When was the last time you considered switching your cash savings?

If the answer is “never”, or it’s something you haven’t done for years, you’re not alone. New research, reported by Wales Online, reports that half of UK adults have never switched savings provider.

Failing to regularly review the interest rate you’re receiving on your savings, and switching your cash into a better-paying account, could be costing you hundreds or even thousands of pounds a year in lost interest – especially as interest rates have risen sharply over the last 18 months.

Despite this, the study found that a quarter of adults think switching is too much hassle.

Read on to find out why being more proactive with your cash savings could boost your wealth.

Banks face “robust action” from the regulator for not passing on interest rate rises

Since December 2021, interest rates in the UK have risen sharply and now stand at their highest level since before the global financial crisis in 2008.

While banks and building societies have increased the rates they are charging mortgage customers, they have been criticised for not rewarding savers by passing on rate rises as quickly.

Indeed, the Financial Conduct Authority has given banks until the end of August to justify the savings rates they pay on their accounts before facing “robust action” by the regulator.

This follows the FCA’s recent review of the savings market. The Guardian reports that this found nine of the biggest savings providers – including Nationwide, Lloyds, NatWest, HSBC, and Santander UK – passed on only about 28% of interest rate rises to easy access savings accounts between January 2022 and May this year.

The average interest rate on those accounts rose only from 0.07% to 1.25% over that period, even as the Bank of England rate rose from 0.25% to 4.5%.

Switching your savings could boost your wealth by hundreds of pounds a year

When asked what would encourage them to switch their savings, 76% of respondents to the Atom Bank study said they would need to gain an extra £150 in interest every year to make it worthwhile.

However, depending on the amount of savings you have, it’s quite possible to make significantly more than that by switching your account.

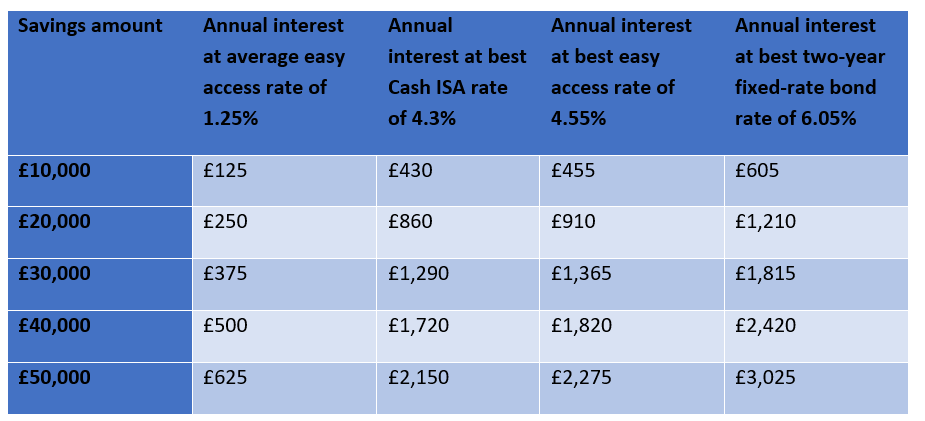

The table below shows the level of annual interest you can expect to earn on different levels of savings. It compares the current average rate on a high street easy access account (1.25%) to the best paying:

- Cash ISA rate of 4.3%

- Easy access account of 4.55%

- Two-year fixed-rate bond of 6.05%.

All of these rates were reported as “best buys” by Moneyfacts on 1 August 2023.

As you can see, even switching a small amount of savings could see you generate hundreds of pounds in additional interest each year. And, moving £50,000 of savings from the average easy access account to the best-paying account could earn you more than £1,600 in additional interest.

Mark Mullen from Atom Bank said: “The myth remains that switching banks is a time-consuming and difficult process.

“Savers today have the best rates at their fingertips, and just a few clicks on a decent app can earn them an extra few hundred pounds a year. The sooner people realise this, the sooner big banks will be forced to change their ways.”

Be aware of the Personal Savings Allowance and the tax you might pay on interest

While interest rates were at historic lows, paying tax on your savings interest probably wasn’t a concern for you. It’s unlikely you would have earned enough interest for it to be an issue!

However, as interest rates rise, it’s much more likely that you’ll pay some Income Tax on the interest you earn.

Each adult in the UK benefits from a Personal Savings Allowance (PSA). This allows you to earn a certain amount of interest each year without paying any tax. In the 2023/24 tax year, the PSA is:

- £1,000 for basic-rate (20%) taxpayers

- £500 for higher-rate (40%) taxpayers

- £0 for additional-rate (45%) taxpayers.

Looking at the example above, if you’re a higher-rate taxpayer you’d only have to have around £11,100 in the best easy access account to find yourself exceeding your PSA and paying tax on your savings interest.

Remember also that the PSA covers any interest you earn from bank accounts, savings accounts, credit union accounts, building societies, corporate bonds, government bonds and gilts. So, if you have savings in multiple accounts, it’s the total interest that will determine whether there is tax to pay.

In an environment of higher interest rates, it’s much more likely that you will end up paying tax on your savings interest, particularly if you’re a higher- or additional-rate taxpayer.

So, one simple way to ensure you shield your savings from tax is by making the most of your ISA entitlement.

Each individual can save up to £20,000 in a Cash ISA in the 2023/24 tax year – that’s £40,000 for a couple – and any interest is paid free of Income Tax.

If you have a longer-term savings horizon, you may want to consider a Stocks and Shares ISA. Here your money is invested in alignment with your risk profile and all returns are paid free of Income Tax, Capital Gains Tax, and Dividend Tax.

Using your annual ISA allowance can help you to build up a significant sum in tax-efficient savings over several years, helping you to make the most of higher interest rates and/or the potential for investment returns, all while shielding your wealth from tax.

Get in touch

To find out how we can help you to make the most of your cash savings, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.