In some ways, it’s hard to believe that it has now been more than two years since the prime minister told us all to “stay at home”.

While deserted streets, queues to get into your local supermarket, and daily Covid briefings are now largely a thing of the past, the world has changed immeasurably in the two years since the first lockdown.

Here are five ways the world of personal finance has changed dramatically since March 2020.

1. Inflation is back

As economies opened up after lockdowns, demand for goods and services surged.

With many global supply chains still affected by Covid – and issues such as Brexit and the blockage of the Suez Canal also affecting the movement of goods – demand began to outstrip supply. The war in Ukraine and Russian sanctions have also driven up the price of fuel and energy.

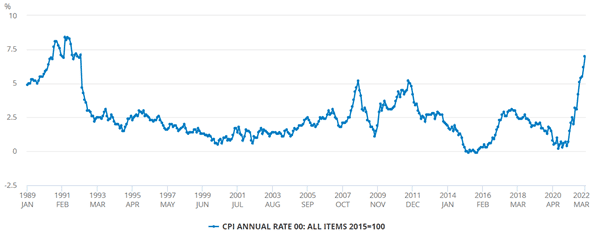

All this has meant that inflation has returned to a level not seen since the early 1990s. According to the Office for National Statistics, prices rose 7% in the year to March 2022, as the chart below shows.

Source: Office for National Statistics

In simple terms, something that cost you £100 a year ago will cost you £107 today.

Having managed to keep inflation around its 2% target for the best part of two decades (with some minor exceptions), the Bank of England now have a challenge in combatting the rise in prices. Their first step has been to raise interest rates, with the base rate now sitting at 0.75%, up 0.65% since December 2021.

Read more about how rising inflation affects your wealth in our recent article.

2. More people – especially young people – interested in investing

Over the last couple of years, it’s fair to say that stock markets have been volatile. After an initial steep downturn in spring 2020, most global markets have recovered and are now trading around, or even higher, than their pre-pandemic levels.

Despite this uncertainty, the last two years have seen an increase in interest in investing – particularly among younger people.

Research from Halifax found that 16% of young people aged 18 to 24 have taken their first steps into stocks and shares since the start of the pandemic.

Investing in a way aligned with your risk profile can generate positive returns which can help you to achieve your longer-term financial goals.

However, DIY investing does have its pitfalls – you can find yourself overweighted in certain assets or investments, for example – so working with a financial planner can ensure your portfolio is suitable for your aims.

3. House prices have reached record levels

As the first lockdown hit, the common assumption was that the housing market would suffer. With sellers not being able to conduct viewings, and surveyors unable to value homes, many expected property prices to struggle.

Of course, in the last two years the exact opposite has happened. Fuelled by a surge in demand for country homes and the “race for space”, and a Stamp Duty holiday that saved property buyers thousands of pounds in tax, house prices have reached record highs.

The Guardian reports that the average UK house price hit a record of £282,753 in March 2022. Prices are now 11% higher than a year ago, about the largest annual increase since the 2007 financial crisis.

The newspaper reports that average prices have risen by a staggering £43,577 since the first coronavirus lockdown in 2020.

4. Increase in interest in ESG investments

While more people have turned to investing since the first lockdown, there has been a particular interest in “ESG” investments – those which consider environmental, social, and governance factors.

The pandemic raised some fundamental questions about the way we live and work, and there is evidence that this fed through to a greater demand for ethical investments. The Glasgow COP26 summit also highlighted vital climate change issues, leading to many people seeking to align their investments with their ethics.

Reuters reports that a record $649 billion poured into ESG-focused funds worldwide in the year to the end of November 2021, up from the $542 billion and $285 billion that flowed into these funds in 2020 and 2019, respectively.

5. More interest in protection

The last two years have shown us that the unexpected can happen at any time. Considering that more than 172,000 people have passed away in the UK due to Covid, it’s perhaps no surprise that the pandemic has led to an increase in interest in personal protection.

According to a study by insurer Canada Life, the pandemic has prompted 5.8 million UK adults to buy – or consider buying – life insurance. Additionally, research published in Insurance Business UK reveals the pandemic has pushed more UK consumers to take out income protection insurance.

Whether it’s cover to protect your income, ensure your family receive financial support in the event of your ill health or death, or specialist insurance to protect your company and business interests, the right protection is a key pillar of a good financial plan. So, it’s logical that the unexpected events since March 2020 have led to millions seeking the appropriate cover.

Get in touch

Whether you’re thinking about changing your approach to investing, reviewing your protection, or you’re worried about the effects of inflation, get in touch for a chat.

We can help you to ensure your financial plan is aligned with your goals, so email info@blueskyifas.co.uk or call us on 01189 876655 to find out more.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.