match a divorce settlement with a client’s future lifestyle could be missed if it happens after an initial financial settlement has been agreed.

For example, we can work out whether any monthly maintenance will be enough, both today and in the future. We can also look at a lump sum option and use sophisticated cashflow modelling to forecast spending alongside future interest rates and inflation, to calculate how much cash your client will need in the long term.

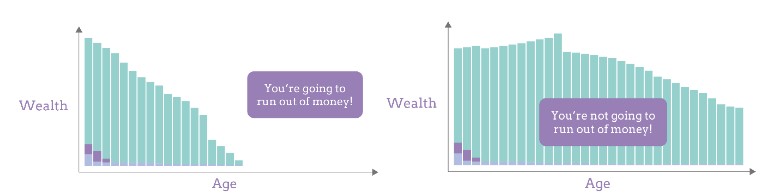

As the illustrations below show, cashflow modelling can powerfully illustrate how things might look post-divorce. This tool helps to clearly demonstrate whether a client is likely to run out of assets and identify at an early stage what a client’s financial future may look like.

The visual representation is often the light-bulb moment that many seek. Where can we find this advice?

Ideally, your client needs a professional who is regulated to give financial advice and is conversant with (and experienced in) the divorce process from a financial and legal perspective.

As Resolution accredited specialists, we’re one of a limited number of firms who have proven their skills and expertise working with clients facing family disputes. The accreditation is a mark of excellence in practice and demonstrates outstanding levels of skill, meaning we are ideally placed to provide the holistic and bespoke advice your clients need.

We can also help your clients to receive a fair pension settlement

2023 will be the first Divorce Day since the “no fault” divorce laws came into force. While these reforms are designed to make the process easier and less confrontational, concerns remain that it will see even fewer couples agree a fair settlement.

You’ve previously read about how fewer than 1 in 8 divorces involve any sort of pension sharing – overlooking one of the biggest assets that clients will have accumulated during their marriage.

A concern with no-fault divorces is that, with a streamlined and easy online process, many couples will either fail to take pensions into account at all when dividing assets, or grossly underestimate the value of these assets.

As pensions on divorce experts, we can:

- Obtain values of pensions

- Produce a Pension Sharing Report

- Help a client set up a pension to receive a pension share.

We’ve even just made the process for obtaining a Pension Sharing Report easier for you and your clients. This includes a new “document checklist” to help your clients to obtain the report as quickly as possible.

Get in touch

If you have clients who would benefit from financial advice ahead of their divorce, we can help.

We can forecast a client’s future finances to give them confidence to take their next step, and to help them ensure they receive a fair settlement that puts them in a secure position.

We can also help your clients to divide pensions equitably.

To find out more, and the benefits of working with BlueSKY, please email info@blueskyifas.co.uk or call us on 0118 987 6655.