Last month we looked at five powerful reasons to top up your ISA before the tax year end. ISAs are a tax-efficient way to grow your wealth, with all returns paid free of both Income Tax and Capital Gains Tax.

In the spring, you’ll often see lots of articles and adverts urging you to make the most of your ISA allowance before the tax year end. However, could there be a better way to make your ISA investment?

Investing in an ISA at the start of the tax year can give you an extra year of tax-efficient returns

In the 2022/23 tax year, adults in the UK can save up to £20,000 into an ISA. This could be in:

- A Cash ISA where your interest is paid free of Income Tax

- A Stocks and Shares ISA where any returns are paid free of Income Tax and Capital Gains Tax (CGT)

- A Lifetime ISA if you’re aged between 18 and 39 and you’re saving for your first home or your retirement (there’s a £4,000 limit for a Lifetime ISA).

You may also decide to split your contributions between various types of ISA – but remember you can only have one of each type of ISA in a tax year.

While many people wait until the end of the tax year to top up their ISA, there are some advantages of getting in early and investing right at the start of a tax year.

Rather than waiting for 12 months, you could make your ISA contribution on April 6 and sit back, knowing you will have a full year of tax-efficient savings to enjoy.

You could be better off by investing early

Research from a leading investment app has revealed that you may be better off by investing into an ISA at the start of the tax year rather than the end.

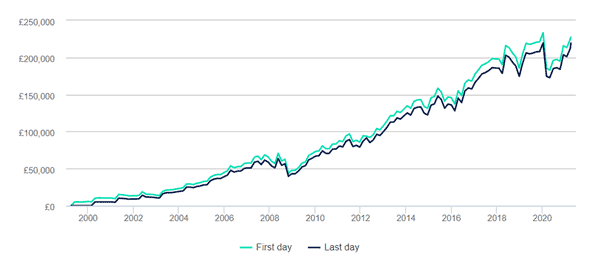

The research compared the return from investing £5,000 each tax year in the UK stock market since Stocks and Shares ISAs launched in April 1999. One example saw someone investing on the first working day of the tax year, the other on the last working day.

Whichever option you took, you’d have done very well. Both approaches returned more than 99% growth, not including charges.

However, you’d have been £7,795 better off overall by investing at the start of each tax year.

Source: HL. Includes 2020/21 subscriptions for both.

Of course, you should remember that the value of your investment can go down as well as up and you may not get back the full amount you invested, and that past performance is not a reliable indicator of future performance.

However, what this shows is that, if you’re an early bird and you make your ISA investment early in the tax year, you could be better off in the long term than someone who waits until the last minute.

An alternative is to save into an ISA regularly across the tax year

We’ve recently written about how global markets have experienced an uncertain start to 2022.

If you’re not sure whether it’s a good time to invest, saving regularly into an ISA can be a useful alternative.

Investing on a monthly basis spreads the cost of your investment, removing some risk if markets fall in value in the short term. This is called “pound cost averaging” and it can help to smooth returns in investment markets that constantly move up and down.

Here’s an example.

Scenario 1 – investing a lump sum

- You have £10,000 to invest in April and the unit price is £2. Investing your entire lump sum means you buy 5,000 units.

- In May, the unit price falls to £1.80. As you have 5,000 units, your investment is worth £9,000.

- In June, the unit price rises to £2.50. As you have 5,000 units, your total investment is then worth £12,500.

Scenario 2 – investing regularly

- You have £10,000 to invest in April and you decide to invest £5,000 now and £5,000 in May. You buy 2,500 units now at a unit price of £2.

- In May, the unit price falls to £1.80. Your £5,000 investment buys you a further 2,777 units.

- In June, the unit price rises to £2.50. As you have 5,277 units, your total investment is then worth £13,192.

Investing regularly means that your contribution could even buy more of the same investment if the market falls.

Of course, the opposite is true if markets are rising. Here, you may be better investing a lump sum as you may be able to buy fewer units in each subsequent month if the value rises.

Get in touch

If you want to make the most of your ISA allowance, but you’re not sure when to invest, we can help. We’ll work with you to create a financial plan designed to help you to live the life you want, and to grow your wealth in the most appropriate way for you.

Email info@blueskyifas.co.uk or call us on 01189 876655 to find out more.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.