The last year has been an uncertain, stressful, and difficult time for many. So, it’s perhaps no surprise that fraud has been on the rise in the past few month as scammers target vulnerable, worried people.

Money Marketing reports that the City of London Police say that scams are up by 400% while the Pensions Regulator is investigating more than £54 million-worth of lost pension savings in cases affecting 18,000 savers.

If you’re worried about falling victim to fraud, here are three current scams to be on the lookout for.

1. Pension scams

According to This is Money, more than £30 million has been reportedly lost to pension scams since 2017.

While the specifics of scams vary, scammers typically design these to encourage you to transfer your pensions, often with guarantees of high returns. Common signs of a pension scam include:

- Suggesting you can access your pension “early” (i.e. before the age of 55)

- Cold-calling – unexpected approaches by email, text, or phone

- Offers of a “free pension review”

- Opportunities for one-off or limited investments

- Promises of high returns, often in unusual assets or overseas

- Offers that require a quick decision or that are time limited.

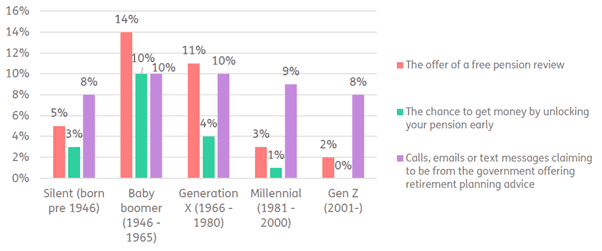

If you’re aged between 55 and 74, you are at particular risk according to the latest Financial Conduct Authority data. Scammers are increasingly focusing their attention on so-called “baby boomers” with one in four (23%) 55 to 74-year-olds receiving an unsolicited approach in the 12 months to October 2020.

As you can see from this chart, these approaches mainly constituted offers of free pension reviews (14%), offers to “unlock” pensions early (10%) or contact about retirement advice claiming to be from the government (10%).

Source: FCA

Stephen Lowe, group communications director at Just Group, who analysed the research said: “There is an epidemic of scam activity because fraudsters have worked out that the pensions of the “baby boom” generation are rich pickings and some unsuspecting savers are open to ideas about how best to take and use that money.

“Promising quick access to cash lump sums or high returns on investments is an easy way to get people’s attention – and ultimately their cash.”

2. Investment scams

In an environment of low interest rates, many people are on the lookout for ways they can make their hard-earned savings work harder.

Promises of guaranteed or high returns are therefore likely to appeal to many savers – and this is a way that fraudsters can swindle you out of your money.

Scams are increasingly sophisticated. Investment fraudsters can clone telephone numbers so that they appear to be from your bank and have studied banks’ procedures and security questions so that they sound authentic.

They sometimes even create official looking websites containing fake FCA registrations, or glossy prospectuses that aim to convince you that their investments are genuine.

Many of the claims made are similar to pension scams, so look out for promises of guaranteed and high returns, time-limited offers, and unusual assets to invest in.

If you’re unsure whether an investment opportunity is genuine, get in touch with us and we can provide guidance.

3. Covid-19 scams

The Independent recently reported that “vaccine scams now present biggest threat to personal financial security”.

Fraudsters have been quick to pounce on the uncertainty caused by the pandemic and so you should be on the lookout for a range of Covid-19 scams.

Jason Costain, head of fraud at NatWest, said: “You are now more likely to be a victim of fraud in the UK than any other crime. It makes sense to take some simple steps to make yourself and your family more fraud proof.”

A common current scam sees victims receive a phone call, email or text message containing a link to a fake NHS website. You will be asked to complete an application form to register for the vaccine asking for various personal and bank details which are then used by criminals.

The NHS has confirmed that you won’t need to provide any of these details when making a vaccine appointment.

Other common scams include fake Covid-19 tax refund emails, as well as texts and calls claiming you are entitled to a support grant or tax rebate due to the pandemic. Again, fraudsters are looking for you to provide personal details such as their name, date of birth, address and perhaps card details.

With these details, scammers will either:

- Steal your money directly

- Call you pretending to be from your bank’s fraud team and persuade you to either provide card or account information, or passwords, or tell you that you need to move your money to a new, safe account.

If you do receive any messages like this, report them to report@phishing.gov.uk immediately.

Get in touch

If a pension or investment opportunity looks too good to be true, it probably is.

We can help you to avoid financial fraud, so if you want trusted, independent advice, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.