The Russian invasion of Ukraine is, above all else, a human tragedy and we must not lose sight of this fact. All our sympathies are with the people involved in the war and it is impossible for us to fully understand what it must feel like to be living in a country which is effectively being ripped apart.

While acknowledging that the conflict is primarily a human tragedy, we also understand that there are implications for all of us who are currently investing in stock markets around the world.

A rough start to 2022

2022 had already got off to a bad start from an investment perspective before Russian tanks rolled into Ukraine. After governments had pumped billions of pounds into the world economy in response to the Covid pandemic, many people were asking what the economic repercussions of this might be in the short and medium term.

With supply chain bottlenecks becoming apparent, in turn leading to elevated costs of living, the answer was becoming obvious – a period of higher inflation.

Traditionally central banks, like the Bank of England, have sought to control inflation by increasing interest rates.

Prior to the war in Ukraine, there were some concerns that central banks had underestimated the levels of inflation that we are currently seeing. This means that predicted future interest rate rises are likely to be higher than originally predicted. The markets reacted negatively to this prospect.

The war in Ukraine has added to the pressure on global supply chain concerns and deepened inflation worries. As I’m sure you are all too aware, when we fill up our cars or go to the supermarket, things are now noticeably more expensive than they were even a couple of months ago.

Higher prices tend to mean we have less cash in our pockets to spend on other things and this has an impact on share prices. The good news is that the Bank of England is still predicting more “normal” levels of inflation will resume over the long term.

Remaining invested is typically the best course of action in volatile periods

Stock market volatility (the ups and downs) is effectively the price paid for the superior returns that investing in the markets have delivered consistently over long periods of time.

History shows that holding your nerve as an investor and not reacting to events as and when they occur is typically the most successful strategy for dealing with short-term market volatility.

While it feels natural to want to disengage from the markets in times of market stress, history shows that this is seldom the right call to make. If you are a long-term investor (as all of you are) then history shows that doing nothing is usually the right course of action.

All of you will have a financial plan that was carefully constructed and that considered short-term stock market volatility as one possible scenario.

So far, the BlueSKY portfolios and other investments that we recommend have reacted in a predictable way to the current market turbulence. This means that lower-risk portfolios have fallen much less than higher-risk portfolios. When assessed against other similar investment strategies available, the performance of the BlueSKY portfolios is similar and entirely in line with expectations.

To give you a flavour of how frequently stock markets fall, if we go back in history then we can see that the US stock market loses 10% of its value on a temporary basis around every 18 months.

In other words, it is common for markets to fall significantly on a regular basis. However, if we were to look at the long-term performance of the US stock market (the S&P 500 Index) over 20 years or more, then you would see that the total returns achieved by the patient investor would have been more than 440% (compared to UK cash rates which would have returned 44%).

The secret of capturing these returns is by staying in the market and holding your nerve even when things look rough.

Trying to time the market can see you miss some of the best days

The wealth manager Schroders conducted a study of investing in the UK stock market over the last 35 years.

They found that missing the best 10 days in the market reduced your annualised returns from 11.4% to 9.5%. However, if you missed the best 30 days in the market your annualised return dropped to only 7%.

To put that into perspective using cash terms, based on £1,000 invested in 1986 this would reduce your final value from £43,595 to £10,627 – a whopping difference of £32,968.

Also, with a great deal of frequency, the best days in the market occurred very soon after the worst days.

If you felt that selling out of the market now was the right thing to do, then history is not on your side. It is unlikely that you would be able to time your re-entry into the market in a way that puts you in a better position than had you done nothing.

Understandably, people wait for confirmation of their view that “things had got better” before re-entering the markets. This invariably means waiting for the stock market to get back to the level it was (or higher) when you sold out – thus locking in a loss.

Markets are forward-looking – they don’t wait for things to actually get better, they wait for the expectation that things will get better (even if seems that we are still in the eye of a storm). The biggest recent stock market jump was on the day that the UK first went into lockdown in 2022. Therefore, many people who sold into cash missed out on the big bounce-backs.

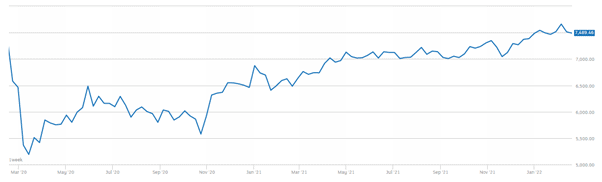

As we saw with the Covid crash, the sharp decline in the stock market was relatively brief. Indeed, had you remained patient, the FTSE 100 had recovered to its February 2020 level by the winter of 2021 – less than two years later.

Source: London Stock Exchange

We are not suggesting that the market will rebound in the same way that it did after the Covid crash (and, by the way, it has not fallen by anything like the same magnitude).

However, if we were to look at other events that live in the memory (such as 9/11, the financial crisis in 2007/2008, the Brexit vote in 2016) then we can see that despite the “crisis” having a different dimension, in the long term stock markets will continue on their march upwards.

Too much cash can mean inflation erodes the real value of your savings

Of course, on occasions like this, holding cash for short-term expenditure is a proven strategy – it means that cash can be accessed while markets are choppy.

Cash, however, is no long-term solution for those of you who wish to grow your wealth ahead of inflation. With inflation at more than 5%, the real value of cash is being eroded by around 4.5% a year (assuming that you are getting Bank of England base rate on your savings – many of you aren’t!).

Even though interest rates are predicted to increase later this year, there is still no expectation that interest rates will reach more normal levels (historically around 4%) for many years to come. The expectation is that the rate of inflation will remain higher than interest rates (at least in the medium term) and, therefore, cash savers will continue to see their purchasing power eroded.

While being invested in a portfolio of stocks and shares when markets decline can test our resolve and make us question our decisions, we can draw on the lessons from history that reaffirm to us that sitting tight and doing nothing is always the right thing to do.

As always, if you have any concerns about the situation and wish to discuss these with your planner then we are here to help. Email info@blueskyifas.co.uk or call us on 01189 876655.