It can be reassuring to know your money is somewhere secure and precisely how much you have, which is exactly what cash savings accounts offer.

However, while cash savings can be useful for short-term expenditures or emergency funds, when it comes to your longer-term financial goals, keeping your savings in cash might not be such a good strategy.

Over time, cash is less likely to keep up with inflation when compared with other forms of investment, which could mean your wealth doesn’t grow enough for you to achieve your longer-term goals.

Read on to find out why keeping too much in cash savings could hamper your returns.

Inflation is the biggest killer of cash savings

Unless the interest rate for your cash savings account is consistently higher than inflation, your cash will lose its real value over time.

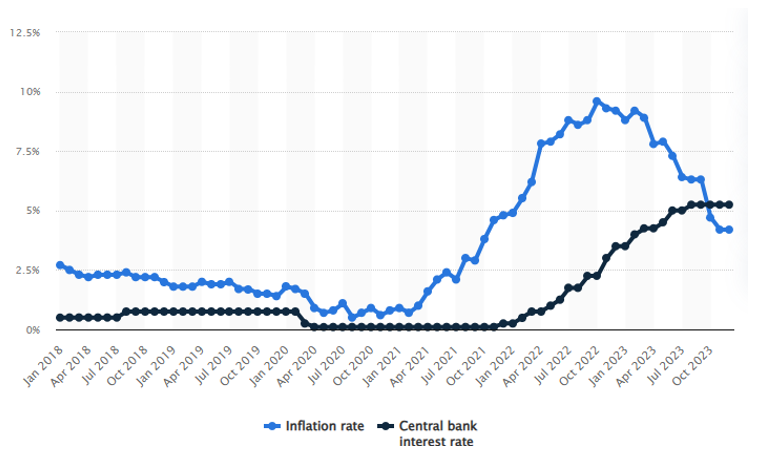

For example, Macrotrends reports that, in 2018, UK inflation averaged 2.29%, and data from Focus Economics shows that in that same period, the Bank of England’s (BoE) base rate was 0.75%.

So, if you had £100 in a cash account in 2018 with a 0.75% interest rate, after a year you would have had £100.75.

But because inflation averaged 2.29%, you would need £102.29 for your cash to have the equivalent purchasing power as it did before. While the value of your savings may have increased, their real value would have decreased.

In the last few years, the UK experienced some of the highest inflation levels in decades, reaching 11.1% in October 2022.

The BoE incrementally raised the base rate of interest to 5.25% in response, which has helped to bring inflation down but is still significantly above the BoE target of 2%.

The latest figures from the Office for National Statistics (ONS) show UK inflation to be at its lowest level since September 2021 (3.2%), and interest rates are still relatively high as the base rate remains set at 5.25%.

So, interest rates are currently higher than inflation.

However, the graph below shows that, until the end of 2023, inflation had been consistently higher than interest rates for more than five years.

Source: Statista

As you can see, any cash savings you held during this period would likely have lost their value in real terms.

So, what can you do to give your wealth a better chance of keeping up with inflation?

Investing in the market can help your wealth to keep pace with inflation

It is a good idea to keep some cash savings for an emergency fund, but when looking at longer time horizons, investing could give your wealth a better chance of keeping pace with rising prices.

Forbes reports that between 1928 and 2022, cash outperformed the US market over a calendar year only 12 times.

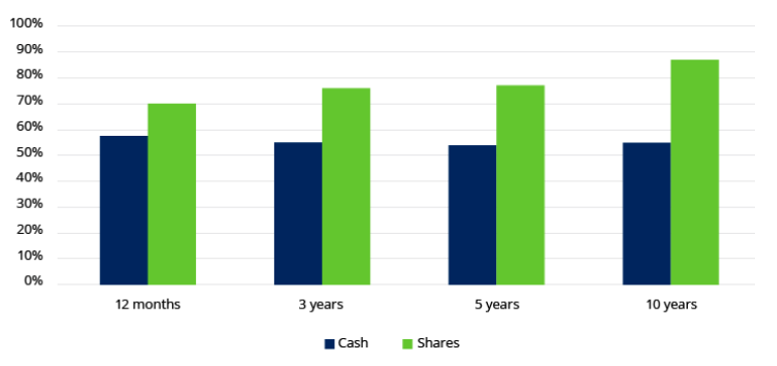

The graph below shows the percentage chance of beating inflation if you save in either cash or shares over different time frames.

Source: Schroders

The graph shows that cash savings have roughly a 55%-60% chance of beating inflation, however long you save. It’s slightly better odds than a coin toss.

Shares, on the other hand, not only have a better chance of beating inflation than cash, but they also have an increased chance of doing so over longer time horizons. Indeed, there is a nearly 90% chance investing in equities will beat inflation over a decade.

Diversifying your investment portfolio can help protect your wealth

While investing always comes with risk, you can protect your wealth against potential losses by diversifying your investment portfolio.

Diversification could include spreading your investments across different sectors and regions, as well as investing in different asset classes.

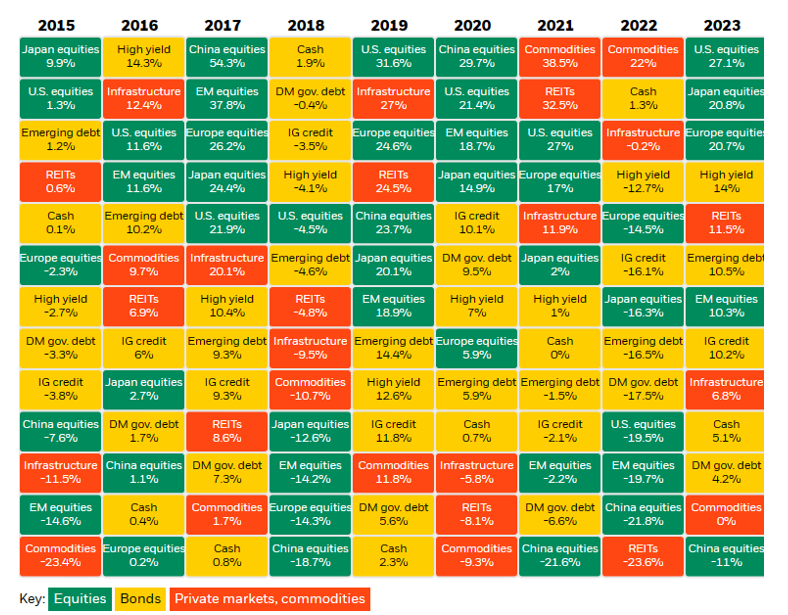

The chart below shows the annual returns for selected asset classes ranked from best (top) to worst (bottom) each year between 2015 and 2023.

Source: BlackRock

As you can see, predicting which asset classes will do well or badly in any given year is very difficult.

Although diversification cannot entirely eliminate the risks of investing, a diversified portfolio means that if one area of your investments falls, your wealth is protected, as the risk is spread across an array of holdings that are unlikely to all dip simultaneously.

You’ll also see from this graphic that holding all your wealth in cash would likely have underperformed other asset classes – indeed, there are five occasions across this nine-year period where cash was one of the four poorest-performing assets.

Get in touch

To find out more about how to diversify your portfolio and protect your cash savings against inflation, get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Risk warnings

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.