Oscar-winning novelist and screenwriter John Irving once said that “good habits are worth being fanatical about”.

Many people use the new year as an opportunity to develop new habits – going to the gym, stopping smoking, or eating more healthily are among the most popular. Developing good financial habits can also benefit you, boosting your wealth and giving you peace of mind.

So, here are five positive financial habits to adopt in 2022.

1. Pay yourself (and your future self) first

Many people wait until the end of the month and then save whatever money they have left in their account.

Instead, paying yourself first can boost your savings in a way that the future you will thank you for. Set up a regular standing order or direct debit to your pension and savings that goes out immediately after your earnings hit your bank account. Then, spend whatever you have left.

Creating this habit increases the likelihood that you’ll save enough for your future. It also converts saving money from a desire into a necessity, meaning you prioritise your financial wellbeing.

2. Ignore the “noise”

It’s hard to open a newspaper or switch on the TV news without hearing apocalyptic economic stories. From Brexit to Covid, we’re bombarded with inflation, interest rate and stock market data around the clock.

When you hear news about falls in the FTSE or rising inflation, it’s easy to become distracted, and to want to take steps to protect your wealth. However, there’s an adage that posits “it’s time in the markets, not timing the markets” that counts.

Our approach is always to find the right investments for your goals and risk tolerance, ignore the “noise” and take a long-term approach. Trying to time when you enter and exit the market is all but impossible, even for seasoned fund managers.

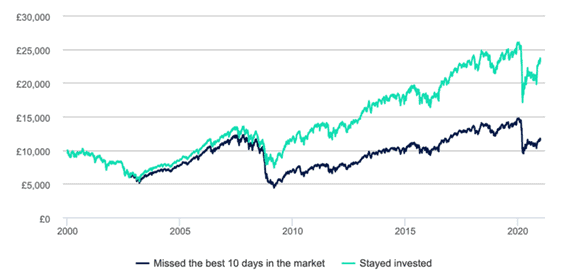

The chart below shows the effect on the value of your investments if you had missed just the best 10 days in the UK stock market between 2000 and 2020, with dividends reinvested.

Source: Lipper IM, from 03/01/2000 to 31/12/2020. Figures based on starting investment of £10,000.

An investor who stayed the course ended up with £23,171.83 at the end of the 20-year period. This is £11,668.88 more than the poor investor who missed out on the best 10 days in the market.

As you never know which way the market will move from one day to the next, get into the habit of ignoring short-term movements and staying invested. This will likely prove a better strategy.

3. Talk about your finances

In a 2021 survey reported in the Daily Mail, just 54% of Brits said they were prepared to talk about money with their friends and family.

Thankfully, this proportion seems to be increasing. The study also found that lockdowns have had a positive impact on the way that we discuss money with our partners, with 4 in 10 respondents saying that staying in and spending more time with each other over the last year has meant we are more open to discussing finances.

Being able to have open and honest money conversations with your friends and family is a great way to improve your financial literacy and to develop new ways of managing your money. It can also be good for your relationships and can help you to start working on your financial goals.

Simply, the more you talk about money with friends, family (or your financial planner!), the more confident you will be in the progress you’re making to better your financial future.

4. Increase your investment contributions as your earnings increase

Have you been guilty of seeing your spending expand as your earnings increase? If so, you may be experiencing “lifestyle creep”.

Lifestyle creep happens when your discretionary spending increases as your earnings rise. It can take the form of an ever-escalating taste for more expensive things or simply a growing number of regular expenses that drain money from your bank account.

A good habit to develop is to increase your savings and pension contributions as your earnings increase. If, for example, you committed to putting aside 15% or 20% of your earnings, rather than a fixed amount, you can ensure that your savings keep pace with your overall wealth.

5. Use all the tax allowances and exemptions you’re entitled to

Nobody wants to pay more tax than they have to. So, get into the habit of using all the tax breaks you’re entitled to. For example:

- If you pay basic-rate Income Tax and your spouse or civil partner is a non-taxpayer, use the Marriage Allowance to save £252 in Income Tax

- If you’re a higher- or additional-rate taxpayer, make sure you claim your additional pension tax relief in your self-assessment tax return

- Maximise your ISA contributions, as all returns are paid free of Income and Capital Gains Tax

- Take dividends if you can up to your annual £2,000 Dividend Allowance

- Make Inheritance Tax gifts if you’re concerned about paying tax on your estate when you die.

Our comprehensive tax year end guide explains more about how to make the most of your tax allowances and exemptions and boost your wealth. Download the guide to find out more.

Get in touch

As a BlueSKY client we keep your investments under regular review. However, if you want to know more, email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.