In recent months you’ve probably seen that the inflation rate in the UK is rising. The rate has increased sharply in the last few months, to 2.5% in June – the highest it has been for nearly three years.

Inflation is now above the Bank of England’s 2% target and think tank the Resolution Foundation believes it could increase to more than 4% before the end of 2021.

As restrictions ease and consumers spend their lockdown savings there could be a surge in demand for goods and services. Combine this with supply issues caused by Brexit and the pandemic, and the cost of living could be set to rise sharply.

Inflation eats into the value of your money, which can be a risk – especially if you’re saving for the future. Read on to find out why you should be concerned about rising inflation, and what you can do to mitigate its effects.

Inflation eats into the value of your money

In simple terms, inflation eats into the value of your money. The current rate of 2.5% means that something that cost you £100 12 months ago cost you £102.50 today.

Over the long term, cost of living rises can have a serious effect.

Even if inflation remains at the Bank of England’s target of 2% per annum, over time your cash will be worth a third less in 20 years’ time and worth less than half of its current value in 40 years.

Source: Thesis

Of course, these figures account only for expected inflation. If inflation exceeds the Bank of England target, the impact will be even larger.

Inflation can be a particular issue if you’re saving for your retirement as you could end up living off your savings for 20, 30 or even 40 years. Making sure the value of your fund can sustain you – especially when you may need to draw an increasing amount of money every year to keep pace with inflation – is a real challenge.

So, how can you inflation-proof your savings?

Investing your money can help to ensure it retains its real value

Over the last decade, savers have contended with record low interest rates. Trying to generate a good return from cash savings in the last 10 years has been all but impossible.

As of 9 July 2021, financial analysts Moneyfacts report that the best easy access savings rate in the UK pays just 0.5%. Cash ISAs pay a similar amount.

So, had you invested £100 a year ago and it had earned 0.5%, it would be worth £100.50 now. Compare this to the inflation rate where goods costing £100 a year ago cost £102.50 now. Your cash has lost value in real terms.

If inflation continues to rise, and interest rates do not follow suit (or rise more slowly) this situation is only going to get worse for cash savers.

Ironically, many people keep money in cash as it’s deemed “low risk”. However, if your cash is reducing in value year-on-year, isn’t that risky in itself?

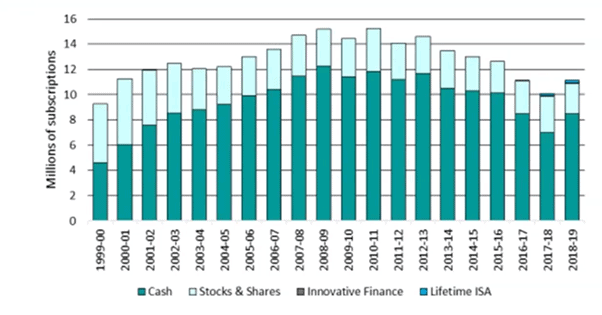

Despite the ultra-low rates, consumers continue to pour their savings into cash. The chart below shows the total value of ISA subscriptions since 1999, and you’ll see that most money goes to Cash ISAs.

Around three-quarters of all money being invested in an ISA goes into a Cash ISA. Of course, there are sometimes good reasons for this. You might want to keep an emergency fund of savings in an easy access account. You might want to keep some funds in cash so you can draw income from them in periods of market volatility.

However, in the long term, cash is not the way to inflation-proof your money.

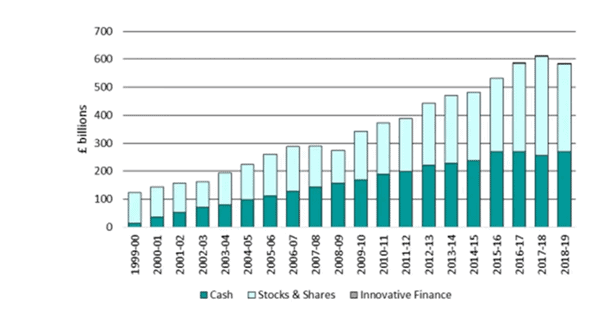

The second chart below shows the total value of ISAs in the UK. You can clearly see that, despite significantly less money being invested in Stocks and Shares ISAs, the total value of those ISAs is higher.

So, there’s less money going into Stocks and Shares ISAs than Cash ISAs, but there’s more money in Stocks and Shares ISAs. It’s proof that investing your money, rather than saving it, can work.

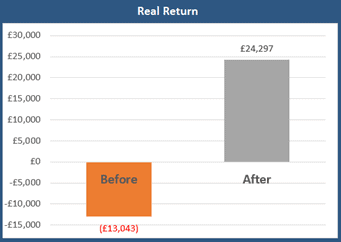

A worked example

Let’s say you have £50,000 that you want to invest. You have two simple choices:

- Cash in a traditional savings account paying 0.5%

- Stocks and shares earning 4% growth a year.

Let’s also assume that the inflation rate remains at the Bank of England’s 2% target for the next 20 years.

At the end of the 20 years, if you had left your savings in cash, they will be worth £55,245. However, taking inflation into account, its real value will be £36,957. The value of your savings has essentially reduced in real terms by £13,043 over the 20-year period.

Had you invested your £50,000 instead, at the end of the 20 years it would be worth £109,556. Taking inflation into account, its real value is £74,297. The value of your savings has increased by £24,297 in real terms over the 20-year period.

(Figures calculated using Prudential inflation calculator.)

Pension savings can add even more value

One way that you could make the most of your cash savings is to consider investing it in your pension.

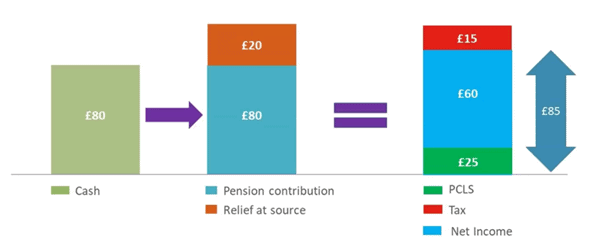

The infographic below shows you how you can generate an instant 6.25% return by investing cash into a pension.

Firstly, your pension contribution benefits from basic-rate tax relief. Your £100 pension contribution only costs you £80 as a basic-rate taxpayer.

Then, you can extract your £100 under the “uncrystallised funds pension lump sum (UFPLS)” method:

- 25% can be taken as a lump sum – that’s £25 tax-free cash at 0% tax

- £75 is taxable at 20%. You’ll pay £15 Income Tax and so the net sum you receive is £60

- The total you receive is £85.

Your £80 cash has grown to £85 – a 6.25% return – straight away by investing it in a pension. Of course, you’ll benefit even further if you leave your pension invested to generate an investment return.

If you’re a higher- or additional-rate taxpayer then the benefits can be even greater:

- You can claim an additional 20% or 25% tax relief through your tax return

- Just 1 in 7 people are higher-rate taxpayers in retirement. So, you may be able to claim higher- or additional-rate relief on your contributions, and only pay basic-rate tax on the income you draw.

Either way, pensions can provide a solid way to inflation-proof your income and generate a higher return than leaving your savings languishing in cash.

Get in touch

To find out how we can help you to make the most of your cash savings, please get in touch. Email info@blueskyifas.co.uk or call us on 01189 876655.

Please note

The figures represent only potential growth over the term shown and is not an indicator of future performance.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.