Over the past couple of months, you’ll probably have read about the story of GameStop. In short, a highly organised group on social media took on Wall Street by promoting and buying GameStop stock, driving up the price and forcing hedge funds to close shorted positions and lose billions of dollars.

You may also have read about the value of Bitcoin hitting new highs, or the people who have made money investing in Tesla (a hugely volatile stock).

Of course, what a lot of these stories don’t tell you is how, after a surge, the stock prices slip. How many investors will simply have timed the market wrong, buying at a peak and selling after a loss?

While these “get rich quick” schemes might pique your interest, it’s worth taking a step back. Often, trying to time markets is more akin to gambling than investing. And it ignores the question: what are you investing for?

Buying stocks and shares in one company is risky

One of the key issues with GameStop is that its inflated stock price didn’t align with the company’s overall financial situation. In truth, the retailer was struggling and had plans to close 1,000 stores – hence the reason large hedge funds were betting on the stock price to fall.

While a relatively small group of investors might have made money, many jumped on the bandwagon, bought stock at highly inflated prices, and saw the value of their investment plummet.

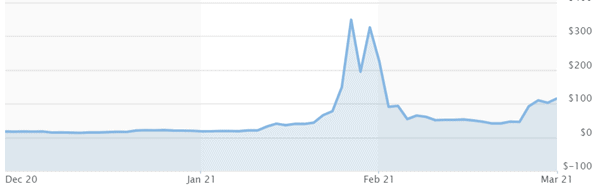

Here’s the GameStop stock price over the last three months:

Source: MarketWatch

The same is true of Tesla shares, which have fallen from a high of $883 in January to around $700 by mid-March. Had you decided to invest at the peak, you’d have lost around 20% of your investment in just a couple of months.

Time in the markets, not timing the markets

There’s an old phrase that says “it’s time in the markets, not timing the markets” that counts. What this means is that returns are frequently driven by you remaining invested, rather than trying to “buy low, sell high”.

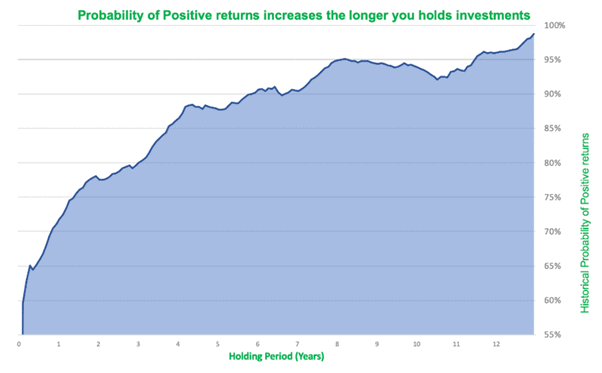

Nutmeg analysed data from 1971 to 2020, and found that, if you had randomly picked one day during this period and chose to invest just for that day, you would have had a 52.3% chance of making gains — similar odds to the toss of a coin. You’d have lost money almost half the time.

However, investing for the long-term dramatically increases your chances of a positive return.

- If you had invested your money for 65 days, during that same 49-year period, your chances of making a profit increased to 65.09%.

- Investing for any one year would have generated a positive return 71.83% of the time.

- Investing for ten years increased your chances to 93.91%.

Indeed, an investor that invested in the stock market for more than 13 and a half years at any point during this period never lost money.

Source: Nutmeg

While there may be some investors who make money in the short term, holding your nerve and focusing on the long term means that the chances of positive returns are very much in your favour.

Take a long-term view

Our investment philosophy is about establishing what you want to invest for, and then to hold a broadly diversified portfolio of UK and global assets for the long term, aligned with your tolerance for risk.

Focusing on your own long-term goals, and having a disciplined plan in place, is a much better approach (and less stressful!) than trying to time the market.

Following the herd and deciding to invest in a single company ignores many of the rules of sound invest. Not only are you failing to diversify your assets, but you’re also ignoring the point of investing: to reach your long-term goals.

Investing is not a competition. You don’t have to make “more” than other people. You just have to make enough so that you can achieve your ambitions and live the life you want.

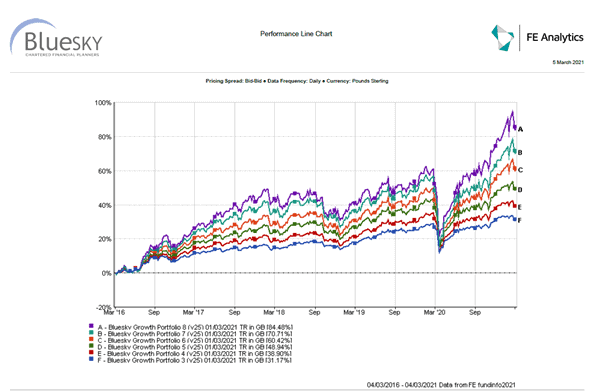

Here’s the performance of the BlueSKY portfolios over the last five years (the various portfolios have different risk profiles).

You can see that, even despite volatility resulting from the pandemic in 2020, the portfolios have returned between 31% and 84% in the last five years (Read more about why our approach works).

Investing like this may not make the headlines, but it’s how we help all our clients achieve their life goals.

Get in touch

To find out how our successful investment approach can help you, please get in touch. Contact us by email at info@blueskyifas.co.uk or call us on 01189 876655.