When it comes to extracting money from their business, and saving tax-efficiently for the future, pensions offer excellent benefits.

Of course, to balance the generous tax relief on offer, the government places limits on the amount of tax-efficient contributions individuals can make in a year.

In the 2022/23 tax year, the Annual Allowance means clients can contribute £40,000 gross into their pension tax-efficiently (or 100% of their earnings, if lower). High earners and clients already drawing their defined contribution (DC) pension flexibly may have a lower allowance – more of this below.

Recent figures published by Money Marketing show that the number of individuals breaching the Annual Allowance has skyrocketed, increasing by more than 675% in five years.

Read on to find out why this can result in punitive tax charges for clients, and how they can manage this issue.

The number of individuals facing Annual Allowance issues is rising sharply

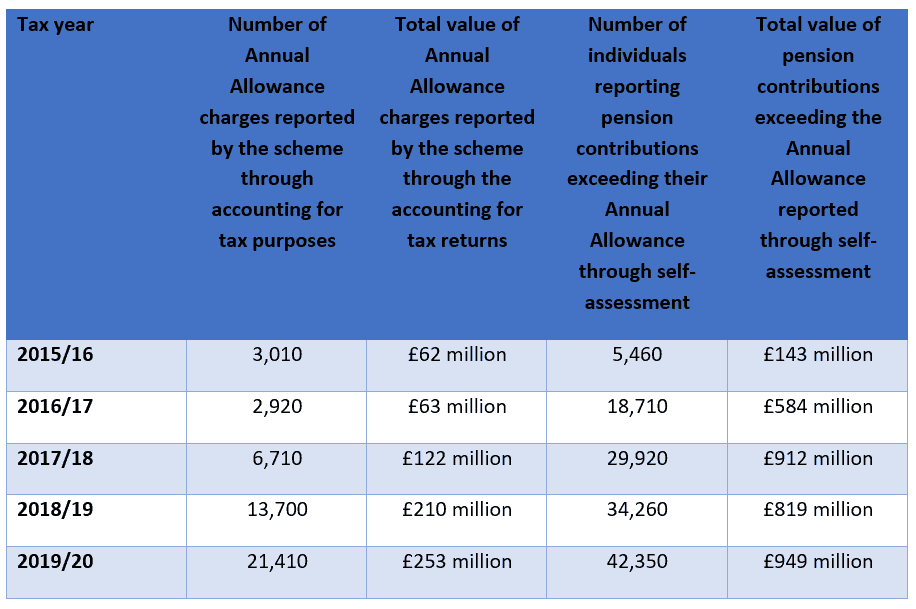

A recent House of Commons report, shared by Money Marketing, shows that the number of individuals reporting pension contributions exceeding their Annual Allowance rose from just 5,460 in 2015/16 to 42,250 in 2019/20.

The total value of pension contributions exceeding the Annual Allowance reported through self-assessment rose from £143 million to £949 million over the same period. That is a 564% increase in five years.

The issue for clients is that breaching the Annual Allowance can lead to tax charges. As the table below shows, individuals paid a total of £253 million in charges in 2019/20.

Source: Money Marketing

With other allowances frozen until 2026, it’s likely that even more clients will be affected by this issue over the coming years, as earnings and salaries rise.

The complicated problem of the taper

A couple of years ago, you may recall a series of headlines concerning NHS professionals refusing to accept overtime because they were being hit with punitive tax charges.

While this issue led to reforms to the Tapered Annual Allowance, it remains a complex issue that affects thousands of high earning clients every year.

Clients that will be affected by the taper will have:

- A “threshold income” of more than £200,000

- An “adjusted income” of more than £240,000 (essentially, this is their threshold income plus pension contributions).

If both these apply, clients will see their Annual Allowance reduce by £1 for every £2 of “adjusted income” above £240,000.

For example, if a client’s adjusted income was £260,000 their Annual Allowance would be reduced to £30,000. Any client earning more than £312,000 will typically retain an Annual Allowance of just £4,000.

The complex nature of the taper can catch out many clients, especially those with variable earnings or who receive income from a range of sources. It’s easy for high earners to be caught out, so professional advice can help to avoid a punitive tax charge.

Watch out for clients who have started “dipping” into their pension

Over the last couple of years, the pandemic may have hit many of your clients’ earnings. Consequently, many of your over-55 clients may have decided to supplement their income by drawing a small flexible income from their pension.

Anyone who does this is then subject to another restriction on the amount they can pay into their pension tax-efficiently. This is called the “Money Purchase Annual Allowance” (MPAA).

If you have older clients who are still earning, there are lots of reasons why they may want to continue to make tax-efficient contributions to their pension. The generous tax relief, investment growth, and potential employer contributions could all boost their fund while they remain in work.

However, triggering the MPAA means these clients are subject to an Annual Allowance of just £4,000. Pensions Age report that more than 1,000 savers became subject to this reduced allowance every day in 2020.

If clients want to continue making pension contributions, seeking alternative ways of drawing income can help them to retain a higher Annual Allowance. For example, drawing 25% tax-free cash typically doesn’t trigger the MPAA, or they could consider drawing from other sources such as ISAs.

Get in touch

With tens of thousands of individuals facing tax charges for Annual Allowance breaches every year, this is a growing issue.

If you have clients who would benefit from expert advice when it comes to their pension savings, we can help. Email info@blueskyifas.co.uk or call us on 0118 987 6655.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.