Official figures from UCAS show that more than 316,000 UK 18-year-olds applied to university or college this year – the second-highest number on record.

Helping a child or grandchild through higher education may be one of your key goals and an important part of your financial plan. Indeed, This is Money reports that almost 3 in 4 parents (71%) contribute to their children’s university costs, giving an average of £8,723 a year.

It isn’t just parents who are helping with education costs either. The same research found that one-quarter of parents reported their children’s grandparents were helping to pay for university costs also, with those grandparents giving an average of £4,703 a year.

To help you understand what financial support you may want to provide, read on to find out how much university costs in 2024, and discover some ways you can support the students in your life.

Tuition fees are £9,250 a year for most students

One of the biggest costs of going to university is the course itself. The annual cost for students varies across the UK:

- England: £9,250

- Wales: £9,250

- Northern Ireland: £4,750 for Northern Irish students, or £9,250 for other UK students

- Scotland: Free for the majority of Scottish students, and £9,250 for other UK students.

So, for a three-year undergraduate course in England, most students will pay £27,750 for their tuition.

Most students take out loans to pay for their undergraduate tuition. These loans are then repaid once your child or grandchild starts earning a minimum threshold of income – this is £25,000 in England in 2024.

Accommodation costs have risen sharply in the last few years

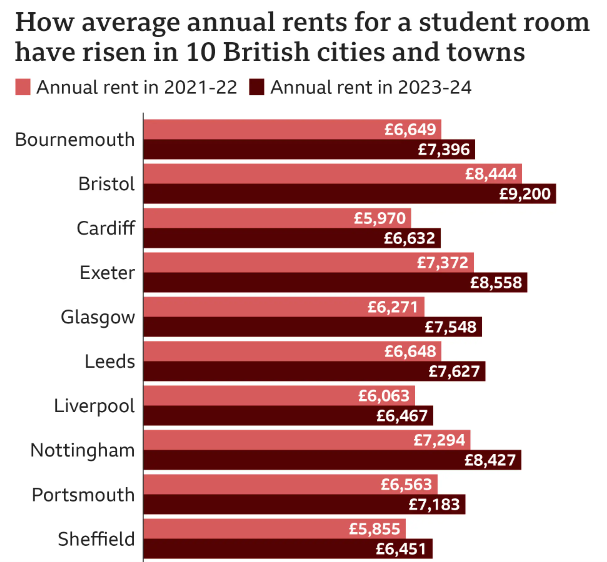

Accommodation costs vary across the UK, although the BBC reports that average annual rents have risen sharply in the last few years, as the graphic below shows.

Source: BBC

The average cost of accommodation across the UK (excluding London and Edinburgh) was £7,475 in 2023/24. Across a three-year undergraduate course, this could mean total accommodation costs of around £22,500.

Living costs average £639 a month, but vary across the country

As well as accommodation, students will also incur living costs for expenses such as food, their mobile phone, transport, and household bills. Many will also have to contribute towards the cost of utilities.

Research from Save the Student reveals that the average student spent £639 a month in 2023 on living costs (not including rent).

Again, there were significant regional disparities. Four of the universities in the top 10 for total spending (excluding rent) are based in London, while eight of the top 10 are in the south of England.

Conversely, students in Nottingham, Lancaster, Lincoln, York, Warwick, Leicester and Loughborough all spend £400 a month or less.

Maintenance loans are designed to help students meet the costs of their accommodation and day-to-day living costs. The amount of maintenance help available is means-tested and varies across the UK.

In 2024, students in England can borrow between £4,767 (the minimum maintenance loan) to £10,227 a year if they are living in the UK, outside London, and away from their parents. This increases to £13,348 in London (a £6,647 minimum loan).

3 practical tips for supporting children or grandchildren at university

As you read above, many parents and grandparents provide financial assistance to children or grandchildren to the tune of several thousand pounds every year.

Here are some further tips that could support your student relatives.

Help them with their maintenance loan application

The amount of maintenance loan available depends on three factors:

- Whether the student is living with parents or away from home

- Whether they are living in London

- Household income.

Helping your child or grandchild to complete their maintenance loan application and providing any supporting evidence could secure the maximum maintenance loan available.

Seek out bursaries or scholarships

Many universities provide additional financial support in the form of:

- Scholarships – These can be contributions towards living costs or tuition fees and are often based on achievement or excellence in academics, sports, or music.

- Bursaries – These are a contribution towards living costs aimed at students with a low household income, or because of their background or personal circumstances.

- Grants – These can cover some living costs or one-off expenses (such as studying abroad) for students with a low household income, or because of their background or personal circumstances.

These opportunities can be worthwhile, so it is worth exploring what additional financial assistance your child or grandchild may be eligible for.

Despite this, UCAS reports that fewer than a third of 2019/20 freshers applied for a scholarship or bursary. Almost 3 in 4 said they didn’t apply because “they didn’t think they were eligible”.

Encourage them to find part-time work

According to a study by the National Union of Students (NUS), 69% of students work part-time on top of their studies.

Finding flexible, part-time work can generate some much-needed income.

Get in touch

If you’d like to incorporate helping a loved one through education as part of your financial plan, or you’d like to explore whether it’s feasible to provide financial support without affecting your own security, we can help.

Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.