This year marks the 180th anniversary of one of the most celebrated festive stories. Charles Dickens’ A Christmas Carol was first published in 1843, telling the cautionary tale of Ebenezer Scrooge, the miser visited by four ghosts on Christmas Eve.

The spirits show Scrooge key moments in his life, enabling him to learn lessons that turn his life around when he awakes on Christmas morning.

If a ghost visited you this Christmas and took you back to see your 25-year-old self, what advice would you give them?

There are likely to be many life (and love!) lessons you’d share, but one key piece of financial advice you’d likely impart is “save more for your future now”.

There’s an old saying that “the best time to save for your retirement was 10 years ago. The next best time is today”.

So, if you’re behind where you’d like to be when it comes to saving for your retirement, here are five tips from the Ghost of Christmas Yet to Come.

1. Ensure you’re making the most of a workplace scheme

Your first step should be to make the most of any existing workplace pension you contribute to.

In most cases, your employer is legally obliged to contribute 3% of your salary to this scheme, and these additional contributions can build up over time.

Many employers will also match your contributions, up to certain limits. So, if you increase your savings, you’ll effectively double your contributions if your employer matches what you save.

2. Claim all the tax relief you’re entitled to

One of the primary benefits of saving into a pension is that you benefit from generous tax relief on your contributions.

Basic-rate tax relief is usually applied at source, meaning that a £100 contribution only “costs” you £80. If you’re a higher- or additional-rate taxpayer, you can also claim additional relief through self-assessment.

However, research reported by PensionsAge has revealed that higher- and additional-rate taxpayers missed out on £1.3 billion in unclaimed pension tax relief between 2016/17 and 2020/21.

Three-quarters (76%) of higher-rate taxpayers eligible to claim pension tax relief through self-assessment failed to do so over this five-year period, while almost half (46%) of additional-rate taxpayers also missed out on this relief.

Claiming all the tax relief you’re entitled to can boost the value of your fund, so make sure you include all your gross pension contributions (your contributions plus the basic-rate tax relief) when you self-assess.

3. Review how your pension is invested

In addition to your savings, employer contributions, and tax relief, the fourth way you build up a retirement pot is through the growth your fund generates. So, it’s important to know how your money is invested.

Take too little risk and you may find that you don’t achieve the growth you need to reach your goals. Take too much risk and you may find yourself stressed about performance, or your fund experiences dips in value that make it hard to manage.

If you have a workplace pension, it’s likely it will be invested in the provider’s default fund. There may be other choices that are more suited to you – for example, if you have many years or decades to retirement, you may want to choose a fund more exposed to equities to provide greater growth potential.

Remember all investments can go down as well as up in value, so you could get back less than you invest. If you’re not sure if an investment is right for you, seek financial advice.

4. Increase your contributions

If you’re behind where you’d like to be when it comes to your pension saving, increasing your contributions is an obvious way to boost the value of your fund.

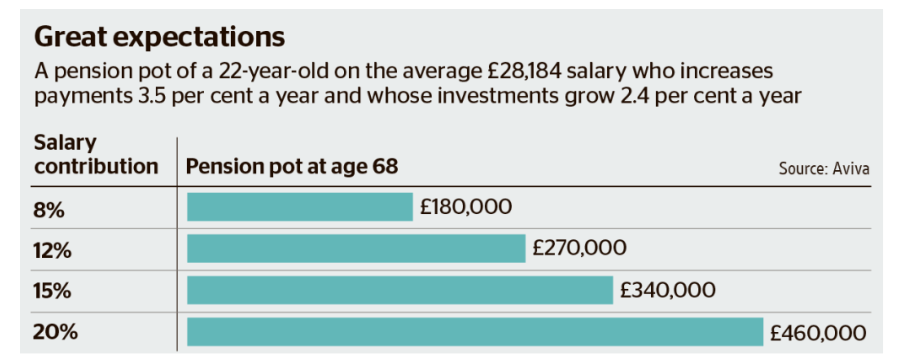

The graphic below shows the benefits of increasing the percentage of salary you invest in your pension on the overall value of the fund at age 68.

Source: The Times

Even increasing your contribution by a small amount could give your fund a real boost. Tax relief and compound returns on your investment over many years can help you grow your savings – so think about whether you could increase the amount you put away now.

5. Regularly review your progress

Research reported by FTAdviser has revealed that 1 in 4 pension savers only check the value of their pension once a year, when they receive their annual statement.

A failure to engage with pensions is more prominent in the over-55s, with 40% saying they never check the value of their pension.

Regularly reviewing your scheme gives you the opportunity to make positive changes now. If don’t review your progress, you may not know you’re off track until it’s too late.

Get in touch

If you’d like to establish whether you’re on course for the retirement you want, or you’d like to review your progress towards your financial goals, please get in touch.

Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.