Sometimes, clients ask us: what’s the difference between a financial adviser and a financial planner?

While there are many nuanced differences between the two roles, one of the most important is that a financial planner will focus on your life goals and ambitions, rather than just advising you on “the best products for you”.

Only by knowing what you want to achieve in life can we help you to devise a plan to get there.

A recent survey from insurer Canada Life revealed the encouraging fact that 9 in 10 people are working towards some kind of goal or aspiration, with the majority (70%) working to achieve financial stability.

So, why is the act of setting a goal so important?

Setting a goal can help to inspire you to achieve it

Having clear goals for the future is a key part of a sound lifestyle financial plan.

When we meet you initially, we spend a lot of time establishing what your goals are. This could be to:

- Retire early

- Ensure you can maintain your desired lifestyle throughout retirement

- Pay for future care needs

- Pass on your wealth tax-efficiently to your children and grandchildren

- Relocate in later life

- Donate to charity

- Start your own business

- Feel secure about your finances when you retire.

Once we know what it is you would like to achieve, we can start to build a financial plan to help you to reach your goals.

Additionally, having a goal can also be a motivation.

The Canada Life research found that, for many people, the act of setting the goal was inspiring in itself. More than half of respondents (51%) said they felt motivated by having the challenge, while more than 2 in 5 said they felt organised and in control of their life while chasing a dream.

Lara Bealing, marketing director at Canada Life says: “Many of us believe we have the power to achieve our own goals, however it’s only human nature to sometimes feel overwhelmed by the challenge.

“Achieving our ambitions rarely, if ever, happens overnight, but don’t be downhearted as making regular small steps towards a goal really can grow into huge strides. A great first step is to seek the help of a financial adviser who can create the right path to financial freedom, whatever life throws at us.”

How to make (and stick to) your goals

A major study from Aegon backs up the finding that having a long-term plan can benefit you. It also says that imagining what your future self might look like can also help you to formulate your plan.

The research says that: “people who are better at imagining their future self are better at working out a long-term financial plan.”

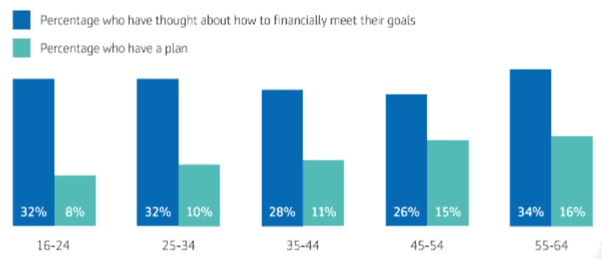

However, despite many people having thought about how to financially meet their goals, relatively few people have an actual plan, as the Aegon research shows.

Source: Aegon

One of the simplest ways you can ensure you focus on your goals is to write them down. Writing goals down really does help you to achieve them, as does making sure that you update your plans as your circumstances change.

This is one of the main reasons we have a regular review with all clients – we want to make sure that you’re still on track to achieve your goals even if your aims and objectives have changed.

When writing your long-term plan, think about these key points.

- Include specific activities you’d love to do in 5, 10, 15 or even 20 years’ time. For example: “in 10 years’ time I would like to be able to work part-time so I can spend more time with my family”.

- Write a personal statement or bucket list. For example: “in retirement I want to have enough saved to see more of the world and live closer to my children”.

- Include financial goals, such as paying off your mortgage, having “enough” to retire early, or helping your children onto the property ladder.

- What are your priorities? Do you want to pay off your debts or mortgage first? Have you built up an emergency fund? Are you maximising your tax-efficient pension and savings contributions?

There’s an old saying: “fail to plan, plan to fail”. So, if you haven’t sincerely thought about your future goals, now’s the time to write them down and start on the path to making them a reality.

Get in touch

If you’d like to explore how you can reach your goals, get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655 to find out more.