Around the world, thousands of charities carry out their vital work every day. You likely support a range of causes, from major international causes supporting communities affected by conflict or famine to tiny micro-charities making a difference in your local area.

Each year, the International Day of Charity takes place on 5 September – so chosen as it was the birthday of Nobel Peace Prize-winner, Mother Teresa of Calcutta.

The United Nations-designated event is an opportunity to support these causes and for charities and volunteers to raise awareness of their work.

As well as helping to do good, supporting a cause close to your heart can also have tax benefits. Read on to find out more.

1. Charities can claim Gift Aid and you can reduce your Income Tax bill

If you donate through Gift Aid, registered charities and community amateur sports clubs (CASCs) can claim an extra 25p for every £1 you give – without it costing you a penny.

As an example, every £100 donation you give to a charity is worth £125 to them under the Gift Aid scheme.

You may have to complete a form for the charity or CASC to claim Gift Aid. They will need your name and address, and you will have to declare that you pay tax in the UK of an amount at least equal to the amount the charity will claim in Gift Aid on your donation.

If you’re a higher- or additional-rate taxpayer and live in England, Wales or Northern Ireland, you can claim further tax relief on Gift-Aided charity donations.

You can claim the difference between the highest rate of tax you pay, and the basic rate of tax (20%, which the charity has already reclaimed through Gift Aid). So, if you’re a higher-rate taxpayer you can reclaim an extra 20%, and if you’re an additional-rate taxpayer you can claim an extra 25%.

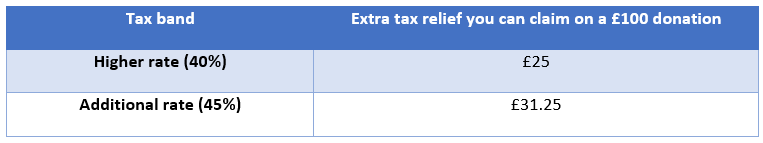

The table below shows how much extra you could get in tax relief on a £100 donation (remember the charity has already claimed the basic-rate tax relief).

You can claim this additional relief through your self-assessment tax return by entering details of all your Gift-Aided donations in the charitable giving section of the form. If you don’t fill in a self-assessment form, you can tell HMRC about your charitable donations, and they can adjust your tax code.

2. Payroll giving can reduce the tax you pay

If your employer, company, or personal pension provider runs a “payroll giving” scheme, you can donate straight from your wages or pension.

Crucially, this happens before tax is deducted from your income and so you will benefit from tax relief, depending on the rate of Income Tax you pay. To donate £100, you pay:

- £80 if you’re a basic-rate taxpayer

- £60 if you’re a higher-rate taxpayer

- £55 if you’re an additional-rate taxpayer.

The minimum deduction from your pay or pension is £1 a week or £5 a month. You may donate to as many UK-registered charities or charitable organisations as you wish, as long as HMRC recognises the charities.

3. Leaving a legacy can help to reduce your Inheritance Tax bill

Donations left in wills represent a significant proportion of total charitable giving.

Investors’ Chronicle reports that UK individuals donate roughly £3.9 billion a year in their will. Cancer Research UK – one of the UK’s biggest charities – makes more than one-third of its £719 million income from legacies in the year to March 2023.

One of the main tax advantages of leaving a legacy to a charity is that this money does not form part of your estate for Inheritance Tax (IHT) purposes. Donations you make to charity before you die are also exempt from IHT.

Moreover, if you leave at least 10% of your net estate to a charity, the IHT rate chargeable on the rest decreases from 40% to 36%.

If you’d like to leave a donation to a charity in your will, here are some tips:

- Include the registered charity number in your will so it is clear which cause you are referring to

- Talk to your family so they are aware of any charitable legacy you want to leave

- Update your will regularly in case a charity has ceased to exist or has changed its focus.

Gifts don’t have to be cash – you can choose to leave property, shares, or other assets to a good cause. You can also leave specific amounts, or a “residuary legacy” – essentially any amount left after other assets have been distributed and any tax paid.

Get in touch

If you’d like to find out how you can incorporate charitable giving into your financial plan, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655. or other assets.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, tax planning, or will writing.