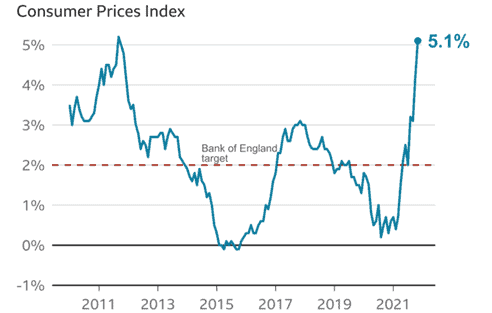

In recent weeks you will have no doubt seen the headlines that UK inflation is at its highest level in a decade.

The cost of living rose by 5.1% in the 12 months to November, up from 4.2% the month before, and ahead of forecasts. Chief economist at the Office for National Statistics (ONS), Grant Fitzner, said that more expensive fuel, energy, clothing and second-hand cars were big factors.

Surging inflation can affect your wealth in a range of ways. Here’s what you need to know.

Inflation eats into your spending power

Since the UK economy reopened after lockdown, companies have struggled to keep up with a surge in consumer demand. Issues surrounding Brexit and Covid-19 have also contributed to global supply chain problems and staff shortages – all of which have combined to drive up prices.

Source: BBC (with figures from the Office for National Statistics)

Inflation is now at its highest level since 2011. Simply put, a year ago your £100 would have bought you £100 worth of goods and services. Today, that same £100 would only buy you around £95 worth.

Ignoring the impact of inflation on other areas, the mere fact that costs are rising at this speed means that your earnings won’t buy as much as they did a year ago – unless your earnings are increasing at a faster rate than inflation.

Your mortgage payments could rise

One of the levers the Bank of England can use to control inflation is to change interest rates. Indeed, the central bank have already increased the base rate, from 0.1% to 0.25%, as the first step in trying to bring inflation back towards their 2% target.

Most commentators expect interest rates to rise further in 2022. The Times reports that markets are pricing in a second rise to 0.5% in Spring 2022, with the base rate hitting 1% by the end of 2022.

If you have a variable- or tracker-rate mortgage, then it looks likely that your repayments will rise in 2022.

Using the Which? mortgage calculator, an 0.5% rise in interest rates (from 2% to 2.5%) on a £300,000 repayment mortgage over 20 years would see your repayments rise by around £72 a month, or £864 a year.

Your cash savings will be losing value in real terms

Interest rates on cash savings accounts have been in the doldrums for years. Now, with inflation rising, the situation for savers has become even more dire – even considering the recent rise in the base rate.

As of 21 December, financial comparison site Moneyfacts reveal that the best easy access savings account pays just 0.71% interest – that’s just £71 a year for every £10,000 you save.

Tying up your money for between one and five years can help you to access a higher interest rate, with some providers offering above 2% on a five-year bond.

However even these higher rates are significantly less than the current inflation rate, meaning that the value of these savings is falling in real terms.

The situation is even worse if you don’t shop around for the best savings account. Many popular high street savings accounts, such as Santander’s Everyday Saver and NatWest’s Instant Saver pay an interest rate of just 0.01%. That is a pitiful £1 interest a year for every £10,000 you save.

Of course, it is important to hold some money in cash savings. Whether this is your “emergency fund”, or you’re approaching retirement and this is your cash buffer, you do need some easy access savings.

However, holding anything above an essential amount in cash is likely to mean your wealth is falling in value. So, you may want to consider investing this money instead.

Investing can help you to inflation-proof your money

Investing your money can be a sensible way of ensuring its value keeps pace with inflation.

- The MSCI World Index – a basket of more than 1,500 shares from developed markets across the word – has generated an average annual return of 12.22% over the last decade.

- Closer to home, with dividends reinvested, the FTSE All-Share grew 140.37% in the 20 years to January 2021. This would have turned an initial investment of £10,000 into £24,037.

- Over the much longer term, the Barclays Equity Gilt Study found that £100 invested in cash in 1899 would be worth just over £20,000 today. However, £100 invested in equities in 1899 would now be worth around £2.7 million.

Of course, past performance is not a guide to future returns. And, you’ll almost certainly have a shorter investment horizon than the Barclays study!

However, in the long term, investing has typically generated superior returns than cash deposits, helping your money to retain its real value.

Get in touch

If you are concerned about the effect of inflation on your wealth, please get in touch. Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.