In 2022, it’s highly likely that your money won’t go as far as it has in previous years. The rising cost of living has driven inflation to its highest level since the early-1990s, with sharp increases in the cost of fuel and energy particularly biting.

On top of the cost of living crisis, there’s also a possibility you will pay more tax in 2022 as well. Changes announced in 2021 come into force this tax year, along with other measures the chancellor announced in his spring and autumn Budgets.

Read on for five reasons you could pay more tax in 2022.

1. A rise in National Insurance contributions

Back in September, the prime minister announced a 1.25 percentage point increase in the rate of National Insurance contributions (NICs). From April 2023, National Insurance will return to its current rate, and the extra tax will be collected as a new Health and Social Care Levy.

In his spring statement, the chancellor confirmed that, while this tax rise would go ahead, he was also raising the threshold at which individuals paid NICs. Rishi Sunak raised the National Insurance Primary Threshold and Lower Profits Limit, for employees and the self-employed respectively, from £9,880 to £12,570.

This equalises the NICs and Income Tax threshold from July 2022.

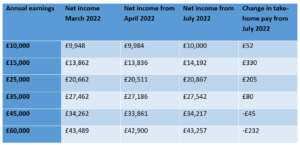

Figures published in the Guardian show that those earning up to £41,389 will be better off from July 2022 than they were in the 2021/22 tax year, although their pay will dip before then.

Source: the Guardian

The net effect of these changes is that, if you earn more than around £41,000 a year, you’re likely to pay more tax in 2022/23.

2. Dividend Tax rise

Alongside the increase to NICs comes a rise in the rates of Dividend Tax.

If you are a company owner or director and you take earnings through dividends, or you own shares that pay dividends, you will pay more tax on any dividends over and above the annual Dividend Allowance (£2,000 in the 2022/23 tax year).

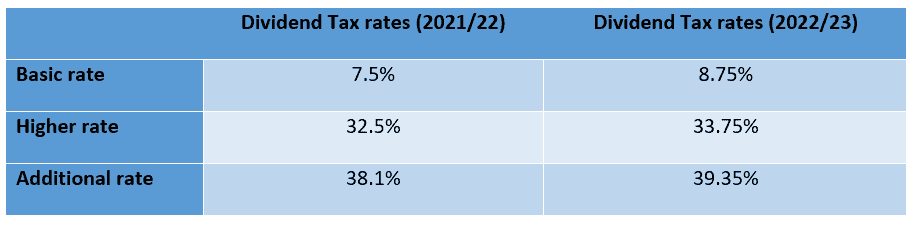

Here are the old and new Dividend Tax rates.

Source: FTAdviser

As an example, if you’re a higher-rate taxpayer taking £10,000 in dividend payments then you will pay 33.75% on £8,000 of dividends. This would result in a Dividend Tax bill of £2,700, up £100 from the 2021/22 tax year.

3. Personal Allowance freeze

The Income Tax Personal Allowance has been frozen at £12,570 until April 2026 while the higher-rate threshold has been frozen at £50,270 to the same date.

So, it follows that if your income increases in 2022:

- You’ll pay tax on more of it (as the Personal Allowance is not rising in line with inflation)

- You’re more likely to pay a higher rate of tax on it.

The Centre for Economics and Business Research (CEBR) estimates that the number of workers paying basic-rate Income Tax will increase by 5 million by 2026.

The number of higher-rate taxpayers is predicted to double to 8 million – all generating an additional £40 billion in tax receipts for the Treasury.

4. Inheritance Tax threshold freeze

In his spring 2021 Budget, Rishi Sunak confirmed that the Inheritance Tax (IHT) nil-rate band would be frozen at its current level of £325,000 until 2026. The residence nil-rate band is frozen at £175,000 until the same date.

So, if the value of your assets (including property) increases over the next few years, it’s more likely the value of your estate will exceed the IHT threshold. Additionally, as your wealth grows, it’s likely your estate will be liable for more tax (at 40%) when you pass away.

The latest official figures show that IHT receipts for April 2021 to February 2022 were £5.5 billion, up £0.7 billion on the same period a year earlier.

5. Lifetime Allowance freeze

As well as freezing the IHT threshold, the chancellor has also frozen the pensions Lifetime Allowance. This represents the total amount of tax-efficient pension savings you can accumulate in your lifetime and will be £1,073,100 until 2026.

If the value of your total pension funds exceeds this, you could pay a tax charge of 55% if you take a lump sum or 25% if you draw as income.

As the allowance has been frozen (rather than rising annually) it’s more likely the value of your pension fund will exceed the limit and so a tax charge will be due.

Figures reported in the Telegraph show that, by the 2026/27 tax year the cap will be £186,300 lower than it would have been had the freeze not been put in place. This means the Lifetime Allowance could affect an additional 400,000 workers.

We can help you to mitigate these tax changes

Growing your wealth in a tax-efficient way, and minimising the tax you pay when you come to draw a retirement income, are two of the critical ways you can enjoy the lifestyle you want.

Whether it’s by using “salary sacrifice” to boost your pension contributions and pay fewer NICs, or gifting assets to reduce a potential IHT liability, we’ll design a tax-efficient financial plan that will help you to reach your goals.

To find out more, contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.