Head to a news website on any given day and there may be lots of reasons for concern.

Whether it’s the latest ecological disaster caused by climate change, political uncertainty, conflict, or worrying economic indicators, there are many stories likely to give you pause for thought.

In his book, Before Happiness, award-winning Harvard educator Shawn Achor examines the link between cutting down the flow of irrelevant information and the increased likelihood of reaching a goal.

According to Achor, humans listen for bad news three times harder than they listen for good news. So, it can seem as if “everything is bad news” which, in reality, is likely to be untrue.

We call much of this information “noise”. And, when it comes to making optimal financial decisions, tuning out this “noise” can help you to stay on track to meet your financial goals.

So, what is “noise”? How do you spot it? And why is it so important to ignore it?

Round-the-clock news means you’re hearing “noise” all the time

One of the most common forms of “noise” occurs when you see headlines about current events and worry about how they might affect your portfolio in the short term.

This might be energy prices, the war in Ukraine, rising interest rates, or high inflation.

In the modern world, the availability of readily available news and data means that you are bombarded with a significant amount of information on a daily basis. You can check share prices on your phone, read headlines from a wide choice of sources, and immediately view the value of your portfolio at the touch of a button.

Frequently checking the performance of the stock market when you’re investing for the long term is one way that “noise” can affect you. The action you take as a result of this – for example, by selling equities if you’re worried about market volatility – might end up hampering your progress towards your long-term goals.

Comment, prediction, and hypothesis are some of the most common types of “noise”. That’s because they are all based on what someone thinks will happen.

Expert predictions about “selling now” or “the best shares to buy” are almost all noise, as no one has a crystal ball and can predict the future. As the old saying goes: “A broken clock is right twice a day”!

Social media is a modern form of “noise”

In the digital age, social media provides one of the most regular and intrusive forms of “noise”.

Faced with financial influencers – so-called “finfluencers” – and experts sharing investment tips and other financial advice, combined with rolling breaking news, means you can often feel overwhelmed.

You may also experience the modern “fear of missing out”, or FOMO, as individuals across Facebook and X explain how they have immeasurably improved their lives through their specific actions.

“Noise”, by its nature, can come from anywhere. And, while confidently delivered promises are key to an individual increasing their influence, they can be a red flag for trustworthy advice.

Think about it this way.

Social media should be irrelevant to good financial planning. The clue is in the “social”, as good financial planning is always tailored to your very specific circumstances and goals. There is no such thing as a “best” investment, or “the best advice”. There’s only ever the best thing for you, given your unique circumstances, tolerance for risk, and ambitions.

If you can screen out the noise, you’re likely to benefit in the long term

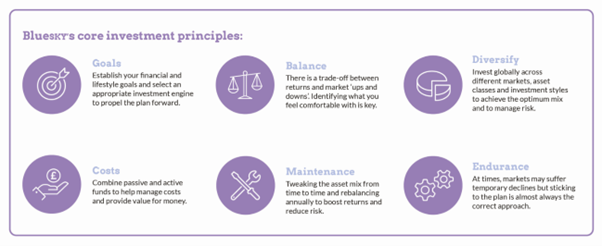

Remembering our key investment principles is important.

You have read before about why dead people can make the most successful investors – mainly because they are not making frequent changes to their portfolios.

Successful investors are people who can tune out the “noise”, ignore the so-called experts and their predictions, and stick to their long-term plan.

Adopting a long-term mentality, maintaining your composure, and ignoring the urge to make knee-jerk changes can help you achieve your goals. It’s the “endurance” principle we believe in – understanding that there will be temporary declines in markets but sticking to the plan.

The initial Covid-19 lockdown period is a great example. Stock markets around the world fell sharply as nations entered mandated lockdowns, with Schroders reporting that the FTSE 100 fell by more than a third in the first few months of 2020.

Had you listened to, and acted on, the “noise” at that time, you may well have reduced your exposure to equities. However, you’d then have missed out on the opportunity for the value of your assets to bounce back. Indeed, the FTSE 100 had risen to its pre-lockdown peak by the end of 2021 – around 20 months late – and then hit a record high in the spring of 2023.

Drowning out the “noise” and sticking to your long-term plan would likely, in this situation, have been the best course of action.

Get in touch

If you’re concerned about global events or you want to explore how our investing principles can help you to create a financial plan that works for you, please get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.