From the blockage of the Suez Canal to petrol and Nando’s chicken shortages, it’s certainly been an eventful 12 months.

A year ago, none of us would have known what a “pingdemic” was or have guessed that the Italians would have done the clean sweep of the Euros, Bake Off, the Olympics men’s 100m, and the Eurovision Song Contest.

In another unpredictable year, there’s been lots we can learn about managing our finances. Here are five key lessons from 2021.

1. Be patient

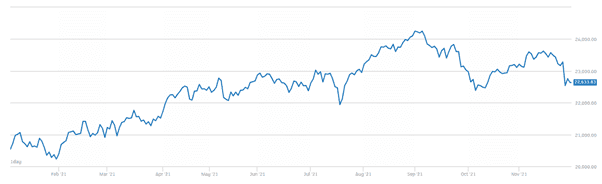

The markets can be volatile places. You only have to look back at the performance of the FTSE 250 in 2021 to see this.

Source: London Stock Exchange

From the start of the year until the end of November the index has risen from 20,537 to 22,635 – around a 10% increase.

However, during the year it’s been as low as 20,228 and as high as 24,248. Rising inflation, new Covid-19 variants, and supply chain issues have all caused uncertainty in the markets this year.

Trying to time the market is all but impossible. So, the lesson from 2021 (and from many other years) is: be patient.

In the short term, the value of shares will rise and fall, sometimes sharply. However, over time, markets tend towards a positive return. Focus on your goals, choose diversified investments that are aligned to your tolerance for risk, and leave them alone.

2. It’s vital you have the right protection

There have now been more than 10 million cases of Covid-19 in the UK. While you may have expected us to be out of the woods by now, hundreds of people a week are still tragically dying, and the government are still having to mandate new measures to control the spread of new variants of the virus.

What the last couple of years have taught us is that it’s crucial to be prepared for the unexpected. From a financial point of view, there are several ways to do this:

- Make sure you have an easily accessible emergency fund of cash you can use if your situation suddenly changes. Experts normally suggest 3-6 months’ income, but this may be more if you’re approaching or in retirement.

- Have the right life insurance and ensure it’s in trust so it goes to your chosen beneficiaries quickly on your death. Life insurance is often cost-effective and ensures your family can maintain their lifestyle now and, in the future, if something happens to you.

- Ensure you have income and health protection in place. Whether you’re self-employed and need to ensure your income is replaced if you’re off work due to illness or an accident, or you want to benefit from financial support in the event of a serious illness, it’s so important to put the right cover in place.

- Write your will and Lasting Power of Attorney. These documents will be invaluable when it comes to managing your assets if you pass away or you aren’t able to manage them yourself any longer.

We can make sure your plans are not derailed by events you can’t anticipate. Get in touch to find out how.

3. Financial planning will be more important as taxes rise

Despite a clear commitment in their manifesto not to raise taxes, Dividend Tax and National Insurance contributions (NICs) will both increase in April 2022. Corporation Tax for larger firms will then rise in April 2023.

On top of this, the chancellor has announced that many exemptions, allowances, and thresholds will remain at current levels until 2026. This includes the Inheritance Tax nil-rate band, the pension Annual and Lifetime Allowances, and the Income Tax Personal Allowance.

All these measures mean that it’s likely you’ll pay more tax over the next few years. So, working with a financial planner can help you to make the most of the tax breaks that are available, ensuring you and your family retain more of your hard-earned wealth.

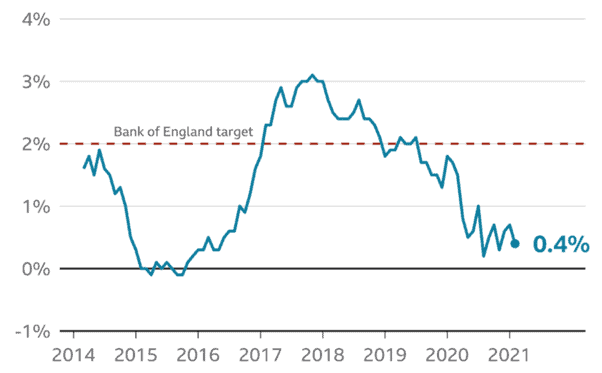

4. Inflation is back

For the last decade or so, the UK has experienced a period of low and mostly stable inflation. Other than a short period when the Consumer Price Index exceeded the Bank of England’s 2% inflation target in 2017/18, rises in the cost of living have been modest for years.

Source: BBC with figures from the Office for National Statistics

However, in recent months inflation has been rising, hitting 4.2% in October. Experts predict it will reach 5% in 2022.

Rising inflation means your money doesn’t go as far. While this may be less of a problem in your working life – as long as your earnings go up roughly in line with rises in the cost of living – it can present a problem in retirement.

This is because your retirement fund may suddenly have to provide you with a greater income so you can maintain your spending power.

Rising inflation also means that money you hold in cash savings can lose value in real terms, especially in an environment where savings account interest rates are so low.

Expect to see interest rates rise in 2022, which could increase the cost of your mortgage if it’s on a tracker or variable rate.

5. Things can change quickly, so a regular financial review is essential

The recent Great British Retirement Survey revealed that 1 in 10 non-retired people expected to have to delay their retirement because of the pandemic. A further 21% were “not sure” whether their plans would have to change.

The last few months may have led you to rethink your plans. Perhaps you’ve decided that you’d like to retire earlier and get out of the rat race? Or maybe you’ve missed the working environment and you’d like to carry on for longer than you expected?

Whatever your situation, a regular financial review can help you to crystallise your plans. We can use sophisticated cashflow modelling software to work out whether you have “enough” to retire, or how many more years you’d need to work to live the lifestyle you want in retirement.

Research from the International Longevity Centre has also revealed that fostering an ongoing relationship with a financial planner leads to better financial outcomes.

In a landmark study, people who reported receiving advice at two different time points had nearly 50% higher average pension wealth than those only advised at the start.

Whatever the last 12 months have meant for you, make sure you regularly revisit your plans to ensure everything is on track.

Get in touch

If you’d like to find out how we can help you to navigate uncertain times, or if it’s time for your regular review, please get in touch.

Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.