When you head to the supermarket, it’s likely that you buy the brands you’re most familiar with. Whether you’re a fan of Heinz beans, Colman’s mustard, or Mr Kipling’s cakes, you know what you get when you choose these products.

Working with companies you’re familiar with can give you comfort and security. But, when it comes to investing, could sticking with what you know be damaging your long-term prospects?

The tendency of investors to build a portfolio featuring shares and funds from their own country is known as “home bias”. And, it’s often something that happens unconsciously.

Read on to find out more about home bias, and why taking a globally diversified approach could help you to boost your wealth.

Home bias means you’re likely to prefer investments in your own country

Home bias simply refers to the tendency to invest in companies and funds in your own country. There are several reasons why it can occur.

Firstly, investors often prefer backing companies they are familiar with. If your mobile contract is with Vodafone, you’re likely more comfortable investing in them than a foreign firm like AT&T or Telefonica simply because you know something of the services Vodafone offer.

When you invest in familiar assets it can also make you feel more in control of the outcome.

You might attach undeserved risk to an overseas asset because you don’t know as much about a specific company or fund. NatWest shares may be more appealing than Chase simply because you have an existing relationship with the UK firm.

Additionally, you may have concerns about the risk of investing in another currency. Many investors invest locally in their home currency to avoid the additional risk of fluctuating exchange rates.

Research from Barclays suggests that most investors allocate around 25% of their portfolio to the UK when UK firms only account for around 4% of the global stock market.

Home bias can reduce the potential for returns

Here’s an example of “home bias” in action.

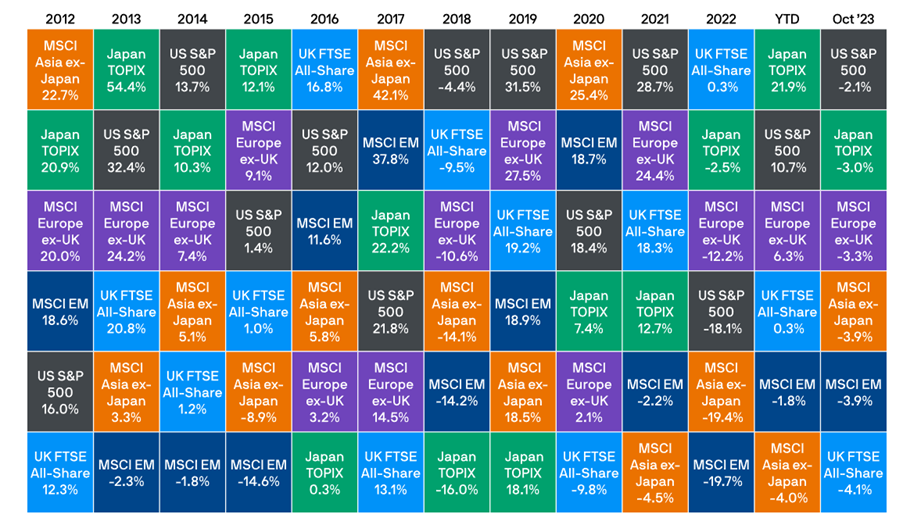

The graphic below shows the returns across various regional stock market indices from 2012 to 2023.

Source: JP Morgan

If you’d exhibited “home bias” and invested only in the UK in 2020, the value of your portfolio would have fallen by around 10%.

However, if you’d also invested in the US, or Asia, you’d have seen double-digit returns from these companies or funds. The gains here would likely have offset the losses in the UK, smoothing out your returns.

You can see that no one region consistently outperforms the other. So, spreading your investments across global markets can help you to take advantage of positive returns in a range of geographical areas.

When it comes to investing, one of BlueSKY’s core investment principles is: “diversify”.

That means investing globally across different markets, asset classes, and investment styles to achieve the optimum mix and manage risk.

As legendary investor John C Bogle once said: “Don’t look for the needle in the haystack. Just buy the haystack!”

Diversifying can also reduce “concentration risk”

Concentration risk means that the performance of a small number of companies could have a disproportionate effect on your overall portfolio. This can expose you to potentially significant risk from individual equities.

For example, at the end of 2022, the 10 largest stocks in the UK accounted for 42% of the UK index market capitalisation. Over-weighting investment in these terms could have a notable influence on your portfolio – especially if the value of their shares fell.

An example of this in action is if you chose a “global equity” tracker fund. Many of these funds have around 60% exposure to the US and, in turn, this exposure is concentrated in a handful of major tech firms (the likes of Meta, Alphabet, and Apple).

What it means is that these funds are not truly diversified. A significant minority of your portfolio will be invested in a handful of large companies.

While the last decade has been very kind to the US (and to the technology sector in particular) this may not necessarily be the case over the next decade.

By genuinely diversifying your portfolio across global markets, you can enjoy the potential for returns in a wide range of sectors and countries – whatever happens at “home”.

Get in touch

If you want to find out how our six core investment principles can help you to build your wealth and make progress towards your long-term goals, please get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.