Working with a financial planner can seriously improve your financial wellbeing. This is something you’ll have read about a lot in our blogs, most recently when a study by Royal London demonstrated just how working with a professional can give you more confidence and security.

Now, a major new report from insurer Aegon has found that, when it comes to giving yourself the peace of mind that you’re financially secure, “mindset” is one of the key factors. Interestingly, Aegon found that this applied to all savers – whether you consider yourself well-off or not.

Read on to find out more about how you can improve your financial mindset, and the emotional wellbeing benefits that can bring.

Are you one of the 45 million Brits who could improve their financial mindset?

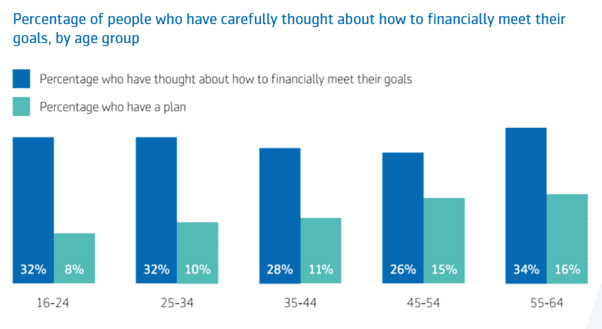

The Aegon study of more than 10,000 consumers is interesting reading. It found that just one in six people (16%) in the UK combine healthy finances and a positive financial mindset, meaning that 45 million Brits could take steps to improve their financial wellbeing.

The Aegon analysis considered factors such as income levels, budgeting skills, and affordability of debt, alongside mindset factors including your willingness or ability to consider your future self or put in place a financial plan. The conclusion was that it is often the mindset factors where most people have the biggest room for improvement.

Common mindset problems reported included:

- Two in five people (38%) have only a vague idea of where they want to be financially in 10 years’ time.

- 28% of people only have a vague idea of what brings them joy or purpose in life – two key elements of being happy.

- Nearly nine in ten people (87%) have no financial plan in place to help them achieve their long-term goals.

- Only 17% of people could answer at least four out of five basic financial literacy questions correctly.

Source: Aegon

In simple terms, people who are better at imagining what their future self or life might look like are better at working out a long-term financial plan. These are two keys to successful financial wellbeing that work really well together and, crucially, is true for both wealthier and less well-off people.

It won’t surprise you to learn that we believe having a financial plan in place is crucial if you want to achieve your aims. We’re not called “financial planners” for nothing!

This plan needs to start by focusing on your financial and life goals. There are many goals you might have: early retirement, providing financial support to children, starting your own business, or leaving a legacy to your children, to name just a few.

Before we start talking about pension planning, investments, or protection we want to know what it is you want to do with your life. Your plan starts there, with all the financial work designed as a means to achieve those ends.

A good financial plan considers what brings you joy, your purpose, and your financial goals (how you get to a position where you can achieve those things financially). And, of course, it’s flexible and adapts to change as your circumstances and life changes.

Mindset is a crucial part of this process. Thinking about your future, identifying what your future self looks like, and putting a plan in place to get there will all help you to take positive steps towards your goals.

5 tips to help you improve your financial mindset

Here are some simple ways you can adopt a more positive financial mindset.

- Create a long-term financial plan and write it down. Work with a planner to create a strategy that helps you meet your goals, as people who have a plan save more regularly and tend to do better financially.

- Consider what makes you happy and what gives your life purpose. Focus your time, energy, and money on making those things happen either now or in the future.

- Set aside some money each month as an emergency or “freedom” fund. It can cover unexpected costs and provide a financial buffer. This is important for your financial wellbeing as struggling to meet everyday costs can make you miserable.

- Think regularly about your future self and lifestyle. Focusing on what you want to achieve in the future and your pension and investment goals keeps you on track.

- Don’t panic in a crisis. For example, when the stock market falls and you’re thinking of changing your investments, remember why you started saving in the first place. Staying calm and focusing on your goals can help you avoid knee-jerk reactions that could affect your long-term plans.

Working with a financial planner can help with many of these mindset changes. For example, we can be a sounding board in volatile times and help you avoid emotional decisions.

We can help create a financial plan and regularly review it with you to keep you on track.

And we can give you the peace of mind that your finances are structured in a way that helps you live the life you want, both now and in the future.

Get in touch

If you want to improve your financial mindset, we can help. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.